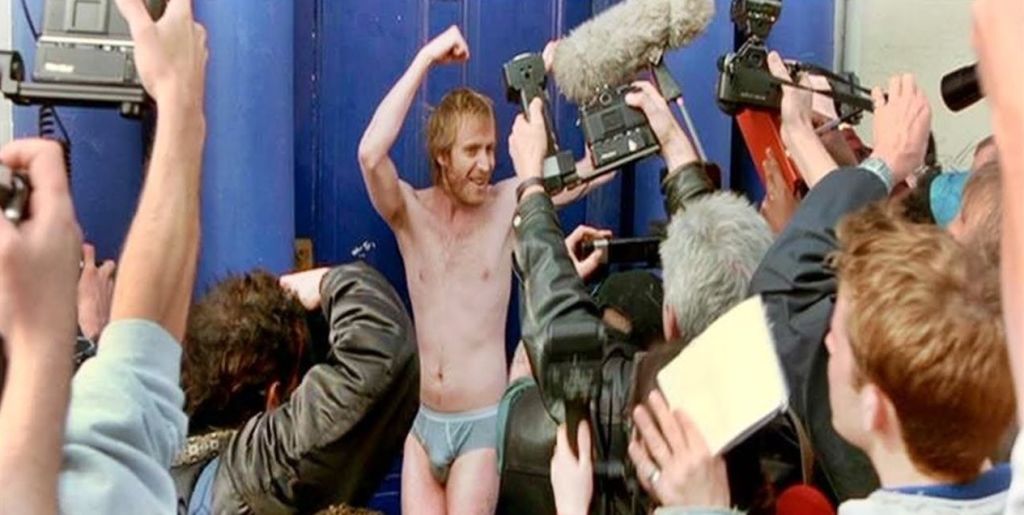

Deadbeat flatmates could mean higher mortgage payments down the track

Flatmates who do a runner from a share house could cost the remaining residents thousands of dollars in unpaid bills.

In a worst-case scenario, it could affect the credit scores of the room-mates who are left behind, meaning they may pay a higher interest rate on their mortgage down the track.

Credit information portal Credit Simple warns renters that disappearing flatmates could cost young Australians up to $7104 a year.

This number assumes unpaid bills mean the flatmates left behind end up with an impaired credit record and pay a higher interest rate when they take out a mortgage.

The figure is based on the difference between an interest rate of 2.8 per cent and 4.8 per cent on a $357,000 mortgage over 25 years.

“Innocent people can be left with a stain on their credit rating when flatmates run up bad debts on rent, electricity or gas accounts in someone else’s name,” said Credit Simple chief executive David Scognamiglio. “This can lock them out of the cheapest home loans, credit cards and mobile phone plans.”

“The problem can take years to rectify, with defaults staying on consumers’ files for five years. Poor payment history can impact your credit scores for two years.”

Scognamiglio notes it’s surprisingly easy to end up with a black mark on your credit score. “A default can be recorded on your credit file if you’re late paying a bill by 60 days and the bill is over $160,” he said. “It can also be really hard to get a mortgage at all once you’ve got a default on your credit file.”

In terms of the total costs for the people left behind when someone does a runner from a share house, Pete Pennicott, a director of financial advice firm Pekada, says this will vary for each household. But it is not uncommon for the costs to equal a couple of months’ rent and utilities’ bills.

“Average rents vary across capital cities, but costs quickly add up,” Pennicott said. “Rent is the biggest expense. But you also need to factor in heating, electricity, gas, internet and cleaning. Insurance policies covering contents in the property may also be a shared cost.”

Pennicott notes the initial impact is a financial hit for which you haven’t budgeted. “When a flatmate does a runner, your housing and utility costs can double for several months and erode your savings,” he said “You might even need to use credit cards to fund these payments. A spike in expenses will naturally see your cash buffer depleted and push you back for goals like saving for a house, car or travel.”

Canberra-based financial planner Michael Miller agrees prevention is better than the cure when it comes to a flatmate doing a runner and leaving you with the bills.

“Proactively make sure bills don’t get out of hand,” he said. “If a flatmate hasn’t paid their share of the rent for two weeks, don’t just stay quiet until weeks becomes two months – ask them for their share.”

“A lot of utility providers will let you pay money towards your bill every fortnight. So, you could all agree to pay a regular fortnightly amount rather than wait for the bill to come every three months,” he adds.

Miller also points out that having to cover a recalcitrant flatmate’s share of the bills and rent may mean it takes longer to save a deposit for a first home.

“It’s a good idea to contact a financial counsellor if you do find yourself lumped with a serious bill,” he said. “The counsellor can help you negotiate with the provider. Even if it’s completely unfair that you’re left covering somebody else, ignoring the problem doesn’t make it go away and is likely to make it worse.”

Flatmate checklist: How to spot a dodgy flatmate

Credit Simple says there are steps you can take to reduce the risk of inviting someone who does not pay their way into your home:

1. Check their employment – Make sure they have a secure source of income to cover bills.

2. Get references – Ask friends who may have lived with the same person if they are responsible and reliable.

3. Put everyone’s names on the lease – If an agent doesn’t think someone is trustworthy after compulsory checks, they’re probably not.

4. Share the risk – Put the bills in different names. Don’t make just one person responsible for everything.

5. Have a house kitty – Putting a set amount into a kitty each week helps keep on top of bills.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More