How to discuss coronavirus-related financial problems with your landlord or property manager

Graphic designer and sole trader Blair Harvey is between gigs at the moment and with work drying up as a result of the coronavirus crisis, he’s worried about being able to pay the rent on his Sydney home.

At the same time, he was contacted by the real estate agent looking after the property he’s buying in Melbourne to say the tenant has requested a rent reduction because of his own financial difficulties.

“That freaked me out,” said Harvey, 47. “Of course, you have to have leeway and consider all options, but with only half that rent coming in, it makes it very tough.

“And you can’t evict tenants now – which is good as that’s wrong – but you can’t claim on your rental insurance unless you’re able to evict the tenant. I’m on the verge of calling the agency back to reduce the rent, but only by so much.”

With Harvey not qualifying for assistance under the new JobKeeper wage subsidy pandemic package and, as a long-time Australia-residing New Zealander, unlikely to qualify for any Centrelink help, it’s a terrible dilemma.

Despite the government’s various economic rescue packages, plenty of tenants still find themselves unable to pay rent. So what should they do?

For the moment sit tight, advises David Hill, director of the Raine & Horne HM Group on Sydney’s Lower North Shore. “We’re being contacted by a lot of tenants asking for rent reductions, but our advice is to wait and see what happens for the moment.

“We’ve had some announcements from the government but they haven’t put in full guidelines yet. The subsidies might mean that people will be able to pay rent or some landlords are proving willing to reduce rents or offer assistance, or rent could be put on hold for now and made up in the future when people get back to work. But we’re telling people to just hang on until the situation becomes clearer.”

The latest $130 billion injection of public funds to pay the wages of those who can be rehired in jobs or who were about to lose work means there’s hope that some tenants will be able to pay most, or all, of their rent.

More people can now also access Jobseeker payments and welfare help, while state governments have put a six-month moratorium on evictions for tenants.

In addition, the big four banks are allowing property owners to pause mortgage repayments for up to six months which, together with record low interest rates, may enable some landlords to be more flexible.

At LJ Hooker, network head of property investment management Amy Sanderson is telling tenants to take a few steps before they approach their real estate agents or landlords.

First, they should visit the Treasury website, she suggests, to try to work out if they’re entitled to any financial help. Secondly, they should take a long, hard look at their outgoings to see if there’s anything they could cut back on.

“Then they should contact an accountant or financial planner,” Sanderson said. “They may have options like accessing their super, too. But then they should contact their property manager and talk to them if they’re in difficulty before they fall into arrears. The agent can then talk to the property owner to see if there’s anything they can do and devise a plan together.

“The banks are freezing mortgages which can help, but landlords may not be able to claim on their rental insurance because the process relies on a termination which can’t be done now. And, in many cases, landlords are losing their jobs too and having to reduce their own costs.”

Other strategies LJ Hooker put forward include the tenant having a discussion with their employer to see what their work situation may be in the future, checking out any income protection insurance policies, and asking for the deferral of repayments on any loans, such as for cars.

Leo Patterson Ross, senior policy officer at the Tenants Union of NSW, believes early communication with a real estate agent or landlord about any financial difficulties in paying rent is vital. He says a tenant should explain their situation in full.

“Be as open and honest as you can,” he recommended. “Keep any moral debate about what’s right in the situation out of it. Many landlords are keen to keep a good sitting tenant as they don’t want to risk months of a vacant property.

“We’re finding that some landlords are coming back and saying they completely understand but others, of course, aren’t. Often, they just don’t have the cash reserves to be able to bargain over the rent and they can’t negotiate and claim the lost rent back on their insurance without an eviction.”

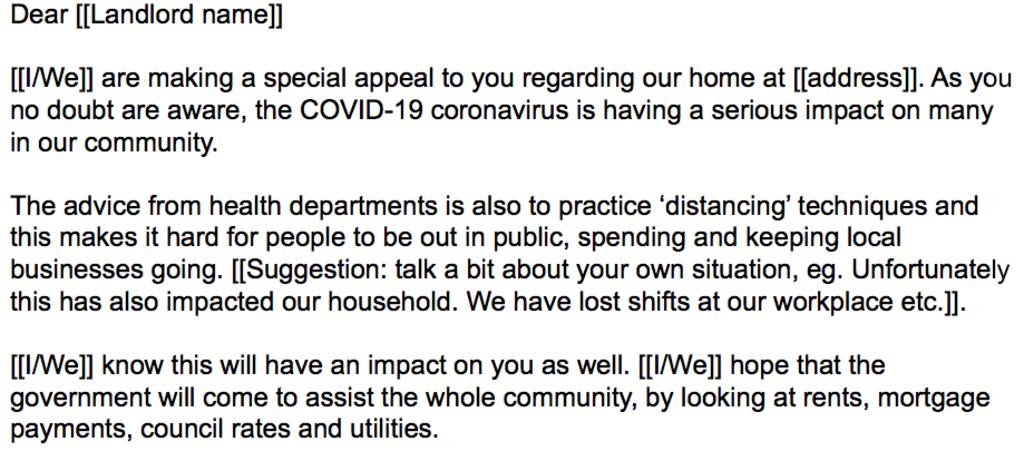

He has put a suggested draft letter for tenants to send to their landlords on the Tenants Union of NSW website.

But another significant barrier, Patterson Ross says, is how the banks are still talking about capitalising the interest over the period of mortgage relief, so landlords emerge with a larger mortgage at the end of the period.

“The government needs to step in and look at these kind of barriers,” he said.

Property advisor and manager Ramon Mitchell, founder of Gault & Co property advisory, also suggests that tenants put forward their requests for rent reduction in writing, with all their rental arrangements clearly outlined as well as their personal difficulties.

“Then provide detail on what changes you would like to implement, whether that be reduced rent and/or a change in lease duration or payment timings,” he said. “Also, provide information about what government assistance you qualify for and whether you’ve already applied for this.

“It’s a symbiotic relationship, so clarity on the process will benefit both parties. If we can all just maintain a sense of humanity and fairness, it will bring benefits to everyone.”

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More