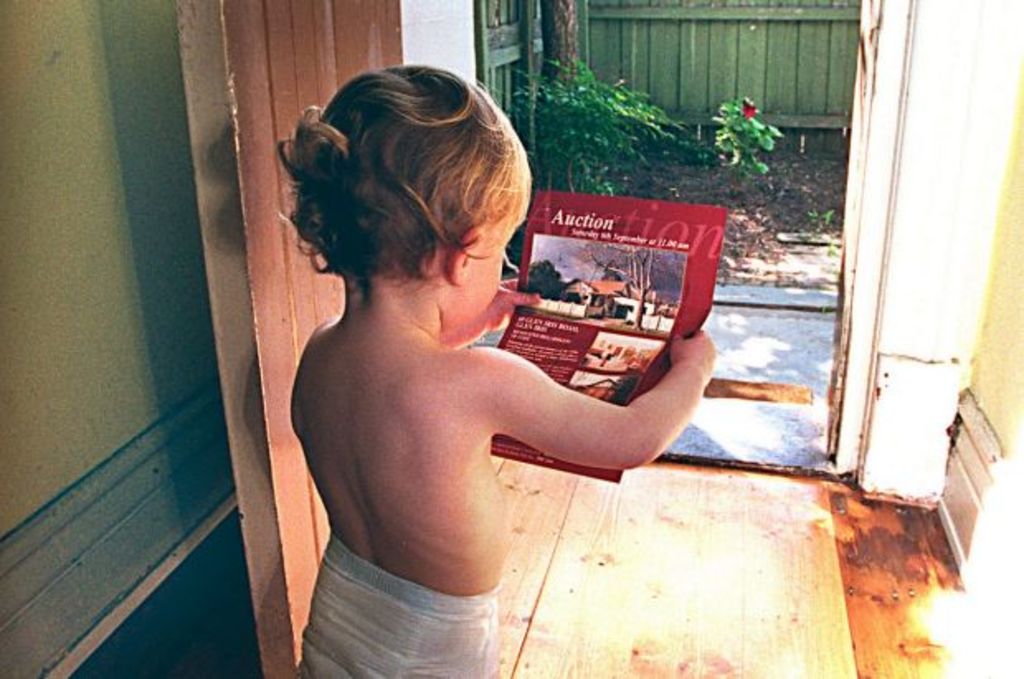

More than two thirds of Australian parents worry their children won't buy a house, survey finds

Most Australian parents fear for their children’s capacity to buy a property in the future – above their ability to save money, afford university tuition and support a family of their own, a new survey shows.

Of more than 1000 children aged four to 14 and their parents surveyed, Cartoon Network’s New Generations study revealed 70 per cent of parents worry about their children’s ability to realise the great Australian dream.

“Every week we read about record auction clearance rates and houses being sold for amounts significantly above reserve,” says Robi Stanton, vice president and general manager at Cartoon Network’s parent company Turner Asia Pacific.

“With housing prices continuing to surge despite interest rates being at a historical low, it’s not a huge surprise that the parents … expressed worries around their kids’ ability to buy property in the future.”

For parents who don’t have the financial means to give their children a leg up on the property ladder – or even if they do – there are several strategies to help them buy their first house, financial experts say.

Suzanne Haddan, managing director of BFG Financial Services, says it is important for parents to develop good savings habits with their children, and encouraging them to spend less than they earn. With children living at home for longer because of the difficulty of buying property, parents could ask their children to pay rent, she says.

“One of the other things you could do is invest the money for your child and start accumulating the money for a home deposit.”

Parents could also offer to match their savings (putting in $100 for every $100 they save), Ms Haddan says.

“What you don’t want is the child to be in their late-20s, and be sitting opposite you and saying ‘mum, dad, I need help with the deposit’,” she says. “And you haven’t had the discussion with them at 18 or 20 about the importance of saving.”

Claire Mackay, a financial planner and chartered accountant from Quantum Financial, says any assistance should be a loan, not a gift.

She advises clients to have a conversation with their children early about helping out on a co-contribution basis.

“And if you don’t have the ability to co-contribute, then it’s even more important that you’re having a discussion with your kids about the ability to save and build up a deposit.”

With property prices rising faster than the ability to save, parents could educate their children from a younger age, First Home Buyers Australia co-founder Taj Singh says.

Many parents are opening youth saver accounts and depositing sums such as $100 a week, he says.

“That’s helping parents set aside money for their kids for the future so they don’t have to outlay money in one go to help them fund a deposit or act as guarantor for their first home.”

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More