Tired of renting? These strategies could get you into the property market sooner

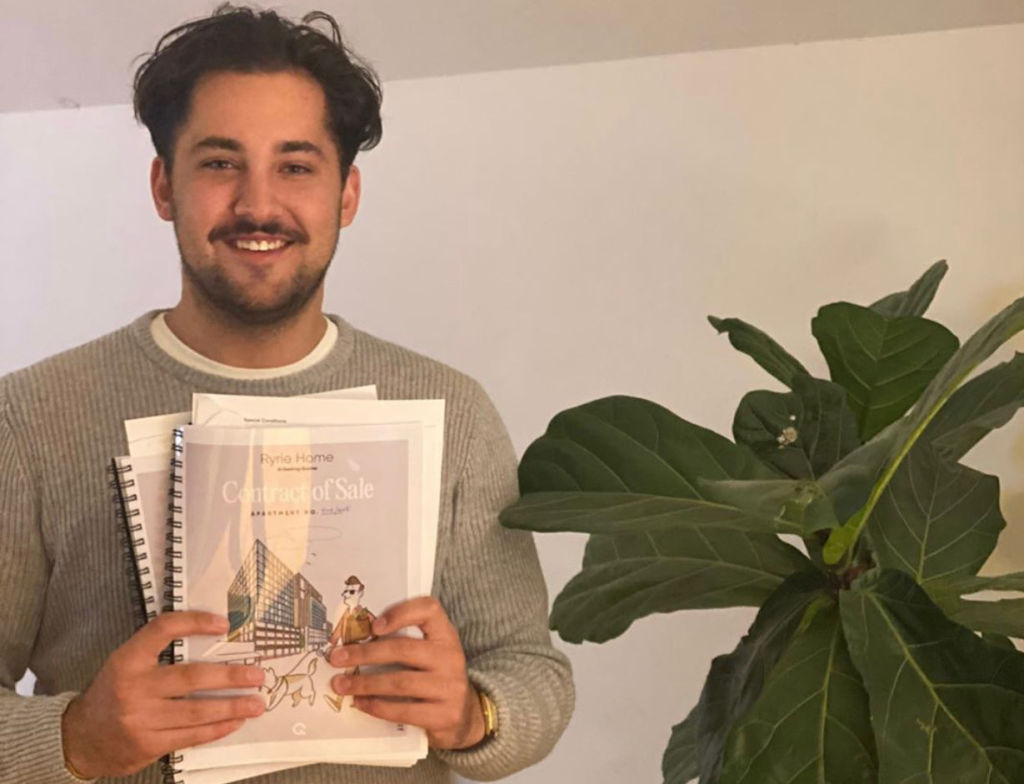

Adam Guala, 25, doesn’t do things by halves. He’s just emancipated himself from the rental market by buying not one but two properties in Geelong. But he has had a little help.

“I’ve always wanted to buy my own place. But it wasn’t until I moved back to Geelong from Melbourne that I started conversations with agents and mortgage brokers,” he says.

“As a renter I’ve lived in every type of property – terrace house, share house, modern and art deco apartments. Now I can finally make my place my own.”

Pandemic notwithstanding, Guala has bought two properties with his mum’s help in the Ryrie Home property development in Geelong. He has since started working for the developer of the project, Franze Developments, in a sales role.

Aside from parental assistance, the low interest rate environment has also helped him get his foot on the property ladder.

“My options were limited as a young, first-home buyer. So I have bought two off-the-plan apartments with my mum to convert into one larger property. I’ll live in the apartment for now and mum and dad will move in when they downsize and I’ll move on. It’s nice to be able to do this with my mum, who is a keen property investor,” he says.

Alternative strategies

While going in with your parents on a property purchase is one way out of the rental trap, there are other avenues buyers can pursue as well.

“If you have a deposit ready, there’s no harm in letting your property manager know you want to buy the place you’re renting,” suggests Nic Cuni, sales director at Franze Developments.

If the response is positive, the next step is to establish a price. An agent can provide an appraisal, but it’s also an idea to get a feel for the market yourself by doing research into comparable property sales.

“The process might be easier if you’re already renting directly from the owner,” Cuni says. “Good communication is key. Be open and direct with your intention.”

Think long-term

AMP financial adviser Andrew Heaven notes it’s important to understand owning is very different to renting. “You need to think through if you can see yourself living in the property you’re renting for years to come. Think about whether the property is in a high growth area and if the suburb is close to public transport, healthcare facilities and schools.”

If the property ticks your boxes, it’s best to make an offer in writing. You can then start negotiations and the sale process.

Shannyn Laird, head of customer experience at property management platform :Different, recommends being reasonable when you’re making an offer. “Use market data to understand what’s fair and back up your offer.”

Multiple paths

Laird says rentvesting – renting where you want to live and buying a property that’s more affordable than the one you’re living in – is another avenue. “This option gives you the best of both worlds – you’re able to enter into the property market earlier and still live where you want.”

Buying off the plan, as Guala did, is a popular option to go from renting to buying. Time is on your side here. While you will need to make a down payment to secure your interest in the asset, in many instances you won’t need to put down a full deposit initially. This will give you time to get your finances in order.

Be aware, however, of the risks involved in buying off the plan. There’s no guarantee that when it comes time to settle that the value of the property will be the same or higher. Real estate is a long-term investment, so short-term market movements are less of a factor unless you plan on flipping.

Buying with family or friends is another way into the market. Property share home loans are an option if you want to buy a property with multiple people. These instruments make it easier to manage repayments and legal processes.

“Set the ground rules if you’re buying a property with friends or family. Think through what happens if someone wants to sell their share of the property. Having open conversations before entering any agreements will hopefully prevent future conflicts,” says Heaven.

As this shows, there are plenty of ways to achieve the great Australian dream of owning your own home. What’s required is some foresight and planning and, of course, a reasonable deposit no matter which path you choose.

This article has been updated since publication to reflect Mr Guala’s relationship with the developer and a correction has been made to Mr Cuni’s place of work and title.

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More