Which Australian cities will see the most property price growth in 2024?

Where in Australia are property values likely to rise most this year? The smart money is on three cities – Sydney, Melbourne and Canberra – with predictions that prices could jump by as much as 10 per cent by the end of 2024.

“With the forecast for a cut in interest rates now being expected later this year, we’re seeing a real change in the trajectory for those three cities,” says Ray White chief economist Nerida Conisbee. “They tend to have the more expensive property and also more sensitivity to interest rates.

“So, with strong population growth and the housing shortage, too, we’re predicting strong price growth for them. And they’ve each just had a really strong first quarter of 2024, so I’m now saying at least 10 per cent. When the rate starts falling, those price increases will begin accelerating.”

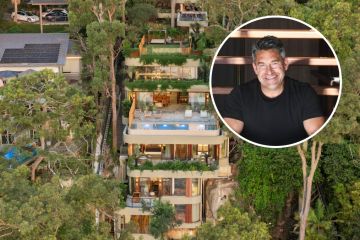

She believes the lower-to-median-priced homes in Sydney and Canberra will see the strongest value bumps. In Melbourne, however, the luxury end is more likely to outperform the rest since it was the sector that fared worst during the pandemic and is now playing catch-up.

While population growth is forecast to slow this year, in 2023, we needed 250,000 new homes, yet only 175,000 were built. Conisbee says the future pipeline is looking even more dire.

Domain chief of research and economics Dr Nicola Powell also believes Sydney could certainly be at the top of the rise. She predicts a spurt of value growth of up to 9 per cent over 2024, with Melbourne and Canberra values also rising.

“A cut in interest rates or other stimulus measures will spark demand and create another price upswing, likely in the latter part of 2024,” she says. An alternative would be an easing of the mortgage serviceability buffer, which would lift borrowing capacity, increase demand, and put upward pressure on prices.

“Population growth has a cumulative longer-term effect on house prices and, therefore, will continue to play a driving role in our housing markets into 2024 and beyond.”

In addition, expensive rental markets could convince many tenants to buy instead, adding to the competition.

Investment property national buyers’ agent Ben Plohl of BFP Property Buyers also favours Sydney and Melbourne for investment; he doesn’t know the Canberra market as well.

“Sydney is certainly going to do well,” he says. “It’s seen an uptick in price growth of 0.6 per cent for March alone, which is pretty decent. So, I’d say, in the next 12 to 13 months, we could see prices up by over 12 per cent, especially as there’s still a disparity between demand and supply.

“At the same time, Melbourne has been undervalued since COVID. We’re doing a lot of research on the city and we favour the inner ring suburbs, especially the inner north, anywhere from Collingwood up to Brunswick into certain parts of Essendon.”

In Sydney, he’s been buying for many investor clients around The Hills district in the northwest and also in western Sydney.

“People like to buy fair-sized blocks of land close to good schools and amenities, so there’s plenty of demand from tenants,” he says. “With the new airport, it’s going to be a completely different area for those holding for 10 to 15 years.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More