Short-term emergency loans make home ownership less likely for vulnerable Australians

Turning to short-term loans to cover emergency expenses puts home ownership even further out of the reach of vulnerable Australians.

Borrowers who are unaware of the impact personal loans can have on their credit scores are facing difficulties applying for a home loan further down the line, experts say.

One in 10 Australians who take out personal loans do so to meet unplanned financial difficulties, research from financial comparison website Finder has shown.

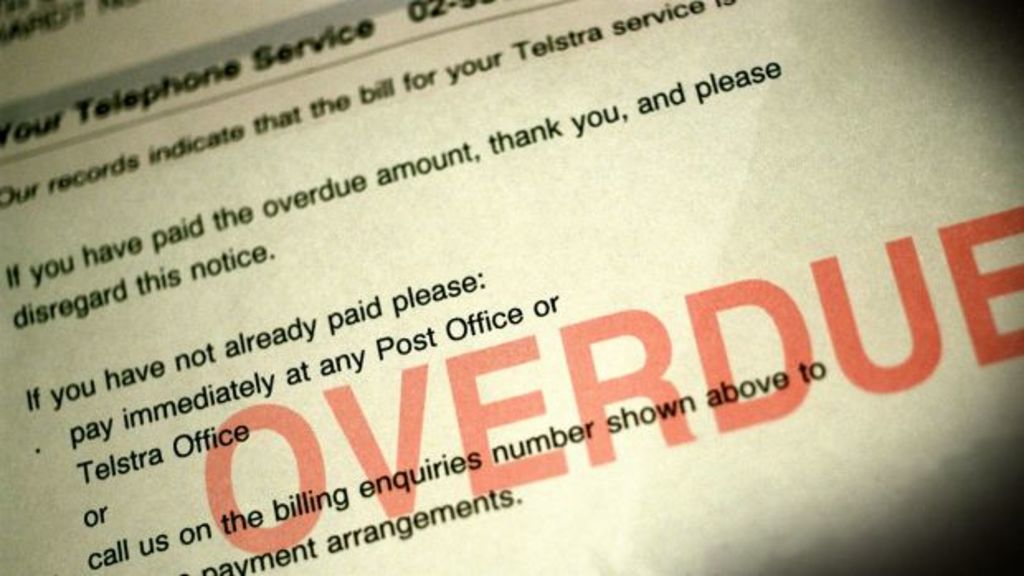

These emergencies could be unexpected medical expenses, or unexpectedly large phone or power bills.

“You don’t want a personal loan to be your only option when faced with a crisis,” said Finder’s Bessie Hassan. “An emergency savings fund should be your ‘plan-A’ not a personal loan.”

High-risk borrowers with low credit scores could find themselves slugged with the highest rates and end up paying considerably more interest on a home loan.

Borrowers with a poor credit score and high-risk profile will pay $10,000 more in repayments over the life of a five-year, $30,000 loan than those with an excellent credit score and low-risk profile, according to Finder.

For borrowers facing unplanned emergency expenses, this financial double-whammy can make it more expensive and harder to escape the debt trap.

Consumer Action Law Centre senior policy officer Katherine Temple, said her organisation was concerned by record levels of debt in Australia.

“A loan for an emergency expense might assist in the short-term, but it can also cause bigger financial problems in the future,” she said.

“Unaffordable debt can have a serious impact on people’s lives.”

Failing to pay back personal loans, or stacking multiple personal loans and credit cards can seriously affect credit ratings, making further borrowing increasingly expensive and pushing back home ownership.

- Related: Could your car be keeping your off the property ladder?

- Related: Bank loans for home renovations plunge

- Related: Low-income earners could save hundreds on power bills

Good v bad debt

The most common reasons people took out personal loans were to fund car purchases, prepare for a baby, pay for a holiday or home renovations, or buy jet skis or snowboards, according to Finder data.

Carsten Murawski, economist in the Brain, Mind & Markets Laboratory at the University of Melbourne, said the findings were concerning, but predictable.

“The worry with an increase in debt is that debt is being used to fund consumption,” he said.

Murawski said any conversation around borrowing needed to include the concepts of ”good” and ”bad” debt.

“Good debt is to buy an asset or an income stream,” he said. “Bad debt is debt that’s used for consumption purposes.”

He said buying a house or a car for work, or financing a renovation could be a good way to use debt. But taking out personal loans to pay for power bills, holidays or consumer spending was a bad way to use debt.

Nine per cent of Australians use personal loans to fund home renovations, with some choosing them as the application process is simpler than other methods. Previous Finder research has found the most renovated room in Australian houses was the kitchen, with 19 per cent reporting they’d spent on average $16,883.

Murawski said about 1 in 10 Australians had less than $3000 in savings to cover emergency expenses, meaning unexpected costs would need to be covered by a loan.

Melbourne man Dean Mobbs told Domain he borrowed $400 from a loan site to pay a utility bill after losing his job.

He still owes about $200 on the loan and said that debt collectors “have not stopped ringing me”.

Murawski said people need to be aware there are more options for those who find themselves in difficult situations, such as the hardship repayment plans many utility companies offer.

He also recommended people look at no-cost microfinance providers such as no interest loans schemes.

You can get free and independent advice about dealing with problem debt by calling the National Debt Helpline on 1800 007 007.

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More