Negative equity: 386,000 home owners owe the bank more than the value of their home

Almost 9 per cent of mortgage holders are now underwater with their home loans, as falling house prices push them into negative equity, new research has shown.

These homeowners have seen their mortgages barely budge as their homes decline in value, leaving them with a loan bigger than the value of their property.

Experts say it’s first-home buyers who struggled to get a toehold on the housing ladder at the peak of the market who are now most likely to find themselves with negative equity.

The research from Roy Morgan found the number of borrowers with little or no real equity in their home has increased by 12 per cent since last year.

An estimated 386,000 home borrowers now owe more than the value of their home, and the number is expected to grow as the housing downturn continues to bite.

The problem is concentrated among affordable homes, with properties owned by home owners with negative equity worth $522,000 on average.

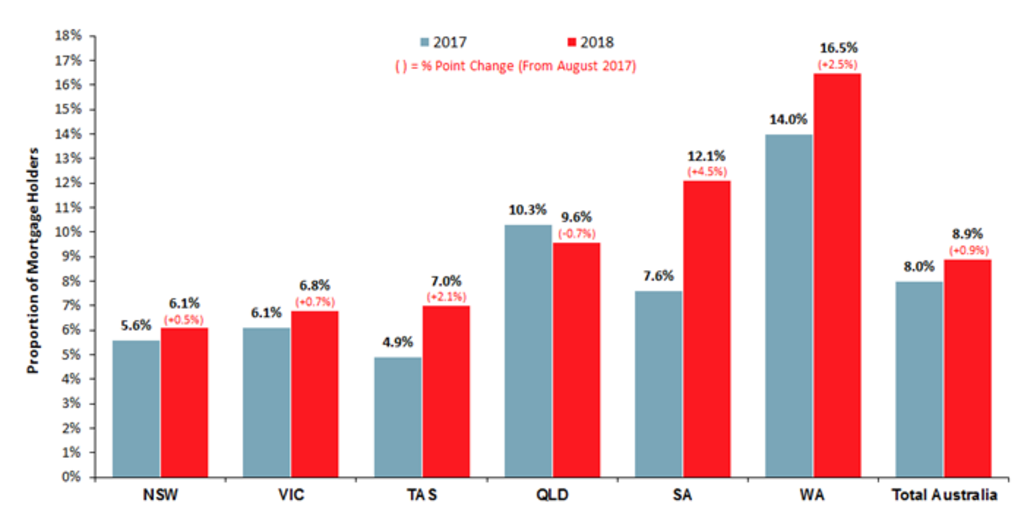

Homeowners in Western Australia are most likely to be in the red, with more than one in six mortgage holders owing more than the value of their home.

In South Australia, 12.1 per cent of mortgage holders are in a negative position – up from 7.6 per cent last year – while one in 10 borrowers in Queensland have negative equity, down slightly from last year.

The proportion of borrowers with negative equity in Tasmania jumped from 4.9 per in 2017 to 7 per cent this year. This is despite house prices increasing by 15.9 per cent in the year to June 2018, according to the Domain House Price Report.

The proportion of borrowers in Sydney and Melbourne with negative equity was slightly up in New South Wales (6.1 per cent) and Victoria (6.8 per cent), where house prices have retreated after several years of increases.

First-home buyers bear the brunt

The higher loan-to-value ratios and the lower average price of properties that are now in the red are key markers that first-home buyers are more likely to be facing negative equity, according to Domain economist Trent Wiltshire.

“First-home buyers generally buy cheaper houses and probably have higher loan-to-value ratios because they haven’t got equity that an upgrader or downsizer might have,” he said.

“It’s not that surprising with falling house prices that more people are in negative equity.”

Mozo housing expert Steve Jovcevski agreed recent purchasers were the ones feeling the brunt of the negative equity.

“It’s disproportionally hurting first-home buyers who can least afford it,” he said.

Roy Morgan industry communications director Norman Morris suggested the data didn’t capture the full extent of the problem, as house price falls have only just begun to be felt.

“By all indications it’s looking to get worse,” he said. “If home-loan rates rise, the problem would be likely to worsen as repayments would increase and house prices decline, with the potential to lower equity even further.”

What’s so bad about negative equity?

Negative equity traps homeowners in loans that are difficult to refinance and discourages owner-occupiers from trading properties as they continue to owe money after selling, according to Wiltshire.

“Owner-occupiers are more likely to stick it out than investors,” he said. “[Investors] have the advantage of offsetting any capital loss against capital gains.”

Jovcevski said owner-occupiers with negative equity were at the mercy of the banks and “whatever terms the banks dictate to them”, adding the situation could have a broader effect on the economy.

“Negative equity is a mindset,” he said, “when people realise when their property is worth less than what they paid for it, consumer spending goes out the window.”

Homeowners with negative equity could improve their position by paying down debts, but according to Wiltshire a market turnaround would have the biggest impact.

“The key for people in negative equity is for prices to rise.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More