How to avoid the most costly winter household hazards and insurance claims

Along with the winter blues come the winter hazards around the home. They creep up on us like the cold and not being protected by your home and contents insurance can leave you vulnerable.

Matthew Lawrence, head of partnerships at Claims Central, says there are two common and costly insurance claims that, come winter, home owners should be particularly conscious of.

“If you look at peril-type costs, fire and escapable liquid are the most expensive costs in the industry at the moment for home and contents insurance,” he says.

Fire and Rescue NSW say that of 4500 residential fires in NSW they attend to each year, one-third occur during winter. Wheat bags, heaters, open indoor fires, electric blankets and power surges can be accidents waiting to happen.

“Fire is normally caused by heating and an electrical surge in electrics in regards to more electric heaters, more appliances being used. Some of these older-wired and metered homes tend to start getting these fires occurring,” Lawrence says.

“It’s important as we move into winter to have a look at things that are around your house that might cause a fire [such as] heaters, electric blankets – especially if they’re a few years old,” insurance expert at Choice Daniel Graham says.

Escape of liquids is often due to dramatic day-to-night drops in temperature, putting strain on pipes which leads to leaks and flooding.

“Take a 15 or 20-degree day that drops to single digits or minus temperature at night. Then the hot water travels through these cold copper pipes and that’s when they tend to give way,” says Lawrence.

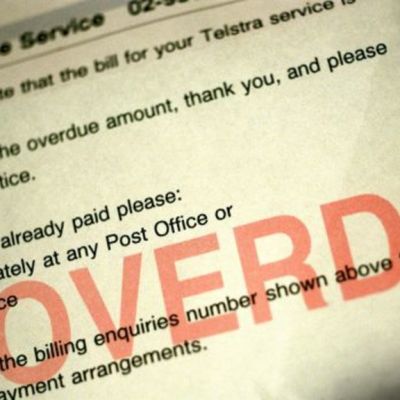

Preventing severe water damage due to the escape of liquids can be done by keeping an eye on changes in your water bill usage and water pressure. A noticeable change could mean there’s a leak which should be addressed before more pressure is placed on the systems in winter.

Mitigating these hazards before they happen is essential, but unavoidable accidents do occur. Nights are becoming cooler and heaters are being drawn out of storage, so it’s important to think about whether your home and contents insurance is currently working to protect you.

“Your house is your castle; it’s where you have the security of your family,” Lawrence says. “If you have losses, you really need to make sure you have that right home and contents cover in place first.”

Most insurance policies cover the same handful of common weather-related events like storms and fire, Graham says, so consumers should focus on looking at what is not included.

“The question instead is: what is excluded from things like storm cover? That’s when you need to go into the policy document to have a look at the nitty gritty and how different insurers are defining these events.”

For example, some insurers do not cover for leaks where the home owner hasn’t taken the necessary steps to minimise it, so it’s important to understand your policy’s details and fix leaks as they occur before they cause water damage.

Graham recommends carefully reading the Product Disclosure Statement, often referred to as the PDS, of each insurer to look out for things like temporary accommodation, cover for contents in the open air and flood cover, which are sometimes optional.

“Temporary accommodation is important so if your home isn’t suitable to be lived in after you’ve made the claim, the insurer can put you up in a hotel or similar rental accommodation.”

Along with covering certain weather-related events, Domain Insure’s home buildings and contents insurance covers fire, escape of liquid and storm damage as well as offering alternative accommodation should these inflict severe damage on your property. It also covers damage to your outdoor furniture or barbecue up to 20 per cent of the total contents sum insured.

Domain Insure’s call centre is based in Australia, so should an accident strike on a winter night, you’re able to begin your claims process straight away.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More