How to negotiate on all your bills to save hundreds of dollars

Taking charge of your finances is one way to navigate tough times, and negotiating cheaper prices for your regular bill payments is a great first step.

Even if you can only negotiate a small saving on a regular payment, it adds up over time, potentially saving you hundreds of dollars per year.

These are some of the expenses you can negotiate and how to go about it.

Mortgage repayments

Can you negotiate? Yes.

Most lenders will allow you to defer your repayments for three months in times of financial hardship, such as if your employment or hours have been affected by coronavirus.

The interest will be capitalised onto your loan, which means your loan balance will increase during this time but you won’t have to make a payment.

“Our understanding at present is this won’t impact your credit score due to the current environment,” says Alex Jamieson, financial planner and founder of A J Financial Planning.

Rent

Can you negotiate? Yes.

At the moment tenants can request a deferral on their rent and not risk eviction. This needs to be privately negotiated with the landlord and some states have announced specific regulations and guidelines. “We’re still waiting on more information about this one,” says Jamieson.

AMP financial adviser Mark Borg says there are other circumstances in which you can negotiate your rent. “Talk to your landlord if prices in your area have changed or maintenance to the property has not been kept up.”

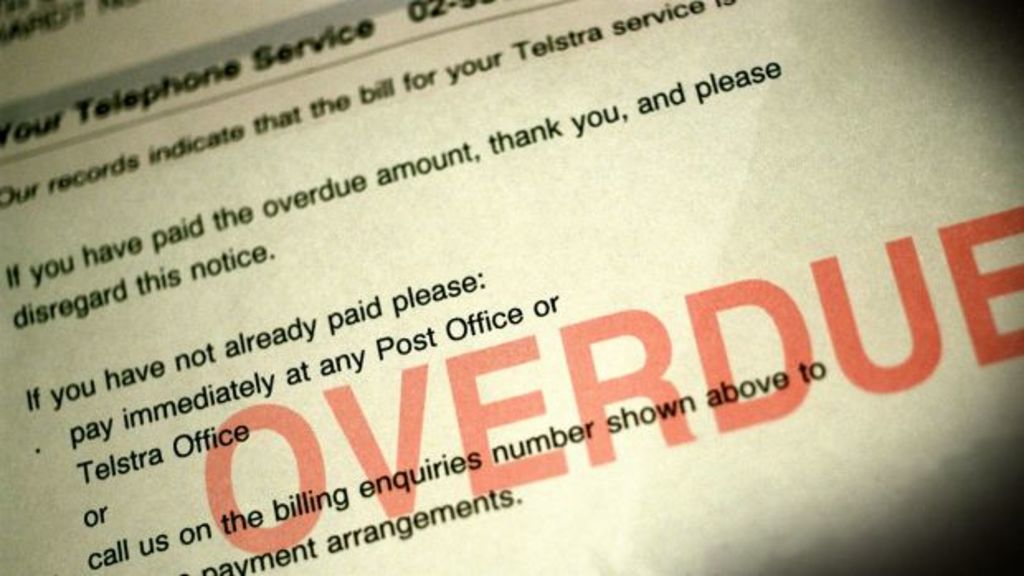

Energy, phone and internet bills

Can you negotiate? Yes.

Most utility and telco providers have indicated they won’t charge late fees if people are facing hardship. Some will also allow people in hardship to postpone payments.

“Let providers know you’re experiencing financial hardship because you’ve lost your job or your income is down. They have teams set up to handle the current situation as it is widespread,” Jamieson says.

Borg notes it’s worthwhile shopping around to find the best deals. “The opportunity for savings is huge. Even just a small saving on one of your bills could make hundreds of dollars of difference over a year.”

For example, paying $20 less per month on your phone bill would save $240 annually.

Insurance

Can you negotiate? Yes, but …

Jamieson says it’s a false economy to negotiate too hard to get your premiums down. “It’s a very vulnerable time and it is important you’re protected. Some life and income protection insurance policies may apply exclusions on COVID-19. So now’s not the time to make changes.”

Gym memberships

Can you negotiate? Memberships should be suspended already.

Gyms have suspended their memberships as they are now closed by government order as a result of coronavirus. Many are offering online classes at a reduced rate.

Health insurance

Can you negotiate? Yes, but take care …

You can talk to private health insurance companies about reducing your cover and therefore its cost. But think twice about whether this is really the right approach in the midst of a global pandemic. Many health funds have also already agreed to freeze their premiums.

Foxtel

Can you negotiate? Yes, but it’s difficult.

It’s believed to be very difficult to get through to Foxtel at the moment with so many people wanting to cancel their subscription given there’s no sport being played right now.

Other streaming services like Netflix offer a fixed monthly fee, which typically can’t be negotiated, although some like Stan are offering fee-free periods for previous customers who had closed their accounts.

How to approach a negotiation

Knowledge is power, so shop around and find out what other providers are offering for similar services.

“Make sure you are somewhere comfortable and private when you call and be ready for a wait,” Borg advises.

Also be prepared to stand your ground when asking for a better deal. Tell them what you are currently paying and ask what they can do for you.

“Or tell your provider about a better deal you’ve found and ask them to beat it. Don’t be scared to ask for a supervisor or manager,” he adds.

Remember your existing provider wants to keep your business. So as long as you’re being reasonable and respectful, staff will do everything in their power to help you. If they don’t, it might be best to take your business elsewhere.

The key is to act now rather than wait, especially if you think your financial situation is deteriorating.

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More