Most property investors believe past performance is a guide to future

Over half of Australian property investors are breaking the golden rule of investing – they use past performance as a guide for future success.

A majority 56 per cent of property investors said “Australian house prices have always gone up in the past” when asked for the main reason for their confidence, according to a 1500-person survey carried out by ME Bank in November.

Meanwhile 11 per cent said “so many other people are buying investment properties it must be safe”, while just 34 per cent were mainly confident thanks to “advice or analysis”.

And, for as long as most can remember, Australian house prices have indeed gone one way – up.

While “officially” calling the end of the Australian house-price boom in early November, UBS analysts noted 6556 per cent growth in the asset class over 55 years.

But ME Bank head of home loans Patrick Nolan warns investors should practice caution and objectivity, “particularly with property prices so high”.

“Analysis and advice is the best basis for making any investment decision, particularly if you’re tempted to rely on past performance, or indeed if you are basing your decision on what other investors are doing.”

More broadly, the temptation to think the good times will simply keep rolling is a “well observed investment phenomena”, according to CMC chief market strategist Michael McCarthy.

“Studies have shown that human beings are not rational agents maximising their utility, and that their financial decision-making involves components that a cold analysis would not allow,” Mr McCarthy told Domain.

“We have this experiential learning bias, so when we see another investor have a good experience with an investment, or if we have one ourselves it tends to reinforce our bias towards that investment.”

The fact that one in 10 property investors said they were confident because “so many other people are buying investment properties it must be safe”, is not a surprise either as safety for investors is seen to be had in numbers.

“Risks arise when you move away from your peer group,” Mr McCarthy said.

“The reality is that if you’re all wrong together then the punishment is a lot less than if you were wrong by yourself.”

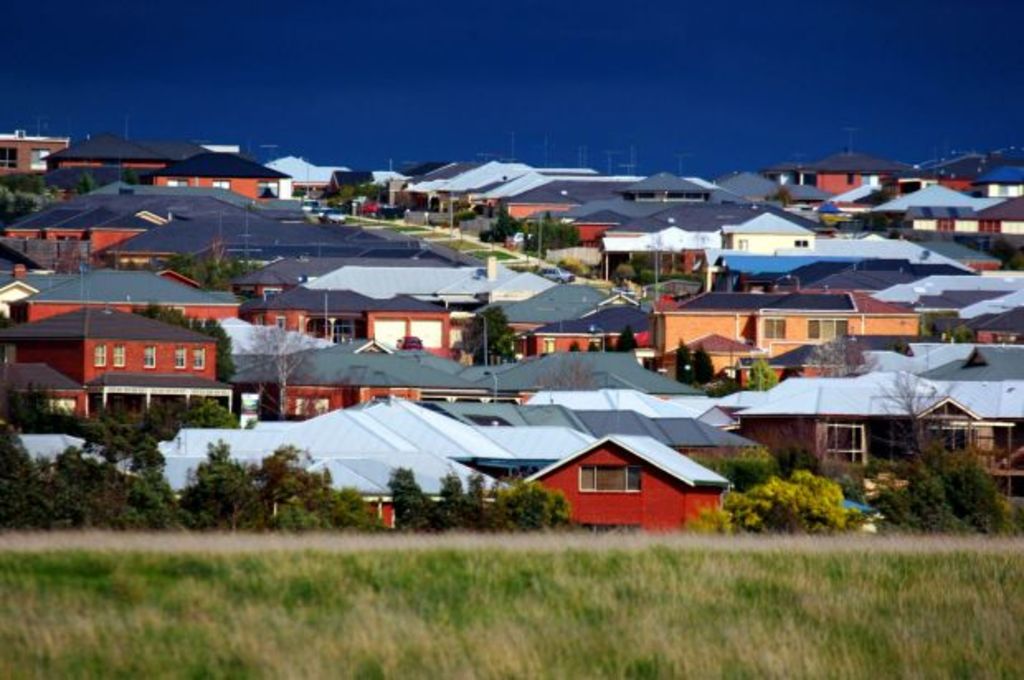

The ME Bank survey presents are particularly interesting given how varied the Australian property landscape is for investors, according to the researchers.

“Australia’s property market is diverse and not all properties are performing equally at any one time,” Mr Nolan said.

“While Perth is currently recovering from a downturn, Melbourne and Sydney are growing albeit not as fast, while growth in Hobart has improved.

“Apartment development in Brisbane, Sydney and Melbourne are also at record high levels, with some commentators speculating supply may outstrip demand in the short-term.”

The result follows the surprising news that 24 per cent of property investors are now “happy” to see property prices fall in order to assist the widespread capital city affordability issue, with more Australians now expecting to benefit from weaker prices growth.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More