RBA holds the cash rate at 4.35 per cent as inflation persists

The Reserve Bank of Australia (RBA) has held the cash rate at 4.35 per cent, despite June quarter consumer price index (CPI) figures showing an uptick in inflation.

While it may be frustrating to see other countries like the United States cutting interest rates, economists say Australia’s sticky inflation figures mean our cash rate will stay on hold until the RBA hits its 2 to 3 per cent target.

“There are a couple of reasons why the RBA has chosen to hold,” says PRD real estate chief economist Dr Diaswati Mardiasmo.

“When it comes to our inflation rate, it’s still quite high. It hasn’t come down as much as the RBA would like it to, and in their forecast, they’re forecasting that there might be a couple more rises in our inflation rate.”

“If we were to cut and then go back up again, it would shock the economy even more because then people would feel that they have more money and might spend more. Then inflation will go up even further, and the RBA will be forced to increase the cash rate again,” says Mardiasmo.

“That sort of economic effect is going to be worse for us. Whereas keeping it steady right now is keeping everything stable with the possibility of a cash rate cutting down the line.”

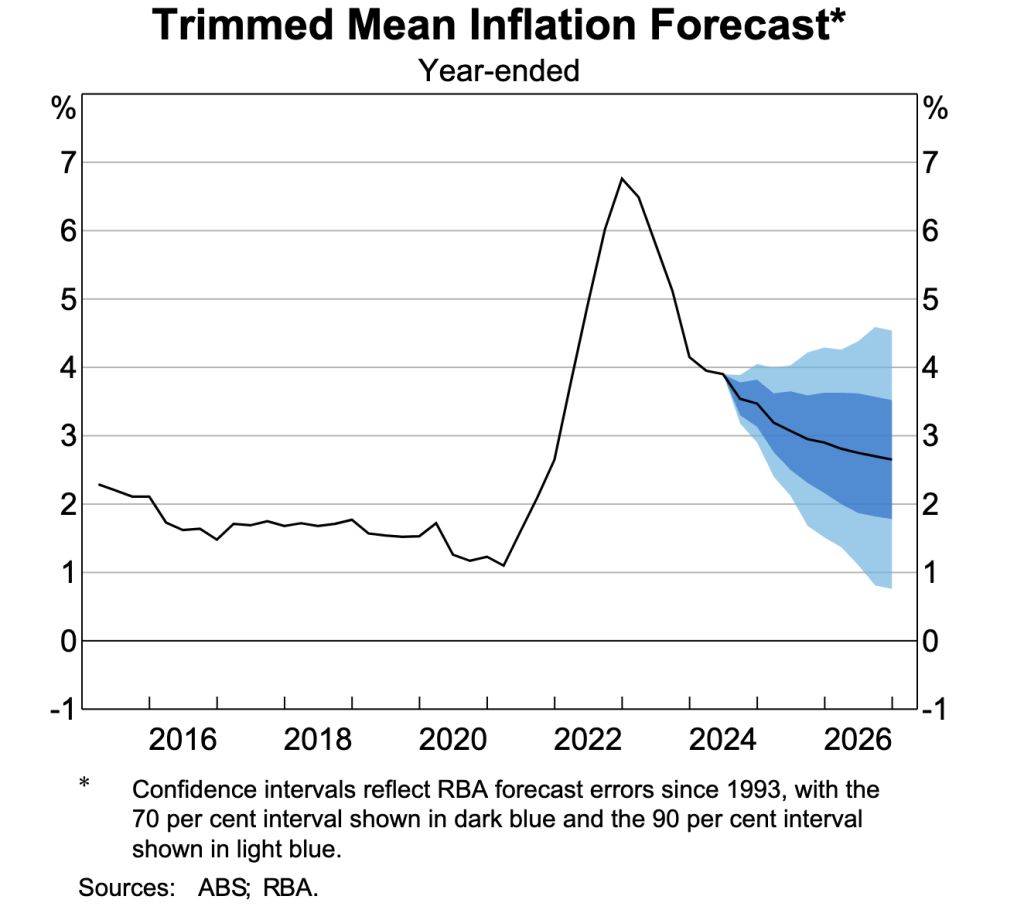

The quarterly CPI, an indicator of inflation, rose by 1 per cent in the June 2024 quarter, and annual inflation rose to 3.8 per cent, above the RBA’s 2 to 3 per cent target, but well below its December 2022 peak.

“The annual rise of 3.8 per cent for the June quarter is up from 3.6 per cent in the March quarter,” says Australian Bureau of Statistics (ABS) head of prices statistics Michelle Marquardt.

“This is the first increase in annual CPI inflation since the December 2022 quarter.”

The most significant contributors were housing, food and non-alcoholic beverages.

“The continuing tight rental market and low vacancy rates caused rental prices to go up 2 per cent for the quarter, following a 2.1 per cent rise in the March 2024 quarter,” says Marquardt.

Sean Langcake, head of macroeconomic forecasting at BIS Oxford Economics, says: “The RBA is kind of choosing between two bad things here. They could have tolerated this inflation running a bit hot for a while, which is what they’re doing, or they had the choice to take interest rates even higher, which would have put more people out of work.

“It’s not like they’ve chosen to tolerate this inflation without thinking of alternatives. It’s just that it’s been deemed to be the best of bad options,” he says.

In the August 2024 Statement on Monetary Policy, the RBA said inflation targets will take longer to reach than previously calculated in May.

“Underlying inflation is expected to be inside the target range of 2 to 3 per cent in late 2025 and approach the midpoint of the band in 2026,” said the statement.

“It is a difficult balancing act. Inflation is still a bit too high, but we are now seeing signs of weakness in the economy,” says Ray White Group chief economist Nerida Conisbee.

“We are not in recession but have now seen three quarters of almost zero growth. Unemployment is creeping up and now sits at 4.2 per cent.”

This prolonged hold period is “the stability Australians are looking for,” says Domain chief of research and economics Dr Nicola Powell.

“A cut is unlikely to happen until next year. But this stable environment is great for confidence as well. We’ve seen that in terms of sellers listing their homes.”

The most recent Domain Market Insights revealed new listings have increased by 13.1 per cent in the past month and 8.1 per cent annually.

While today’s announcement was a hold, three major banks forecast that the first RBA cash rate cut will come in 2025. Commonwealth Bank estimates that it’s still possible to see a rate cut by the end of 2024.

Sep 24

Dec 24

Mar 25

Jun 25

Sep 25

Dec 25

Mar 26

Jun 26

Sep 26

Dec 26

Westpac

4.35%

4.35%

4.10%

3.85%

3.60%

3.35%

3.35%

3.35%

3.35%

3.35%

NAB

4.35%

4.35%

4.35%

4.10%

3.85%

3.60%

3.35%

3.10%

3.10%

3.10%

CommBank

4.35%

4.10%

3.85%

3.60%

3.35%

3.10%

N/A

N/A

N/A

N/A

“Compared to other countries, the RBA clearly didn’t go as hard on bringing things back to earth. That’s why we have higher inflation for longer, but it’s also why we have a jobs market that’s in better shape,” says Langcake.

Last week the US Federal Reserve cut the cash rate for the first time in four years by 50 basis points to 5 per cent, despite US inflation not reaching its 2 per cent target. Other global markets like Canada, New Zealand and the EU have also cut their cash rates.

“The US and Canada, EU and all of the other countries, they increased their cash rate much quicker than we did. We were lagging behind them,” says Mardiasmo.

“The US and New Zealand increased their cash rate about three to six months before us. If you look at it from that time frame, it makes sense that we’re also three to six months behind in cutting the cash rate.”

| Country | Cash Rate |

| USA | 5% |

| Canada | 4.25% |

| New Zealand | 5.25% |

| European Union | 3.65% |

| United Kingdom | 5% |

| Australia | 4.35% |

A country cutting the cash rate before hitting its inflation rate is a matter of timing to boost its economy, says Conisbee.

“The US economy is just looking so weak [compared to Australia],” she says. “The balancing act between not destroying the economy and keeping inflation under control is quite a delicate balance.

“The US must have come to the conclusion that it’s better to just give it a bit of a boost, as opposed to continuing to try and get inflation within that target level.”

For those desperate for a rate cut, Langcake says patience is key because cash rate impacts come with a lag.

“If we’re patient and kind of ride it out, then the fact that inflation is slowly coming down is going to help with cost of living pressures,” he says.

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More