Senate committee backs plan to roll back responsible lending rules, citing home-loan approval delays

Responsible-lending rules could soon be rolled back, after a government report warned home loan approvals were taking too long and were too invasive.

A Senate committee argued the change would not undermine consumer protections, saying the principle of responsible lending was still embedded in other bank regulation.

The findings are in stark contrast to calls from consumer advocates to keep the rules, amid worries the changes would allow borrowers to take out loans they could not afford, with banks facing no penalty if they contravened the existing laws on responsible lending.

Experts have also warned the change would further push up soaring property prices.

The laws were introduced in 2009 after the global financial crisis and require banks to make sure a loan is not unsuitable for a borrower, and verify the borrower’s financial situation.

They came into focus during the financial services royal commission, when case studies emerged of borrowers who could not pay their loans, and the commissioner recommended the laws be kept as is.

Reports emerged at the time of nervous bankers making extra inquiries into customer expenses to avoid making bad loans that would attract any more scrutiny — down to declining applications because borrowers were spending too much on Uber Eats.

Plans to unwind the laws were announced by Treasurer Josh Frydenberg in September in a bid to increase the flow of credit to households and businesses as the economy recovers from the COVID-19 pandemic.

Australian property prices could rise further when lending laws are relaxed, experts say

Australian property prices could rise further when lending laws are relaxed, experts say Responsible lending: Consumer groups warn against moves to make it easier to get a home loan

Responsible lending: Consumer groups warn against moves to make it easier to get a home loan Overhauling responsible lending laws will increase household debt, push property prices up: experts

Overhauling responsible lending laws will increase household debt, push property prices up: experts Changes to home loan rules could boost the average buyer’s budget by $70,000

Changes to home loan rules could boost the average buyer’s budget by $70,000

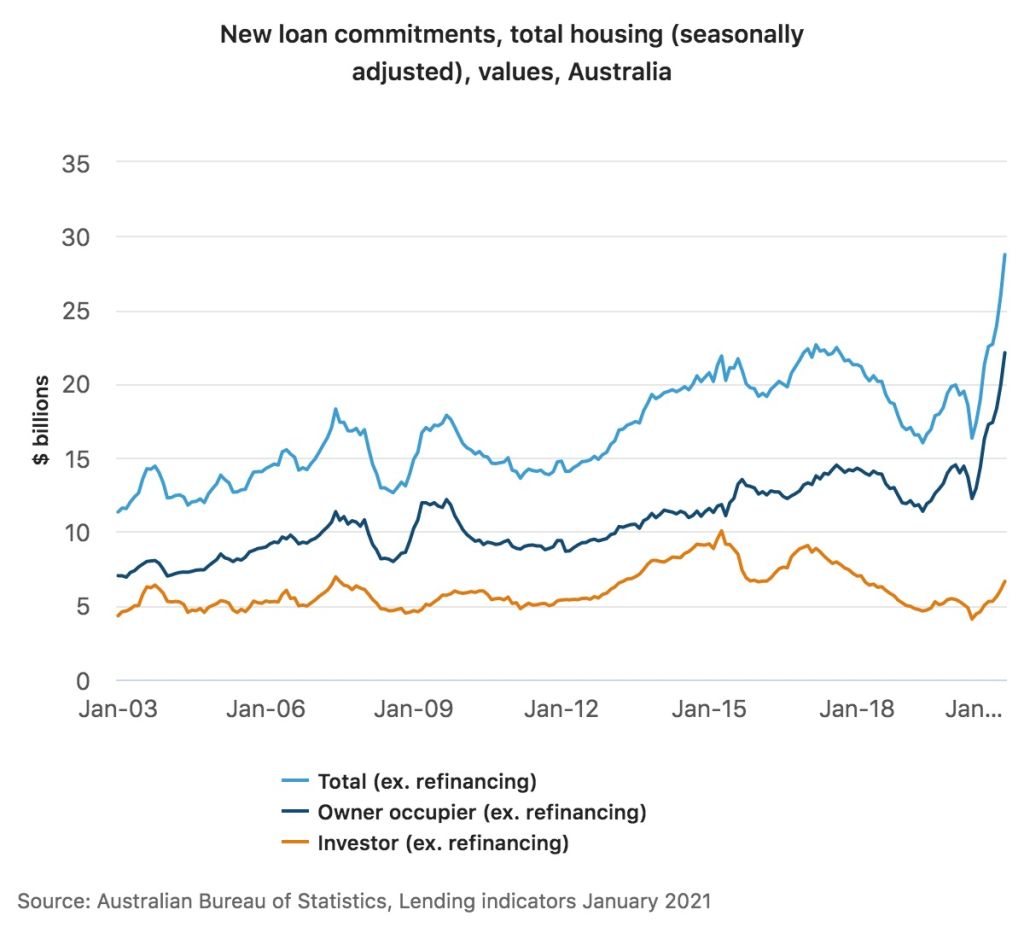

Since then, the value of new home lending has reached record highs, at $28.8 billion in January, some 44.3 per cent higher than a year earlier, on ABS figures.

The federal government takes the view that a well-functioning credit market is essential for economic growth and pandemic recovery, an argument expressed by the Senate Economics Legislation Committee in a report released on Friday backing a change to the laws.

“The current consumer credit protection framework is potentially overly prescriptive,” the report found.

“The committee is concerned by evidence that the regulatory framework has resulted in consumers being unable to access credit in a timely manner to buy their first home or to obtain a grant under the HomeBuilder scheme.

“The committee is also concerned by the invasive and onerous nature of the inquiry and verification processes required under the existing responsible lending obligations.”

Although the committee noted concerns raised with the reforms, it took the view that the change would not undermine consumer protections, and that the principle of responsible lending was embedded in the broader regulatory framework. It suggested raising awareness of the dispute resolution services available through the Australian Financial Complaints Authority.

Labor senators dissented, saying the need for responsible lending laws was affirmed by the financial services royal commission.

They pointed to evidence from consumer group Choice’s chief executive Alan Kirkland, who said more than $350 million in compensation had been paid to consumers after banks breached the laws, adding this would not happen if the laws were changed.

Mr Kirkland also told the inquiry that AFCA was not a law-enforcement agency and existed to resolve relatively small disputes, in contrast to corporate regulator ASIC which can get a bank to set up a large-scale remediation scheme if needed.

Labor also noted evidence from the Australian Banking Association that credit was getting into the economy, and that the ABA did not think current rules were choking the supply of credit.

Choice and more than 120 organisations last year called on the government to save “safe lending” in an open letter to parliament.

The consumer advocacy group last week released an open letter to the federal government about its proposed changes to lending laws, which it says would end safe lending.

It has been signed by 33,000 Australians and 125 community groups.

In the letter, Choice said that changes to the law would mean people would be worse off, as they may get loans they cannot afford to repay and said laws contradict the findings of the financial services royal commission, which encouraged safe lending rules to be enforced.

“If this law is passed, people will be left to pick up the pieces for years to come while banks and other lenders are given a blank cheque to profit from aggressive lending. We need you to stand up for our community and protect safe lending laws,” the letter said.

The Financial Rights Legal Centre has previously compared the change to “throwing away an umbrella in a rainstorm because you’re not getting wet”.

Mortgage brokers have previously suggested home loan approval delays are due to a high volume of applicants, rather than strict lending criteria.

The bill could be voted on as early as this week but would require the support of Senate cross-benchers to proceed.

We recommend

What are the predicted interest rates for 2025?

Dexus takes heart from rate cut

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More