The market that has grown four times faster than property: classic cars

What if the thing in your garage appreciated in value faster than your entire house? It happens more than you think.

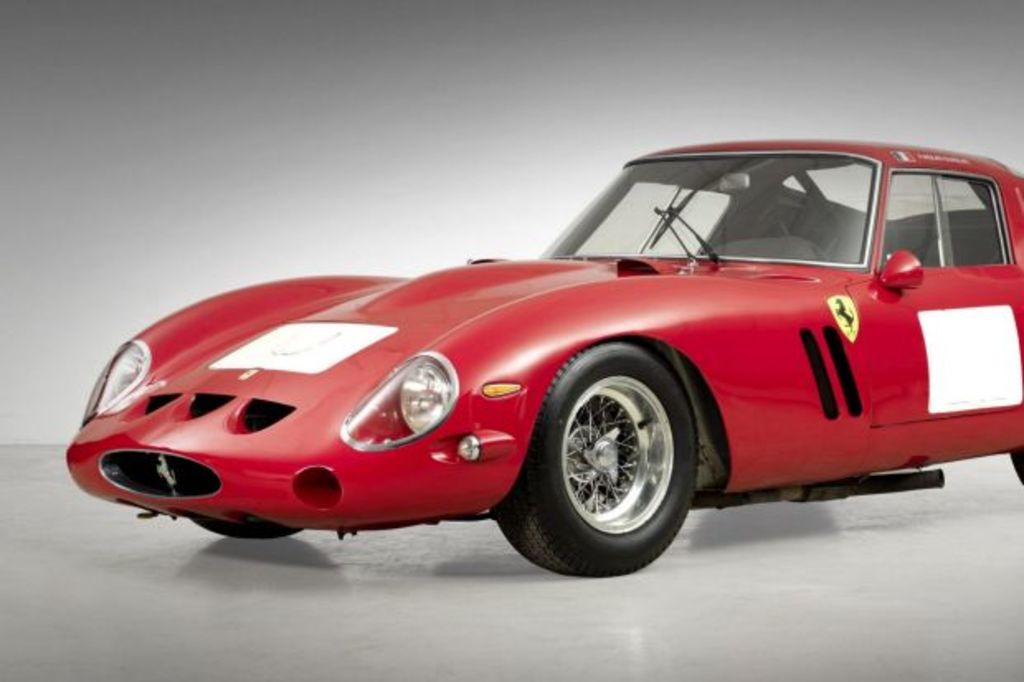

While the value of 99 per cent of cars drops like a stone the moment they leave the dealership, the “blue-chips” of the automotive world – typically seen as self-indulgent and perhaps even compensatory – have turned out to be some of the finest investments of the century.

Remember the McLaren F1? You might have seen pictures of Rowan Atkinson cruising around in his before he famously crashed it, twice.

Here’s some food for thought – if you’d managed to buy a new one 22 years ago, and hung onto it, you’d have made 77 per cent per year on your investment. That’s three and a half times more than a house in Sydney over the same period.

In fact, one of the original 106 made sold at auction on Saturday for $US15.62 million ($19.73 million) in California. While that may seem like a ridiculous price tag to those in the know it represents market value.

Classic cars have gained 404 per cent in value over the past 10 years, according to the latest Knight Frank Luxury Investment Index, which means they’ve strongly outperformed gold, stocks and, yes, even houses in Sydney and Melbourne.

Premium luxury sports cars are now seen as the exception to the broad motor-industry rule that a car starts losing money the moment it’s driven out of the dealership. The likes of special edition Ferraris, Mercedes, Aston Martins and Porsche supercars are seen to have a surprisingly stable rate of return.

The global low interest rate environment of the past decade has helped funnel investors into these sorts of “non-traditional” investments, according to CMC Markets chief analyst Michael McCarthy.

“One of the key challenges for investors has been seeking reasonable returns, given the flood of money that has gone into traditional investment markets like bonds and shares,” Mr McCarthy told Domain.

“And the stretch in valuation that we’ve seen in those markets – there’s little doubt that this highly liquid environment due to the unprecedented central bank activity has seen non-traditional investment markets expand enormously.”

But as world markets finally start finding their footing after the catastrophic global financial crisis, these “alternative” markets could find themselves heading into correction.

“We’ve had a very clear signal from the US Federal Reserve that the tide is about to reverse,” Mr McCarthy said, noting the European Central Bank and Bank Of Japan are also on the verge of lifting interest rates.

“That will have the impact of deflating the air in the global investment market.

“If someone has been waiting all their life to get their hands on a particular piece because they love that piece well then I don’t see any issues but I would suggest that, with this reversal of central banks, we could see a lot of deflation in these non-traditional collectable markets.”

But Shaun Baker, general manager of Melbourne’s Dutton Garage, says a handful of cars remain as close to a safe investment as exists.

“We call some of our cars the ‘blue-chips’,” Mr Baker told Domain.

“We’re the only dealership to have La Ferrari, [McLaren] P1, [Porsche] 918 and [Bugatti] Veyron – and all of those cars are … if you had to call a sure bet, they’re a sure bet in terms of investment.”

While past performance is no indicator of the future of any asset class, the Knight Frank research points out a few “young” classic cars with already-impressive returns. The average percentage price rise noted for McLaren F1s is 1000 per cent since new, and the one being sold this week could return 1600 per cent for the person who bought it new.

Swish that around in your mouth while you have a look at some of the most expensive cars ever sold in the US.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More