Almost one-third of Australians face rental or mortgage stress, survey finds

Almost a third of Australians say they face mortgage or rental stress amid the ongoing coronavirus pandemic, with household savings also taking a hit in recent months.

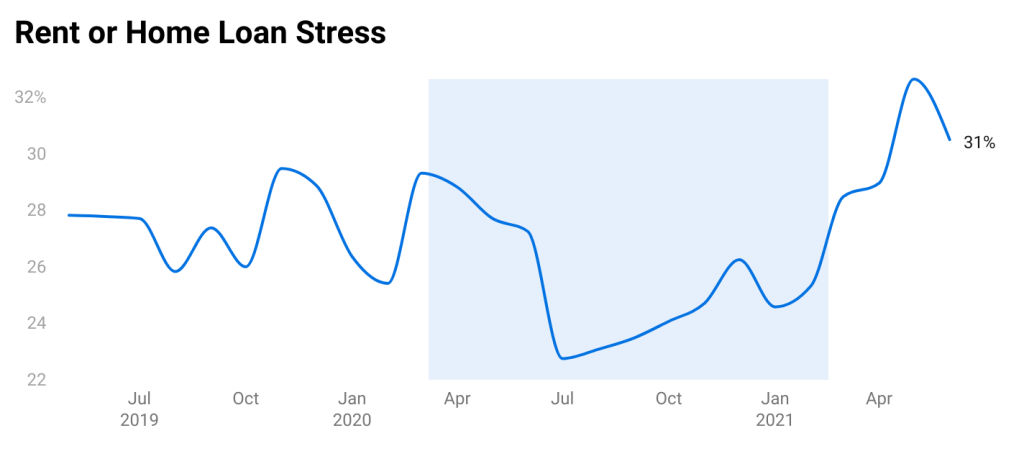

Against a backdrop of rapidly rising property prices and record-high rents across much of the country, 31 per cent of people are struggling to make their rent or home loan payments, new figures show.

While this is down slightly from 33 per cent of renters and home owners in June, it’s well up on the 23 per cent of respondents who reported rent or home loan stress in July last year. The Finder Consumer Sentiment Tracker shows stress levels had been rising steadily since.

Graham Cooke, head of consumer research at Finder, said financial stress had been going in the opposite direction to what might be expected, with stress levels down last year, despite the coronavirus pandemic.

“This shows that the government payments were effective in relieving some of the financial pressure resulting from the first lockdowns,” Mr Cooke said. He noted the stress metric had risen as lockdowns continued and as government support payments were lifted.

People overextending themselves to keep up with rising property prices could also be a factor for increased mortgage stress, particularly among recent first-home buyers, as could recent increases in rates for fixed mortgages.

Mr Cooke noted average monthly cash savings had also taken a hit, dropping to $703 in June – its lowest level since March 2020 – and down from a peak of $953 in February.

AMP Capital chief economist Shane Oliver said mortgage and rental stress might have increased when Australia went into lockdown early last year, but the roll-out of mortgage repayment holidays, JobKeeper and the increased JobSeeker payment, combined with further cuts to interest rates, had eased stress in the months that followed.

Reduced spending and increased savings last year by those whose income was not impacted by the pandemic meant more people might have got ahead on their mortgage repayments as well.

Mr Oliver said the end of support payments and repayment holidays, along with rapidly rising property prices – which have seen people take on larger loans – and growing talk of future rate hikes, could all have contributed to rising stress levels.

“The level of interest payments to household income has collapsed relatively, so in theory, you could argue mortgage stress should be lower, because we don’t have the high level of interest rates, but we know that people have to borrow a lot more to get into the market and people may stress over the amount that they have borrowed,” he said.

Mr Oliver expected stress levels for those impacted by the current Sydney lockdown would fare similarly to last time but noted the support payments were less generous than those seen last year.

However, he noted there was often a disconnect between mortgage stress indicators and the level of defaults, or non-performing loans, suggesting that while more people were stressed, the bulk were still able to meet repayments.

It comes after a report released by consumer group CHOICE earlier this year found that more than 130,000 households in NSW and Victoria alone were on the brink of a financial crisis due to mortgage stress.

The Financial Rights Legal Centre, which offers advice and advocacy for those in financial stress, is consistently getting calls daily from those in mortgage stress, said senior policy and communications officer Julia Davis.

“They are often referrals from the banks, people who were on a COVID-related [mortgage] deferral during 2020 … and all those deferrals have come to an end, and people are not in a position to go back to resuming normal repayments.”

While some had already been facing hardship that was exacerbated by the pandemic, others worked in hard-hit industries like tourism and hospitality and simply had not been able to recover since.

She feared the latest lockdowns would only add to the financial stress of those who had already chewed down on their savings last year and noted some people were already spending less on food and other essentials in order to meet their repayments.

Ms Davis said the increasing stress levels were another reminder of why an overhaul of responsible lending laws still before the senate should not go ahead, with concerns it could see more Australians get loaded up with unsuitable debt. A big concern was that those already facing financial stress could turn to third-tier lenders who may help them refinance at shocking rates that they cannot afford to pay off.

Mr Oliver added overhauling responsible lending laws seemed unnecessary given the surge in lending suggested the current rules were not a constraint on borrowing and added it seemed jarring to relax the laws at the same time as the RBA and APRA were warning banks to maintain lending standards.

He also expressed concern that the 60,000 government loan scheme spots – which help first-home buyers and single parents to get into the market with lower deposits – could cause higher mortgage stress levels down the line. While it was desirable to help these groups onto the property ladder, he said there was a danger in more people borrowing at a very high loan to value ratio.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More