Are build-to-rents the solution to the rental affordability crisis? Not really

A new build-to-rent apartment building has gone up in the small inner-Sydney suburb of Petersham, but a two-bedroom unit costs over $1000 a week to rent.

Build-to-rent (BTR), which is housing built for the sole purpose of being rented rather than sold to individual investors or owner-occupiers, has been the hope of many as the solution to Australia’s rental crisis, but if a two-bedroom apartment is $1090 a week, who is it helping?

The reality is that BTR is won’t be any kind of quick fix, says says PRD real estate chief economist Dr Diaswati Mardiasmo.

“BTR assists [the rental crisis], yes, but not fully,” she says.

“BTR tends to be more of a luxury. It’s usually 10 to 15 per cent higher than the median rent of the suburb. This is due to the cost to build BTR and the all-inclusive services within one.”

Typically, BTR buildings come with exclusive resident amenities and long-term leases, which make them a premium product, says Mardiasmo.

For example, a BTR in Melbourne, Local: Kensington, includes a fully equipped gym and yoga studio, co-working and private dining spaces, a cinema, games room and residential lounge, an outdoor heated pool, barbecue area and a pet-wash station, along with secure bike storage and electric car share.

“Most BTRs tend to be targeted to double-income, no-kids professionals. Basically, people who are working close to the CBD and have higher paying jobs,” she says.

BTRs were never supposed to be a solution to combat affordability issues in the rental market, says UNSW professor of housing research and policy Hal Pawson.

Even with the government concessions that give a tax break in exchange for developers providing a handful of units at a more “affordable rent” ( 75 per cent of market value), it’s still too expensive for lower-income households, he says.

“For example, advertised rents for recently completed BTR schemes in Sydney and Melbourne [typically have] minimum weekly ‘market rents’ in the range of $815 to $935 for a two-bedroom apartment,” he says.

“Thus, according to the 74.9 per cent of market rate formula, the affordable rent for such units would be in the range of $610 to $700 per week,” says Pawson.

The weekly national median house income is just $1770, according to 2021 census data.

“Using the conventional benchmark rental affordability threshold of 30 per cent of household income, rents in this range would be beyond the means of any household receiving a gross weekly income below the range of $2035 to $2334,” says Pawson.

While BTR’s higher price point may seem counterproductive to the rental crisis, Pawson and Mardiasmo say it will eventually help bring it down because it diversifies the type of rentals available.

Jeremy Quinn from Franklin St, a BTR advisory company, says more mature markets like the US and UK have a more extensive price range of BTRs. Typically, in newer markets like Australia, some of the first BTR buildings tend to be high-end luxury living.

“That’s where [developers] went in phase one [of BTRs],” says Quinn. “As the market matures and becomes deeper and wider, we’ll have different price points that target all kinds of renters.”

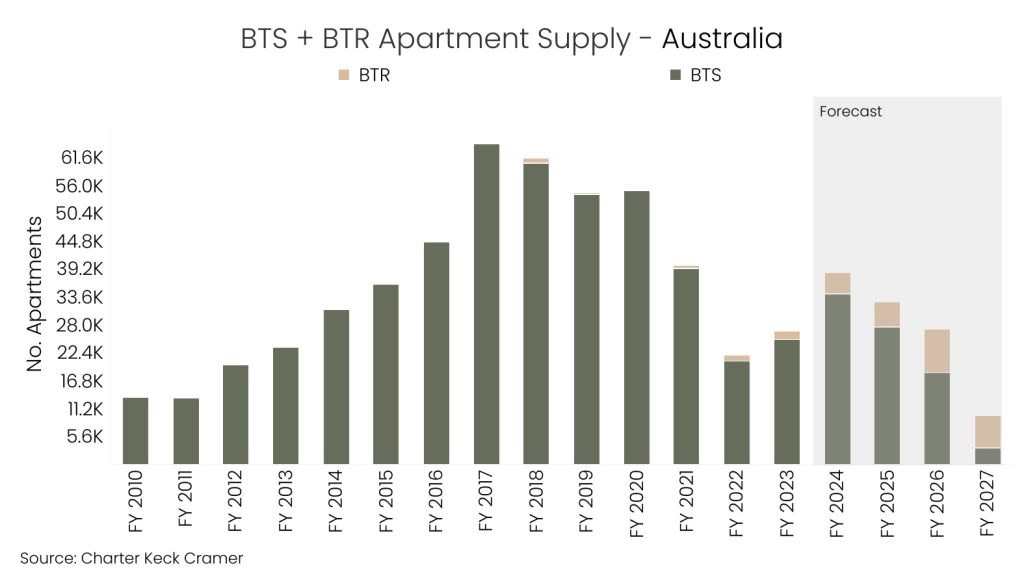

Out of the 2.5 million rental dwellings in Australia, only about 0.2 per cent are BTRs, according to an Ernst & Young Australia report.

Australia’s 0.2 per cent is roughly equal to 23,000 apartments, the report says.

Franklin St’s BTR database forecasts there will be 48,645 operational units by the end of 2027.

While the number of BTRs may seem small, supply is a good thing, and rents should drop across the market, says Quinn.

“It is more of a supply solution in the sense that there are now more choices for people who can afford a premium rent,” says Mardiasmo.

When someone with a higher income vacates a mid-tier or an affordable rental, it opens that property up to people who have a lower rent budget, she says.

“If there are enough [BTRs] built, then it will help reduce the level of house price inflation and rent inflation in the future,” Pawson says. “And once there is diversification of BTRs it ceases to be only a premium.”

“Build-to-rent can move the needle on the housing crisis or rental crisis faster than build-to-sell can, since you don’t need to wait for pre-sales,” says Quinn.

“In a build-to-sell, the developer needs to hit a certain level of sales before they start construction, which adds more years to the time frame.

“Whereas build-to-rent, once you’ve decided to build it, you can start immediately. So, build-to-rent can create supply at all price points faster than built-to-sell can.

“Expensive BTRs will not be the norm,” he says. “It’s a maturing asset class, so it’s just going to take some time [for prices to diversify].”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More