Australian property prices continue to break records despite lockdowns: Core Logic

Australian property prices are growing at their fastest pace in 17 years despite lockdowns, with several cities climbing to record highs, new data reveals.

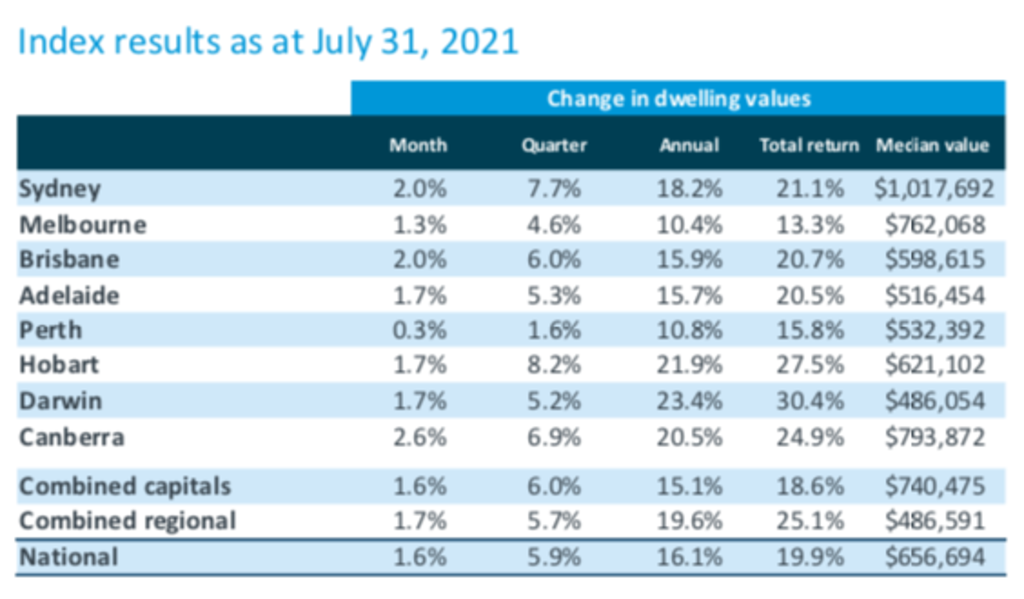

National dwelling values are now up 16.1 per cent over the past year to July, after chalking up another 1.6 per cent in the past month, reaching a median of $656,694, the latest Core Logic Home Value Index released on Monday shows.

The majority of that annual growth was recorded over this year, growing 14.1 per cent in the first seven months.

It is the strongest annual growth seen since April 2004, but the monthly growth rate has been slowing since March this year when the national index rose 2.8 per cent, said Tim Lawless, Core Logic’s research director.

Every capital city, except for Darwin and Perth, recorded new high median prices.

Canberra recorded the fastest monthly growth in July of 2.6 per cent, with its median reaching $793,872.

Darwin recorded the fastest annual growth of 23.4 per cent with the median reaching $486,054.

Perth’s median dwelling value is still 13.8 per cent below its peak back in June 2014 and Darwin’s median value is still 15.3 per cent from its May 2014 peak.

Despite Sydney’s ongoing lockdown, dwelling values rose another 2 per cent in July, and 18.2 per cent over the year, reaching a median of $1,017,692.

The restrictions have spooked vendors who are holding off listing their properties until restrictions ease, putting even more pressure on buyers who are still keen to transact.

“They’ve clearly had an effect on activity but not on values,” said Mr Lawless. “The trend in new listing numbers was rising really quickly leading up to lockdown, but that has fallen sharply more recently, having a drag-down effect.”

Listing levels almost halved in July as a result, with the mismatch between buyer demand and advertised supply a key factor that placed upwards pressure on housing prices, he said.

“One of the biggest impacts of COVID is a further reduction in available supply, which is creating more urgency among buyers.

“Vendors have lost confidence, understandably, when you consider it’s harder to have a property inspected or have an open home.

“On the flip side, we’re not seeing buyer demand easing off; you can still virtually inspect a home or go to an auction online.”

Melbourne’s snap lockdown in July did little to slow property price growth, with the city’s median dwelling value increasing 1.3 per cent in July, and 10.4 per cent over the year, to $762,068.

But Mr Lawless said the rate of growth would inevitably ease as affordability continued to weigh down on price-sensitive buyers such as first-home owning hopefuls and lower-income families.

“Prices are rising more in a month than wages are rising in an entire year,” he said. “It’s a real positive thing for someone who owns a home they’re getting wealthy, but for someone who doesn’t, they’re stuck between a rock and a hard place.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More