Australian borrowers keep up with home loans as economy recovers, but warning over most indebted: S&P

Australian mortgage-holders are keeping up better with their repayments as the economy recovers from last year’s pandemic recession, but borrowers with big debts are more likely to be at risk.

Low interest rates, an improving jobs market and government stimulus have helped home borrowers, a report from ratings agency S&P Global Ratings found, with its key index of mortgage arrears falling to 0.94 per cent in March, lower than 1.03 per cent in March 2020.

“The resilience of household balance sheets, bolstered by government stimulus measures and low interest rates, has enabled many borrowers to build up repayment buffers, cure prior arrears positions, and stay on top of their mortgage repayments,” the report found.

“A small proportion of borrowers are likely to transition to formal hardship arrangements in the coming months, but this is unlikely to cause any significant upward pressure on arrears while interest rates are low and employment prospects strong.”

The upbeat assessment is a stark contrast to worries at the start of the crisis that unemployment would skyrocket and home foreclosures would spiral. It comes after emergency measures last year such as ultra-low interest rates, mortgage holidays and government income support, which, along with a better than first feared health situation, helped steer the nation through the COVID-19 crisis.

House prices have since soared as workers who kept their jobs took advantage of low borrowing costs to get into the property market, with many finding they have to stretch themselves to keep up with rising prices.

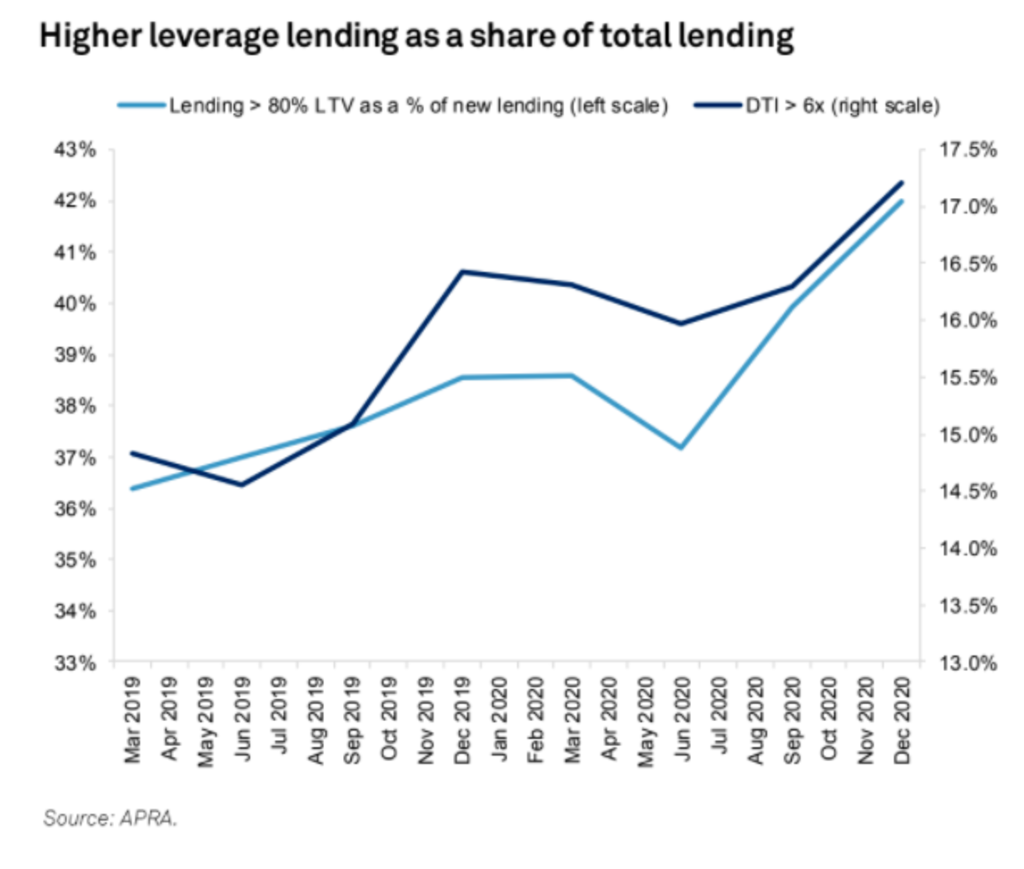

More buyers are getting into the market with a small deposit and a larger loan compared with pre-pandemic, S&P said.

Borrowers are increasingly taking on large debts that are at least six times their incomes.

These are metrics that will be in focus for financial regulators as they decide whether or not to make it harder to get a home loan in the wake of rising house prices.

Although the report noted home ownership has social benefits if the debt can be comfortably serviced, it sounded a note of caution on the risks of large debts.

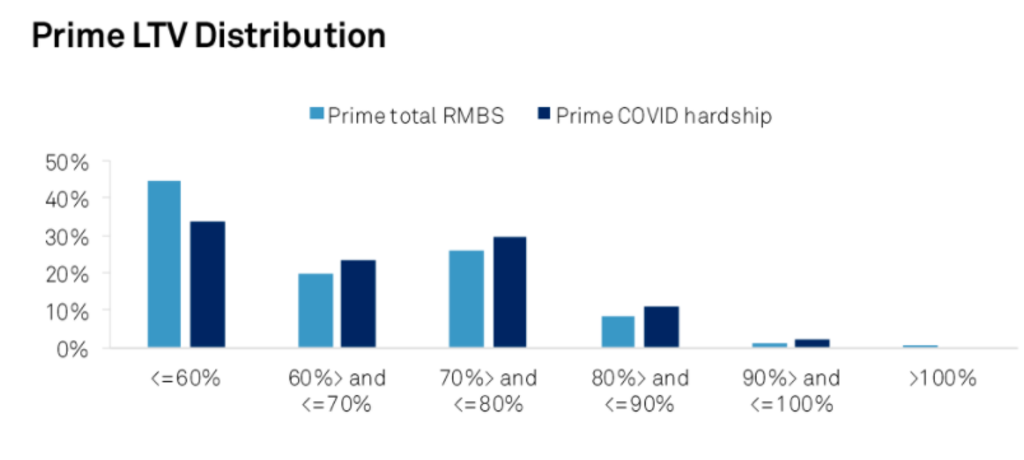

Loans that were still under mortgage holiday arrangements by March were skewed towards borrowers with large debts and small amounts of equity.

Home-owners with a high loan-to-valuation ratio often lack repayment buffers, as they may have only been making payments for a short time.

The report warned that self-employed borrowers could be hard hit by Melbourne’s latest lockdown, especially those in the closed hospitality and leisure industries, as JobKeeper payments are no longer on offer.

Casual workers have lost shifts but they are less likely to own their own homes, the report said.

Many borrowers had been making extra repayments during the pandemic and this will offer a cushion to them in case of lockdowns without government support payments.

By March, mortgage deferral arrangements were more common in South Australia, Victoria and NSW, and less likely in Western Australia and Queensland.

Low interest rates, rising property prices and a recovering economy are set to help most borrowers keep up with their repayments, S&P said.

Arrears look set to remain well below the peaks they reached during the global financial crisis.

And, if borrowers do default, their losses would be limited because their property would be sold into a rising market.

But, it could take some months yet to see if the last borrowers to come off mortgage holiday arrangements can keep up with their repayments.

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

- © 2025, CoStar Group Inc.