Australian house price growth outpaced wage growth in the last financial year, data shows

Australian house prices have outperformed wages over the past financial year, pushing home ownership further out of reach for some, new analysis shows.

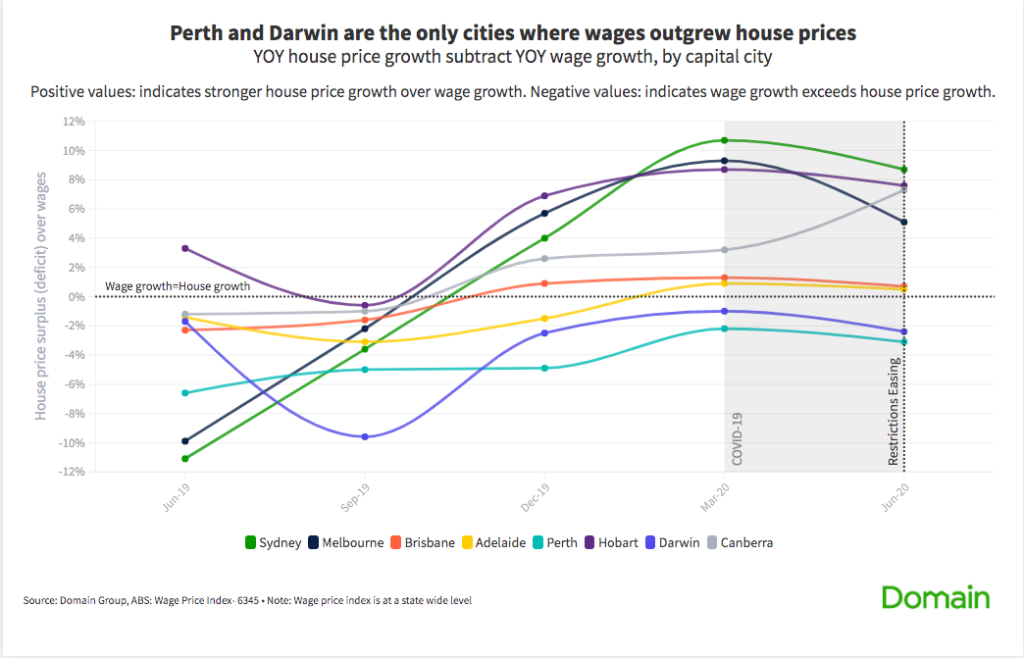

In every capital city but two, house price growth was stronger in the year to June than wages growth, even despite the COVID-19 pandemic that has seen dwelling prices tumble and pushed the nation into recession.

Sydney house prices finished the financial year 10.5 per cent higher than the previous year, Domain data shows. But wages for NSW workers inched up just 1.8 per cent over the same period, ABS figures show, leaving housing outperforming wages by 8.7 percentage points.

Melbourne house prices were 6.9 per cent higher in June than a year ago, but Victorian workers’ wages only grew 1.8 per cent, meaning housing again outpaced income by 5.1 percentage points.

The wages data measures hourly earnings and does not take into account widespread cuts to hours made during the coronavirus crisis, JobKeeper payments and job losses, suggesting the outlook for many home-buying hopefuls could be even worse.

Yet the figures are a tale of two markets, with other workers who managed to keep their jobs through the pandemic in pole position to take advantage of a rapid turnaround in housing sentiment in March that has since pushed house prices lower.

Domain senior research analyst Nicola Powell said even the sluggish growth in wages was largely due to pay rises for public sector workers, while staff in the private sector did not fare as well.

“Overall for Australia, wages growth has hit the lowest rate in 23 years,” Dr Powell said. “Private sector wages grew [but] it was minor.”

House price growth surplus or deficit, year to June

Positive: Indicates stronger house price growth than wage growth

Negative: Indicates wage growth exceeds house price growth

| House price growth | State | Wage growth | Surplus/deficit | |

| Sydney | 10.5% | NSW | 1.8% | 8.7% |

| Melbourne | 6.9% | VIC | 1.8% | 5.1% |

| Brisbane | 2.4% | QLD | 1.7% | 0.7% |

| Adelaide | 3.0% | SA | 2.5% | 0.5% |

| Perth | -1.4% | WA | 1.7% | -3.1% |

| Hobart | 10.0% | TAS | 2.4% | 7.6% |

| Darwin | -0.1% | NT | 2.3% | -2.4% |

| Canberra | 9.3% | ACT | 2.0% | 7.3% |

| National | 6.6% | Australia | 1.7% | 4.9% |

Source: ABS, Domain

But she noted house prices fell in the three months to June, reversing the annual trend as hourly wages held flat in the same timeframe – for those workers lucky enough to keep their jobs.

Sydney house prices fell 2 per cent in the June quarter while NSW hourly wages were steady. Melbourne house prices dropped 3.5 per cent but Victorian wages inched down only 0.1 per cent in the period, before the state went into its second lockdown.

Recent house price falls would be beneficial to any first-home hopefuls who both kept their jobs and managed to get a pay bump, she said.

“For maybe that cohort that has seen their wages rise and don’t own a home yet, but when prices fall it aids affordability to gain access to the market,” Dr Powell said.

“But what we have picked up in the COVID quarter, all cities over that quarter we’re seeing wage outpace price apart from Hobart and Canberra.”

House price growth surplus or deficit, June quarter

Positive: Indicates stronger house price growth than wage growth

Negative: Indicates wage growth exceeds house price growth

| City | House price growth | State | Wage growth | Surplus/deficit |

| Sydney | -2.0% | NSW | 0.0% | -2.0% |

| Melbourne | -3.5% | VIC | -0.1% | -3.4% |

| Brisbane | -1.4% | QLD | 0.0% | -1.4% |

| Adelaide | 0.2% | SA | 0.4% | -0.2% |

| Perth | -1.5% | WA | 0.2% | -1.7% |

| Hobart | 1.4% | TAS | 0.3% | 1.1% |

| Darwin | -1.0% | NT | 0.1% | -1.1% |

| Canberra | 4.1% | ACT | 0.2% | 3.9% |

| National | -2.0% | Australia | 0.0% | -2.0% |

Source: ABS, Domain

Two cities bucked the annual trend, with stronger growth in wages than house prices, she said.

“Over the year, Perth and Darwin wage growth outpaced their house price growth … [they] are the only markets that are more affordable.”

Perth recorded a house price growth deficit of 3.1 per cent compared to wages growth over the year, while Darwin’s house price growth deficit was 2.4 per cent compared to wages.

Nationally, house prices rose 6.6 per cent over the year while wages rose 1.7 per cent, meaning housing outperformed by 4.9 percentage points.

Brisbane and Adelaide buyers may be better able to keep up with the property market, with house price growth outperforming wages by just 0.7 percentage points and 0.5 percentage points respectively over the past year.

But buyers appeared more challenged in Hobart, where house price growth beat wages by 7.6 percentage points, and Canberra, at 7.3 percentage points.

Grattan Institute program director of household finances Brendan Coates said not everyone was on an even keel when it came to home buying during the pandemic.

“You’re seeing higher income young Australians saving more and purchasing a house … and you’ll see a group of Australians who will struggle even more,” Mr Coates said.

He said this would exacerbate the growing gap between those who are able to enter the property market and those who were already finding it difficult.

“I think COVID is going to, in the long term, add to the growing gap of the housing haves and housing have-nots,” Mr Coates said.

He said once government stimulus was factored in, household incomes had outperformed house prices in the last quarter, meaning “some have done very well and saved, and others have suffered”.

“For many Australians, they have a better bank balance than what they had going into COVID,” Mr Coates said. “They either didn’t lose their job and [they’re] spending less or they’ve had income support and had a boost to their incomes during this period.”

Industry Super Australia chief economist Stephen Anthony said home buyers could expect to get access to home loans and find good value units for sale – if they were still employed.

“That’s the flipside of the circumstances – if you still have a job and can demonstrate a reliable income stream, banks will like you,” Mr Anthony said.

“I think you’ll find in every market there is more opportunity but especially in Sydney and Melbourne and in cities where there [are] multi-unit dwellings… That’s assuming that you can get out and buy them.”

While each market was performing differently, he argued most people would find it easier to buy a home now compared to a few years ago.

“It’s complicated. It’s not only complicated by the regionality of each of the markets, it’s complicated by the circumstances, which are unprecedented,” Mr Anthony said.

with Elizabeth Redman

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More