Australian house prices set to jump further before any curbs on lending by APRA

Housing prices appear set to rise before the bank regulator takes any action to slow the market, with the latest official figures showing little deterioration in lending standards late last year.

Soaring property prices have caught the attention of the nation’s regulators, but they have emphasised they do not yet see any worrying rise in risky loans.

And potential home buyers are piling into the market, with a new survey showing home-buying intentions are at their highest level since 2015.

With home prices rising and the Reserve Bank reluctant to increase ultra-low interest rates to slow the property boom while the broader economy is still recovering from the pandemic, attention has turned to other measures.

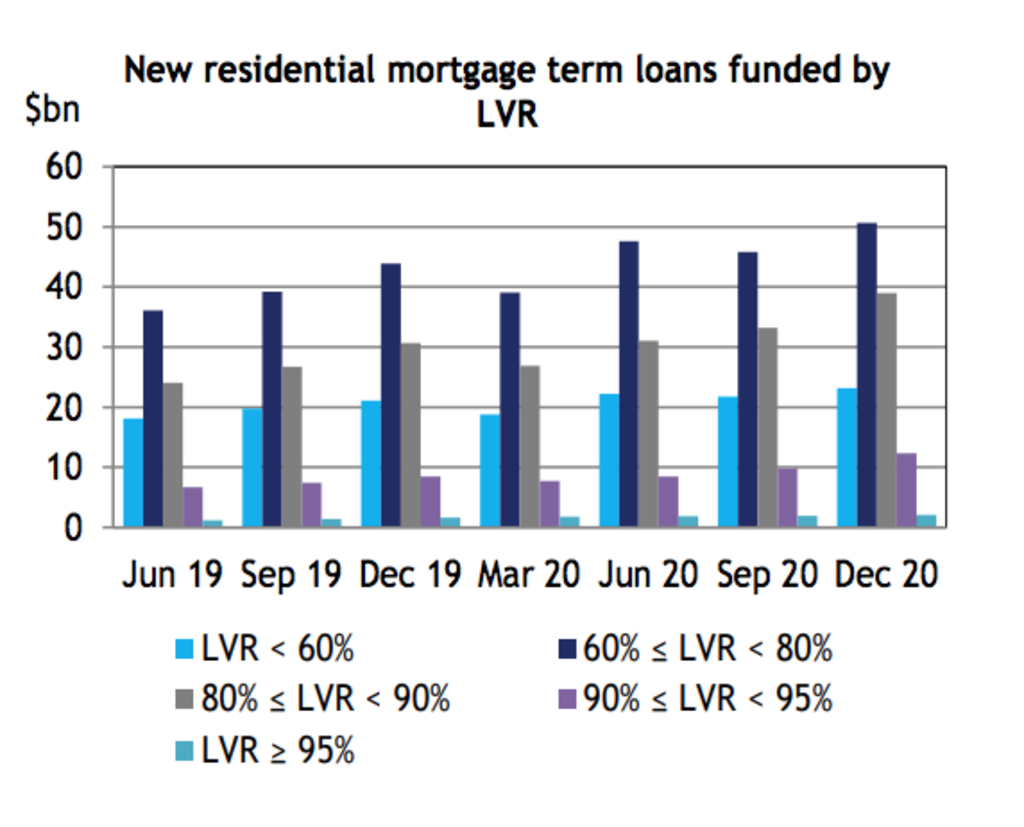

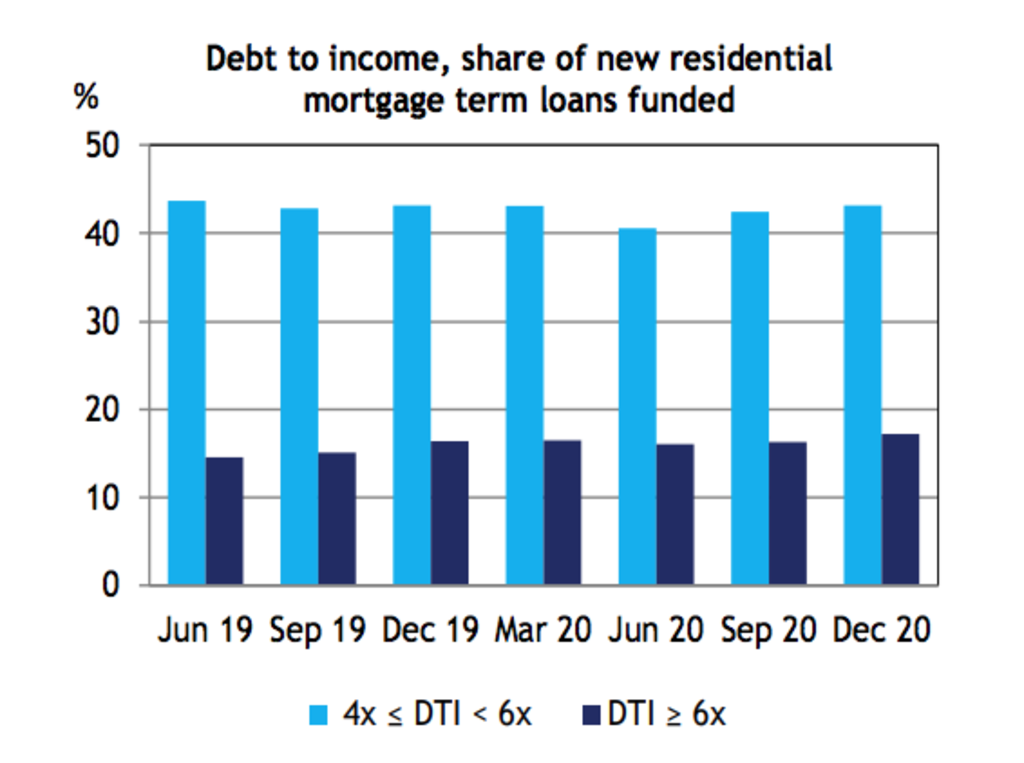

Analysts expect limits on low-deposit loans or high debt-to-income ratios could be introduced later this year or next, moves that would be the domain of banks regulator the Australian Prudential Regulation Authority (APRA).

Such limits would only be likely if evidence emerges of risky lending, such as runaway growth in overall mortgage lending, a jump in loans to investors, a boom in interest-only loans, or other declines in lending standards.

“There is no evidence to suggest a material relaxation in lending standards is accompanying the significant increase in new lending,” APRA said on Tuesday in a quarterly report on bank property exposures.

A rise in mortgage lending “is consistent with favourable borrowing conditions including a historically low interest-rate environment and government initiatives such as the First Home Loan Deposit Scheme and the HomeBuilder grant,” APRA said.

But it warned there could be a rise in borrowers who cannot pay their loans in the coming months as mortgage holidays expire and government stimulus ends. Some $11.8 billion worth of loans were more than a month past due in the December quarter, a 30.6 per cent rise on the previous quarter but 7.6 per cent lower than a year earlier.

The most recent property boom has been driven by owner-occupiers, with the value of new loans to this group rising 23.6 per cent over the year to the December quarter, while loans to investors rose only 13.7 per cent.

New loans written as interest-only – where the borrower does not have to pay off principal for five years – were 31.2 per cent higher than a year earlier.

With prices rising, potential buyers have been willing to take on more debt to get into the market, with a 26.3 per cent rise in loans that are at least six times the borrowers’ income over the past year. Loans with a small 5 per cent deposit were up 27.4 per cent, albeit off a low base.

Westpac senior economist Matthew Hassan noted that these figures are from the December quarter, and Sydney house prices have risen as much as 5 per cent since then.

If the next quarter’s figures raise concerns, the regulator might first increase their surveillance of lending practices, then make a “rhetorical effort” to rein in lending behaviour, he said.

He forecasts the regulator to step in mid to late next year, especially if prices are pushing above their historical levels and investors are stepping back into the market in greater numbers.

“It gives you a bit of an idea of the tempo in this policy space,” he said.

“They operate quarter to quarter; they take a bit more time to digest … what they’re interested in is the quality of lending.”

Dwelling prices are likely to rise 10 per cent overall this year and another 10 per cent next year, he expects.

Official figures released on Tuesday show capital city dwelling prices rose 3.6 per cent over the year to the December quarter, despite the first recession in a generation.

The value of Australia’s dwelling stock rose $257.9 billion over that time, the ABS figures showed.

The Reserve Bank echoed APRA’s comments, highlighting the effect of low interest rates on financial stability in the minutes of its latest minutes, published on Tuesday.

“[RBA board members] acknowledged the risks inherent in investors searching for yield in a low interest rate environment, including risks linked to higher leverage and asset prices, particularly in the housing market,” the RBA said.

“Members noted that lending standards remained sound and that it was important that they remain so in an environment of rising housing prices and low interest rates.”

Skyrocketing sticker prices and red-hot auctions have not yet deterred potential home buyers, a new survey suggests.

Home-buying intentions rose to the highest level in February since the survey began in 2015, according to the Commonwealth Bank Household Spending Intentions series.

Google searches for property were up in the month, CBA noted, emphasising its forecast for dwelling prices to rise 8 per cent this year and another 6 per cent next year.

CBA chief economist Stephen Halmarick said low interest rates and government support for first-home buyers encouraged people into the market despite sky-high prices.

“There’s a general sense that after last year, which was obviously a very difficult year, the economy is coming back quite strongly, the labour market didn’t deteriorate as badly as some people thought it might – that combination is seeing good demand for housing,” Mr Halmarick said.

“The most important metric [the RBA] will be looking at is the quality of the lending, making sure its loan-to-valuation ratios are not too high, and people are not taking on too much debt.

“It’s not the level of debt; it’s the quality of the loans that’s important.”

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More