Australian property values slide for second month: CoreLogic figures

Property values in Australia have continued their downward slide amid the economic impacts of the coronavirus pandemic, although new figures show a milder-than-expected drop so far.

But experts warn the outlook is highly uncertain and depends on the path of government stimulus, mortgage holidays and future virus outbreaks.

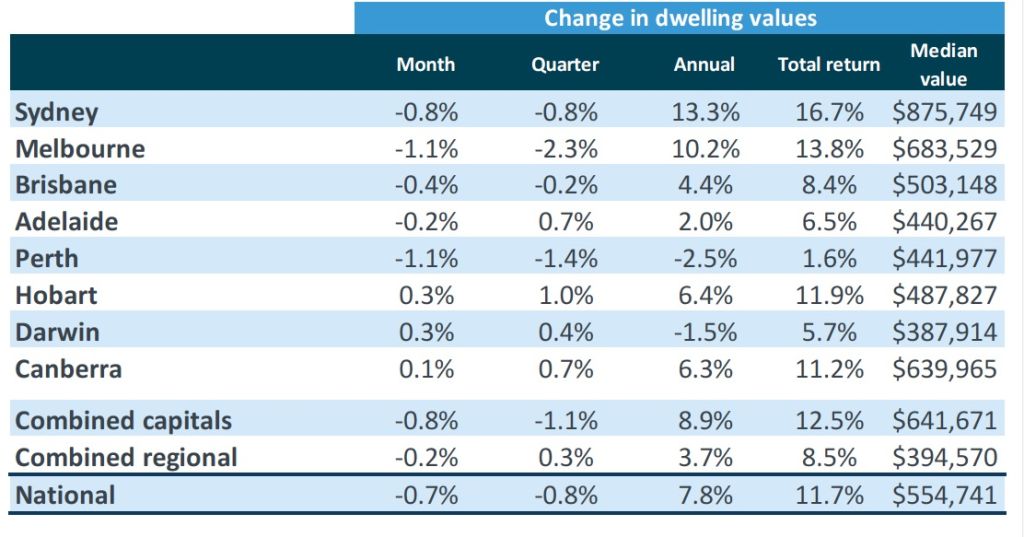

Melbourne and Perth saw the largest decline in values among the capital cities over June, with both recording declines of 1.1 per cent, according to the CoreLogic Home Value index for June released on Wednesday.

Sydney values fell 0.8 per cent over the month, as hundreds of thousands of Australians have been left out of work and uncertain about the economic outlook. Brisbane fell 0.4 per cent and Adelaide dipped 0.2 per cent.

On a national basis, home values dropped for the second month in a row, down 0.7 per cent in June, following a 0.4 per cent decline in May, with the nation’s median property value now sitting at $554,741.

House values fell 0.7 per cent, while units dropped 0.6 per cent.

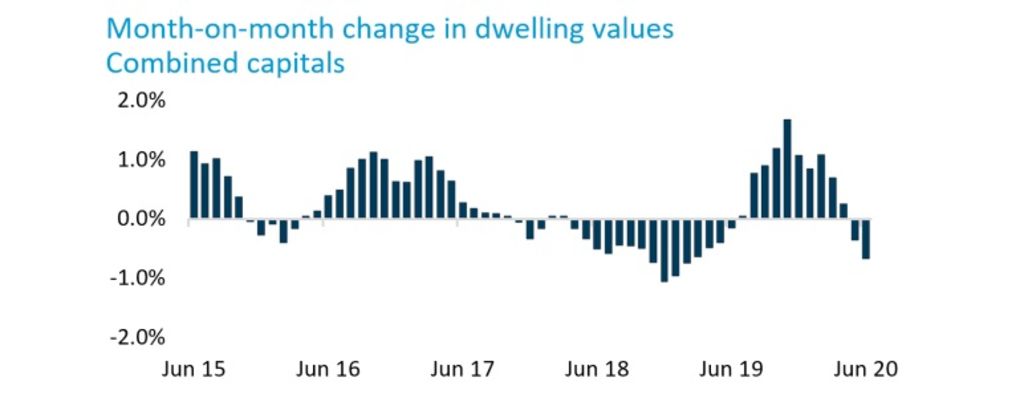

CoreLogic head of research Tim Lawless added: “The downwards pressure on home values has remained mild to date, with capital city dwelling values falling a cumulative 1.3 per cent over the past two months.

“So far, the impact from COVID-19 on housing markets has been milder than initially anticipated.”

He said significant price declines had so far been avoided given the low number of homes hitting the market, combined with low interest rates, government support payments and mortgage holidays offered by the banks.

But he warned the longer-term outlook for the Australian property market remained highly uncertain.

CoreLogic head of residential research Australia, Eliza Owen warned that the decline is starting to accelerate, led by steeper falls in Melbourne and Perth.

“The last [decline of this size] was seen in February 2019, when we were nearing the overall trough of the last downturn,” she said.

In addition to dealing with tougher social distancing measures, Ms Owen said, Melbourne prices had been harder hit because the city had a higher concentration of investors and was more exposed to the pullback in overseas migration. Meanwhile in Perth, where demand had still been quite fragile, the loss of jobs and income had created a bit of a shock to the market.

Hobart and Canberra each recorded a subtle rise in values over the month, Ms Owen said, up 0.3 per cent and 0.1 per cent respectively, but the pace of growth was slower than that seen previously. The ‘more volatile’ Darwin market also saw a slight 0.3 per cent rise in prices, but that was after a fall of 1.6 per cent the previous month.

Regional areas saw prices hold better than their metropolitan counterparts, with Australia’s combined regional median down only 0.2 per cent in June to a median of $394,570.

Ms Owen said regional price movements often lagged behind those in capital cities but were historically less volatile.

“I would not expect to see the same extent of price falls. Having said that, this is a unique downturn,” she said. “Areas exposed to high levels of tourism or a high level of investment … might see more of a price decline.”

The figures also showed the top-end of the market was continuing to lead the downturn, particularly in Sydney and Melbourne where upper quartile values were down 1.3 per cent and 3.7 per cent over the past three months. Values across the to 25 per cent of all the capitals combined were down 1.7 per cent over the past three months, while lower values property values only fell 0.3 per cent.

“Higher value markets tend to be more reactive to changes in the environment, having led both the upswing and the downturn over previous cycles,” Mr Lawless said.

While values were down, sale volumes were up, with CoreLogic figures showing a 21.5 per cent jump in sales activity in May, followed by a further 29.5 per cent estimated increase in June. Despite the increase in homes hitting the market, total listing volumes were still trending down due to solid buyer demand.

Domain economist Trent Wiltshire expected new listings and transaction volumes to continue to rise, but at a slower pace, with prices to remain sluggish.

“Prices in Melbourne are probably the most likely to fall furthest,” he said. “Inner Melbourne had more investors and bigger job losses, it’s more reliant on migration and international students and tourism, so all these factors have really weighed on the Melbourne market more so than most other capitals,” he said. “

“What’s happened there the past week is another factor that could push prices lower,” he said, referring to the lockdown of specific suburbs with high case numbers.

While June saw early signs of improved economic activity and a lift in housing turnover, both Mr Lawless and Mr Wiltshire said the downside risk remained significant.

In addition to the potential risk of a second wave, Mr Lawless said, another key risk was the eventual removal of stimulus measures and mortgage repayment holidays. While he was encouraged that lenders had hinted at extensions to mortgage holidays, he warned borrowers would eventually need to repay loans and government stimulus would taper.

“This is when we could see a rise in mortgage arrears and the potential for a lift in urgent or forced sales,” he said.

“The longer-term outlook for the housing market is largely dependent on how well the economy is tracking when these support measures are removed.”

Mr Wiltshire added the looming ‘fiscal cliff’ expected — when mortgage holidays and government support payments cease in September — was already prompting some buyers to hold off. However, he expected government and banks would taper off support slowly to limit forced sales.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More