Australians are spending almost half their income on mortgage repayments

A recent cost of living survey conducted by online financial brokers Savvy has concluded more than one-quarter of Australians will suffer from mortgage stress in the wake of the Reserve Bank of Australia’s aggressive rate rise.

Many Aussies were taken aback by the nation’s central bank upping the cash rate by a whopping 50 basis points (the biggest monthly rate increase since February 2000), and the results are already being felt.

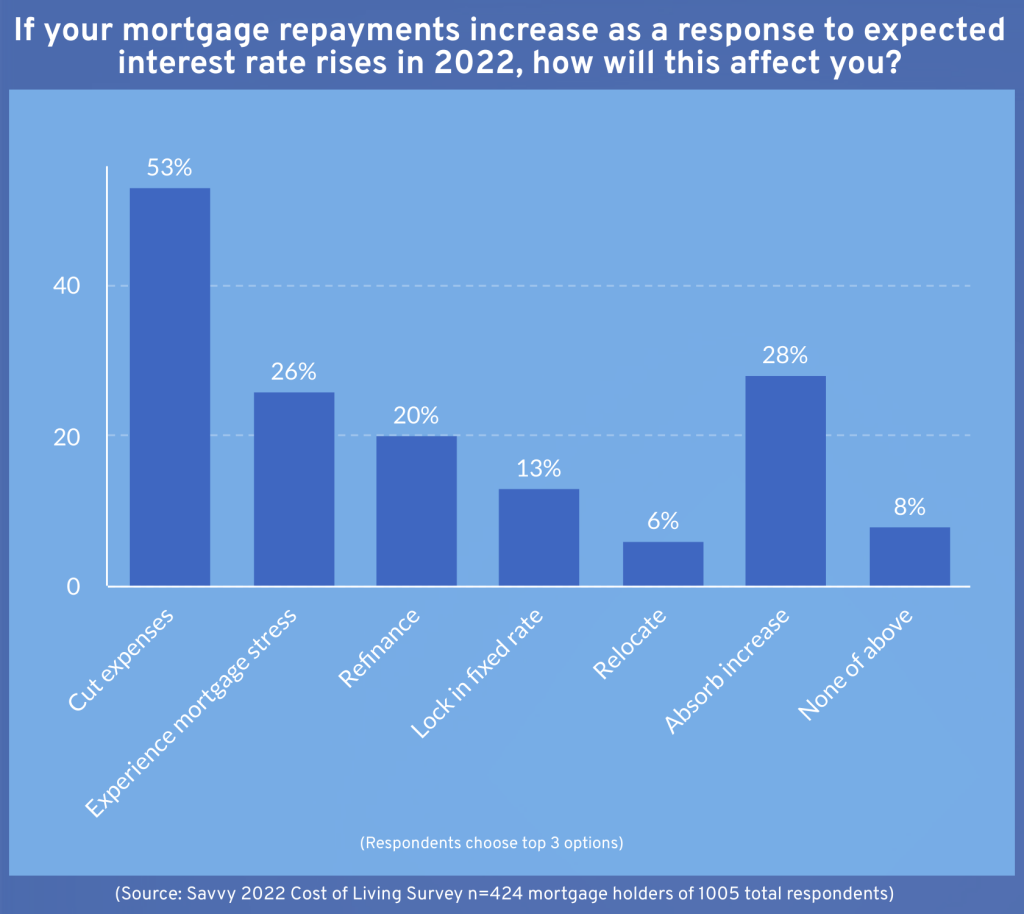

Out of 1005 people surveyed, of which 424 had mortgages, 26 per cent said they would feel the effects of mortgage stress, which is defined as a homeowner or household using more than 30 per cent of their net income to keep up with mortgage repayments.

As a result, the survey found that 53 per cent of participants will sacrifice other expenses to ensure their mortgage repayments are made.

Among the demographics, the country’s youngest homeowners were the single largest to express concern over mounting costs.

According to the survey, 38 per cent of 25 to 34-year-olds and 35 to 44-year-olds advised that mortgage repayment hikes were a worry when factoring in the cost of living.

Other demographics, however, didn’t share the concern as much, with just 18% of 55 to 64-year-olds and 6% of those aged 65 and over being worried about living expenses following the rate rise.

The survey also found that 44 per cent of mortgage holders spend between $251 and $500 in weekly repayments, while 23 per cent spend $501-$750, and a further 18 per cent spend $751 and over.

“If that twenty-three per cent who said they have mortgage repayments $500 to $750 per week were single-income households, they would be in real trouble,” Bill Tsouvalas, CEO of Savvy, said.

“The COVID mortgage holidays are over and for some families, there may not be much left in the tank when it comes to covering mortgage repayments.”

Mr Tsouvalas also advised that anyone currently saddled with a home loan should look to get the best deal possible as soon as possible.

“If you can refinance at a lower rate – lock it in now,” Tsouvalas said. “Nought point eight-five per cent is still a record low; so get around to refinancing or fixing your rate as a first priority.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More