'Likely to lose momentum': Australia's dwelling values continue to grow, though the pace is slowing

Australia’s booming property market continued to rise in October but the rate of growth has slowed dramatically since the start of the year, as a lack of affordability, less government stimulus and more listings hit the market, new figures show.

And a downturn could be “inevitable”, CoreLogic’s head of research Tim Lawless warns, should interest rates rise and supply outstrip demand in the coming months.

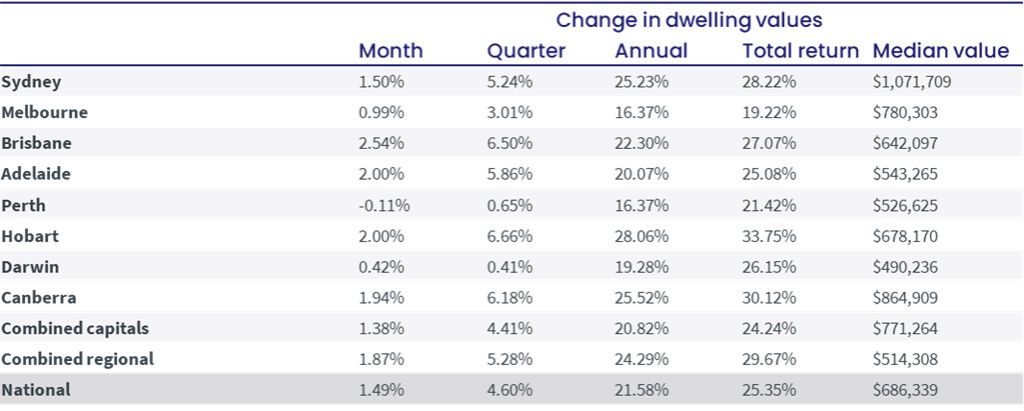

Even so, dwelling values are up by more than 20 per cent in most capital cities since October last year, CoreLogic’s national home value index, released today, shows.

Hobart led the way with a dwelling value rise of 2 per cent in October and 28.6 per cent over the year, to a median of $678,170.

Sydney followed closely, up by 1.5 per cent over October and a huge 28.33 per cent over the year, to $1,071,709, while Melbourne, up 0.99 per cent over the month and 19.22 per cent over the year, saw the median price rise to $780,303.

Perth was the only capital to see a fall in dwelling value, by -0.11 per cent to a median of $526,525.

But it’s Brisbane that has taken over as the fastest-growing market. Property values rose 2.5 per cent during October – the biggest leap of all the capital cities – and prices there have risen 22.3 per cent over the past year.

Nationally, the monthly dwelling value growth rose by 1.49 per cent in October to a median dwelling value of $686,339, almost half of March’s peak rate of 2.8 per cent.

Mr Lawless said growth had slowed as housing-related incentives like HomeBuilder and stamp duty relief had now ended. At the same time, new listings have surged by 47 per cent since September.

From today, the Australian Prudential Regulatory Authority will also tighten the way mortgage applications are assessed, making it a little more difficult for buyers to get finance, which may have an impact, though it would not be dramatic, Mr Lawless said.

“Combining these factors with the subtle tightening of credit assessments … it’s highly likely the housing market will continue to gradually lose momentum,” he said.

“In the immediate future I think we will have more of the same price easing but people need to be prepared for the fact there could be a downturn,” Mr Lawless said.

CoreLogic data showed house values continued to outstrip those of units, as people looked for more space.

It was particularly evident in Sydney, where house values rose a stunning 30.4 per cent over the year to October, compared to the 13.6 per cent rise in unit values.

Likewise, Melbourne saw house values rise 19.5 per cent over the year, with units up by 9.2 per cent.

The results reflect Domain’s latest House Price Report, which showed national house prices had reached record levels, jumping by 3.5 per cent in the September quarter and 21.9 per cent across the year, to a median of $994,579.

Sydney’s house prices skyrocketed another 4.6 per cent over the three months to September to a record median of almost $1.5 million, while Melbourne’s record house prices rose by another 1.6 per cent to a median of just over $1.037 million.

That was despite both markets being hard hit by the coronavirus crisis and spending months in lockdown.

Brisbane’s house prices, which have benefitted from both Sydneysiders and Melburnians moving north to escape lockdowns in both cities, rose 4.6 per cent to break the $700,000 barrier and are now at a $702,455 median.

Meanwhile, Perth’s house prices had fallen 0.6 per cent to a median of $598,601.

Domain chief of economics and research Nicola Powell agreed a downturn could hit the market, with population figures falling as coronavirus saw the international border remain closed throughout 2021.

“Weak population growth, as well as supply increasing, is going to play out on the market,” Dr Powell said. “It has been a pressure cooker this year for the housing market and we’re now seeing some of the steam come out of it. Buying conditions are improving for those looking for a home but we could see supply outstrip demand.

Lending figures released by the ABS on Monday morning indicated first-home buyers are feeling the affordability pinch – activity from first-home buyers has fallen for the eighth month in a row.

New housing lending fell -1.4 per cent from the month prior to $30.31 billion in September, largely driven by a decline in new owner occupied loan commitments, which dropped by -2.7 per cent.

The value of loans refinanced to a new lender in September also declined, which was the first fall in six months. Canstar’s analysis of the ABS Lending Indicators data shows Australian mortgage holders refinanced $16.16 billion worth of loans to a new lender in September 2021, down -9.1 per cent on the month prior.

But Canstar group executive, Financial Services, Steve Mickenbecker described the falls as “modest”.

“With lockdowns ending and travel restrictions easing, we can expect further buoyancy in property markets and lending in coming months,” he said.

The flood of first-home buyers had now receded, he said, with upgraders now the dominant borrowing segment. The value of lending to upgraders increased by 30 percent over September 2020.

“First-home buyers … were early out of the blocks after the first round of lockdowns, but have been flat over the last 12 months and not even keeping pace with property price increases,” he said.

“Investors have followed an inverse path to first home buyers with negative growth in the value of new loans in 2020, followed by close to doubling of lending values in the last 12 months. There is no doubt that first home buyers have been crowded out in the housing price rush.

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More