Australia's 'life changing' 2 per cent property deposit scheme is a step closer

The federal government’s new “help to buy” laws, which will assist 40,000 Aussies to purchase a property with as little as a 2 per cent deposit, are in the home stretch.

The legislation for the shared equity scheme will be introduced to parliament this week.

It takes the average Aussie first-home buyer 12 years to save a house deposit, but that timeframe blows out to 20 years in the highest-value capital city of Sydney, data shows.

Under the Albanese government plan, up to 40,000 eligible low and middle-income Aussies will enter into an equity agreement with the federal government and a lender, and will need a minimum 2 per cent deposit to participate.

The government will take a 30 per cent equity stake in existing homes and 40 per cent in new builds.

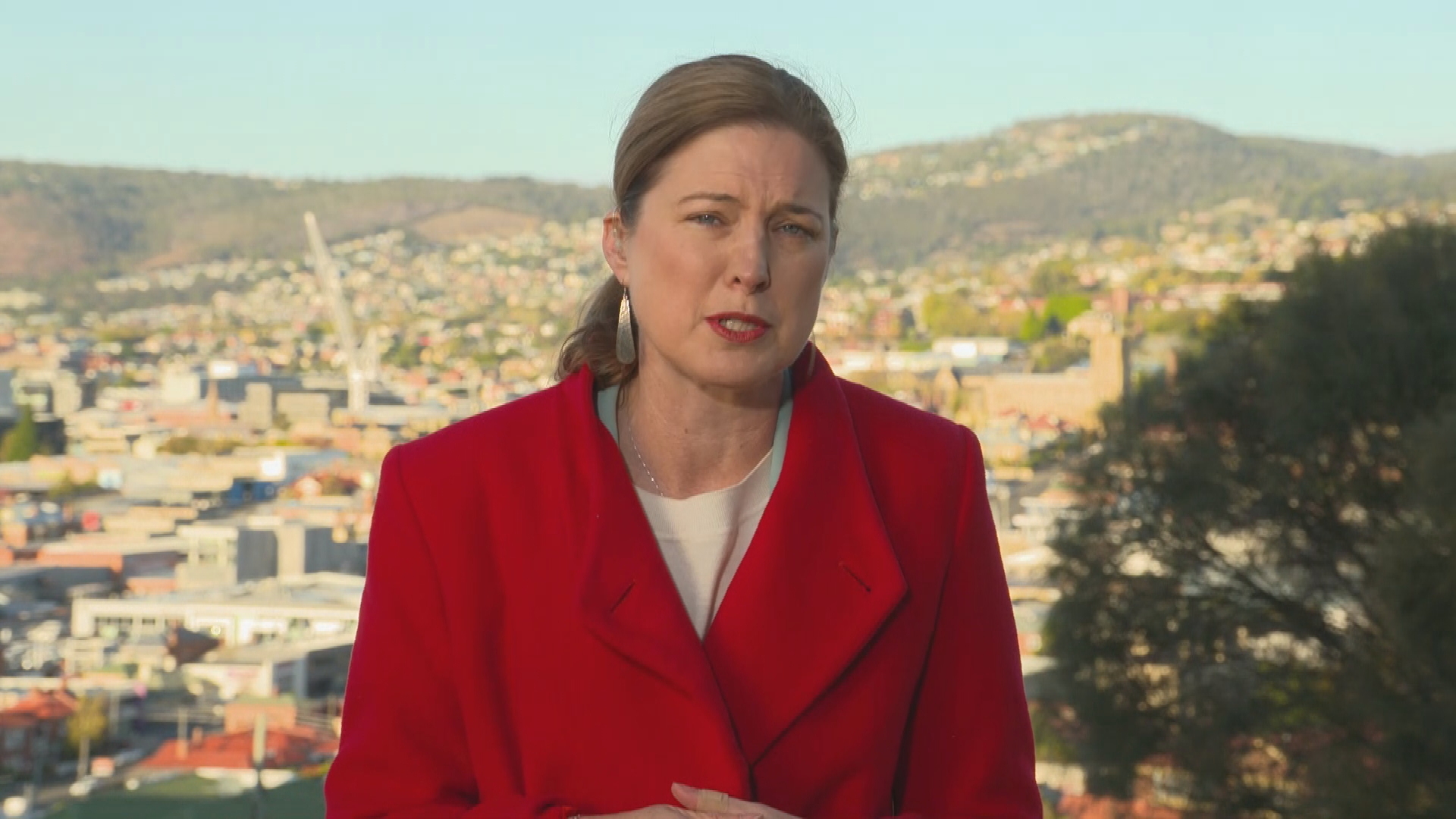

Housing Minister Julie Collins told the ABC the scheme will be “life changing” for the 10,000 Aussies a year it aims to help into a home.

She said the equity structure will keep buyers’ costs down.

“For Australians who have not been able to get into a home, this will be life changing,” Ms Collins said on the ABC on November 28.

“This is about supporting them with a 2 per cent deposit and about the government having an equity stake in their homes, so their mortgages will be lower and their repayments will be lower.”

Meetings with banks and lending institutions have been underway, so the program has taken longer to launch than hoped, Ms Collins said.

It is slated to start in 2024.

“We think we have all the parameters right, we now need each state to pass legislation, they have indicated they will do that as soon as possible – early next year,” Ms Collins said.

“We want to get this scheme up and running as fast as we can.”

Currently, home buyers need a 20 per cent deposit in order to purchase without attracting thousand of dollars in lenders’ mortgage insurance.

However, the average first-home buyer needs at least 12 years to save for a deposit for the average apartment and 16 years for the average house, according to figures released this year by financial comparison website Finder.

The deposit saving time explodes to 20 years for a Sydney first-home buyer aiming to ink a deal on an average house.

Finder crunched the nation’s average weekly earnings, median property prices (in March), and assumed households are saving 25 per cent of their income after paying for rent, groceries, utilities, internet, phone and transport.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

/http%3A%2F%2Fprod.static9.net.au%2Ffs%2F984a4521-8cd5-445d-98f5-d4da7d41e192)

/http%3A%2F%2Fprod.static9.net.au%2Ffs%2Fb5a86b60-f041-4197-8bb9-02438eeabcd3)