Bidder competition for property at auction heats up during lockdown, figures show

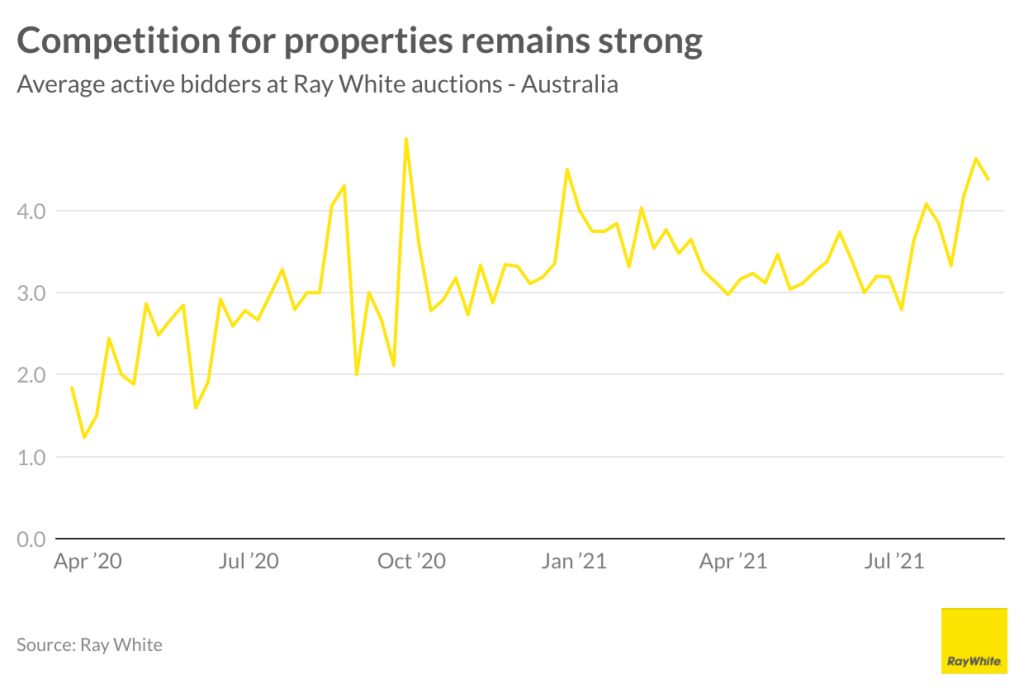

Auction competition has been heating up in lockdown, with the number of bidders per auction reaching its highest level this year, new figures show.

Last weekend, an average of 4.4 active bidders made offers at each auction held around the country and 4.6 per auction the weekend before, Ray White data shows.

This compares to an average of 3.4 over the past 12 months, and the trend has been rising over the past two months after hitting a trough of 2.8 in the second week of July.

With little stock on the market, some bidders are still trying hard to buy a property after months of searching, while others have been prompted to upgrade by the enforced time at home.

“People are out there wanting to buy but there’s not much stock available and sellers are understandably cautious,” Ray White chief economist Nerida Conisbee said. “They perhaps feel it would be better to [sell] when restrictions are relaxed.”

Despite the hit to the economy from the extended closure of non-essential businesses in New South Wales, Victoria and the ACT, and earlier stay-at-home orders for south-east Queensland and South Australia, the job losses are concentrated in younger workers and renters, Ms Conisbee said.

This meant workers lucky enough to keep their jobs tended to save money during lockdown, she said.

The auction market has diverged between cities, with Sydney recording strong preliminary clearance rates north of 80 per cent in recent weeks as potential buyers can still conduct private inspections. In Melbourne, more vendors have been withdrawing their homes from auction, pushing the clearance rate below 40 per cent last weekend, as physical inspections are not allowed.

Clearance rates are still high in locked-down Canberra, and in open Brisbane and Adelaide.

In Sydney, bidder interest is defying expectations as potential buyers re-evaluate their homes in lockdown, BresicWhitney head of sales and chief auctioneer Thomas McGlynn said.

Usually at the tail end of a boom, he would see the share of registered bidders who actually make a bid decrease.

The opposite has happened at his agency. Through May and June, 40 to 50 per cent of registered bidders participated, and that has since risen to 65 to 75 per cent, he said.

“It’s been a very very tough time for many different people, but in relation to the property market itself, it’s rehashed what we saw last year, which is people valuing the space they live in above anything else,” he said.

“And people wanting to spend more and to actively chase the lifestyle of living in a property that delivers them a great home environment throughout these tough times. I believe that’s had a lot to do with encouraging people to get in and actively participate.”

He has noticed that a larger number of bidders are active above the reserve, and buyers are pushing hard with big bids to try to win.

Even with a 30 to 40 per cent increase in listings this spring, there would be more than enough buyers to create competition, he said.

Cooley Auctions’ Damien Cooley has also noticed a rise in the number of participants at his auctions, to an average of 8.5 bidders so far this financial year, compared to an average of 6.5 for the year to June.

The average price achieved is now 9 per cent over a vendor’s reserve compared to 6 per cent in the previous financial year, he said.

“Our market’s got stronger, no doubt,” he said. “We’re definitely seeing a lot of owner-occupier activity right now, not so much investor activity.”

He attributed it to the lack of stock and time spent at home. At virtual auctions, he reads out the registration numbers for all bidders as parties cannot see each other on virtual auction platform AuctionNow, which he said prompts buyers to bid strongly.

“A lot of people are sitting on their computers or their devices saying, ‘far out, there’s 15 bidders on this, we’re going to have to go strong’,” he said.

He also noted the bounce back in prices after Sydney’s first lockdown last year, with some keen buyers now worried the market will do the same once the city reopens.

Even as more properties are listed this spring, he expects quality homes to sell “unbelievably well” as interest rates remain low.

In Melbourne, where some vendors are choosing to wait until the real estate market reopens, Nelson Alexander’s Arch Staver is also seeing keen interest at online auction.

“A great many of our virtual auctions have been the result of an acceptable offer being placed by a particular. party, only to have that offer challenged,” he said.

“It’s been quite surprising because the challenges have come, often more than one and sometimes as many as three people want to challenge.”

Pent-up buyer demand is strong and it is not unusual to receive four to five enquiries on one property in a day, he said.

Although he is hopeful of being able to run in-person inspections when it is safe to do so, some buyers have been willing to make offers on the condition of the home passing a building inspection, and his team has sold 28 properties where both the inspections and auctions were conducted virtually since Saturday.

In Brisbane, which is open, locked-down buyers in the southern states were trying to purchase sight unseen, Place Estate Agents’ Drew Davies said.

It is not uncommon to have up to 10 registered bidders per auction, with usually half of these active, he said.

“For a while there, we had the local market hanging back a little bit, we had appetite from interstate investors, but now we’re starting to see the local market dig deeper,” he said.

“The local market was missing out to interstate buyers for the past three months. There’s definitely been a change of mindset.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More