‘Boom-time conditions’: Why some auctions are so hot in a property downturn

Home buyers are likely to face more competition as the number of active bidders per auction inches upwards and the property market shows signs of stabilising.

Bidder numbers are higher this year than in the spring, though some experts say there are few homes for sale and the outlook for the market is still uncertain.

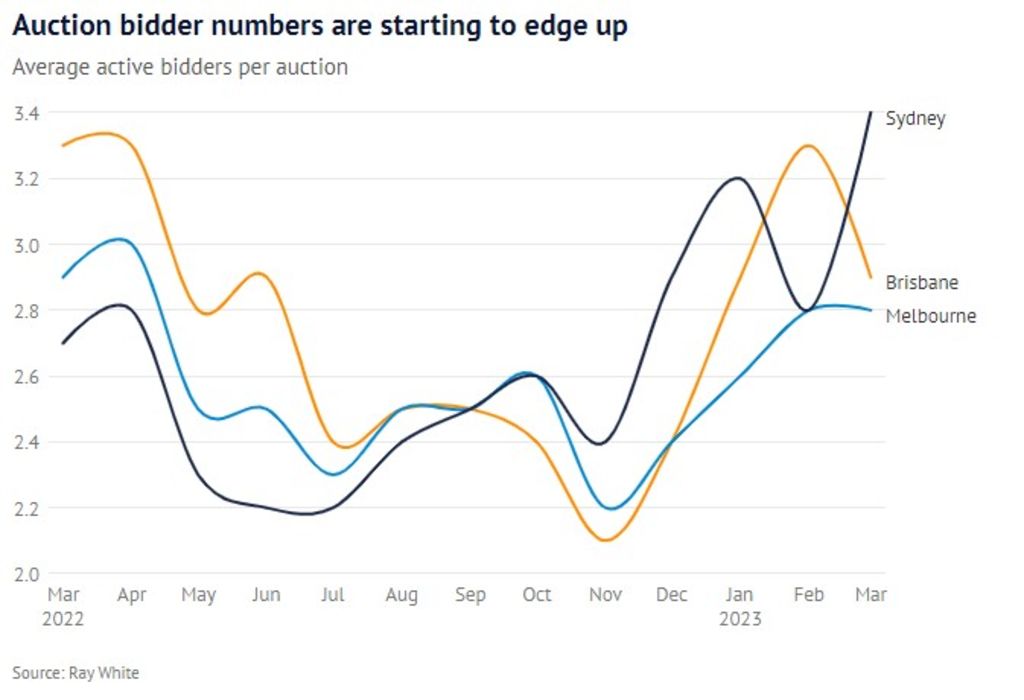

In Sydney, the average number of active bidders per auction lifted to 3.4 in March, after holding below 3 during the spring selling season last year, figures from real estate agency Ray White show.

In Melbourne, active bidders have risen to 2.8 in February and March, up from a low of 2.2 last November.

It comes as separate research from CoreLogic showed an increase in dwelling values of 0.6 per cent over March – the first national rise in 11 months. Sydney was up 1.4 per cent and Melbourne rose 0.6 per cent, while the flow of new listings for sale was below average.

Auction clearance rates have been holding in territory that suggests prices are stable or rising over recent weeks, on Domain data, and some neighbourhoods have been even stronger. But Tuesday’s Reserve Bank board meeting will offer clues as to whether further interest rate rises are likely, which could send the property market back into reverse.

Ray White chief economist Nerida Conisbee said the data, based on observations by the company’s real estate agents, coincided with an increase in prices that she described as an upwards trend.

“On the ground, our data is showing bidding action increasing,” she said. “That’s also clearly showing that there’s people out there who are looking to buy at the moment.

“Anecdotally, we are hearing from our agents that prices do seem to be moving. And things that couldn’t sell a few months ago are selling.”

Westpac senior economist Matthew Hassan said it was too soon to say if the national uptick in prices as measured by CoreLogic was part of an upwards trend or just a stabilisation.

“We need to be careful with what we’re seeing at the moment,” he said. “The March gain [in house prices], particularly in Sydney, looks pretty lopsided.

“Houses and the top tier are leading the way. The rest looks like a stabilisation.”

BresicWhitney chief executive and chief auctioneer Thomas McGlynn said the rise in active bidders pointed to an increased appetite to buy and was driving price gains.

“That’s what drives the market up, those who are actively participating,” McGlynn said.

He said the majority of auctions he calls now record more than five active bidders, similar to the boom-time conditions of 2021.

“Once you’re getting over five active bidders, that’s pretty much boom conditions … it’s only a matter of time we’ll see aggressive price rises,” he said.

Some auctions had standout results, such as the three-bedroom house in Sydney’s Marrickville that soared $400,000 above reserve at the weekend, or a family home in Melbourne’s Kew that beat its reserve by even more. But others passed in or only just topped a vendor bid.

Hassan said that despite a rise in bidders, the lower number of sales still made it hard to tell if the market had recovered. Elevated auction withdrawals showed vendors weren’t always able to achieve the prices they wanted, he said.

“If we look at March in Sydney we’re seeing an average of 15 per cent of auctions withdrawn prior,” Hassan said. “Melbourne’s withdrawal rate is 7 per cent, and it tends to be lower than Sydney.

“At times last year [Sydney was] getting 25 per cent withdrawn, but it’s still quite elevated. It’s pointing towards stabilisation rather than price gains.”

Any Reserve Bank interest rates pause would not breathe life back into the property market because the previous hikes were yet to fully pass onto the wider economy, Hassan said, and low numbers of sales meant the data collected was volatile.

“You can be buffeted one way or the other in those kinds of conditions,” he said. “There’s not enough evidence to suggest there’s a resurgence in prices. It looks to be a stabilisation.

“The economy is yet to feel the impact of those rate rises. It’s looking like we’re going to see a stop-start year for house prices.

“When you have price movement in the 0.5 per cent range, that can be a wrinkle. It’s not an uptick in prices, it’s more the end of declines.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More