Brisbane property market finishes 2021 in first place with 'extraordinary' growth

Brisbane has finished the year as Australia’s fastest-growing property market, with property prices continuing to rise full steam ahead at the same time Sydney and Melbourne’s markets are slowing down.

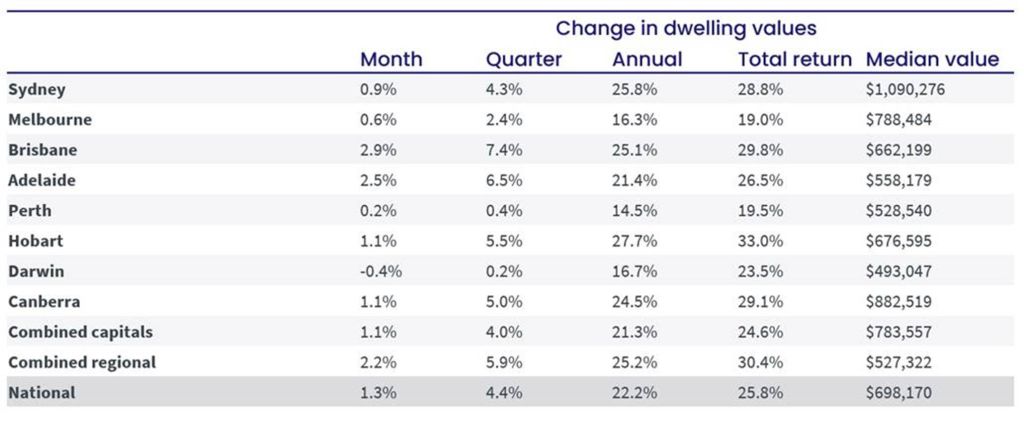

Core Logic’s Best of the Best report found Brisbane dwelling values rose 2.9 per cent over November and a massive 7.4 per cent over the quarter, its highest rate of quarterly growth since 2002.

Sydney rose by only 0.9 per cent over November and Melbourne by 0.6 per cent. The only capital to come near Brisbane was Adelaide, where dwelling values rose 2.5 per cent over the same time.

Brisbane’s annual growth now sits at a massive 25.1 per cent, only just below Sydney’s growth of 25.8 per cent and well above Melbourne’s annual growth of 16.3 per cent.

Core Logic head of research Eliza Owen said Brisbane’s property market had managed to gain further momentum in recent months while other capitals were flagging, mainly due to its relatively low level of stock, which was keeping competition between buyers intense.

“Over the past months there’s been 14,000 properties for sale but at this time of the year, Brisbane would usually have 24,000,” she said.

“That’s very different to what’s happening in Sydney and Melbourne, where they are back to pre-Covid stock levels.”

Brisbane’s most popular neighbourhoods included Cleveland and Camp Hill, which topped the list of suburbs with the highest total value of sales in Greater Brisbane, followed by North Lakes, Redland Bay and Thornlands.

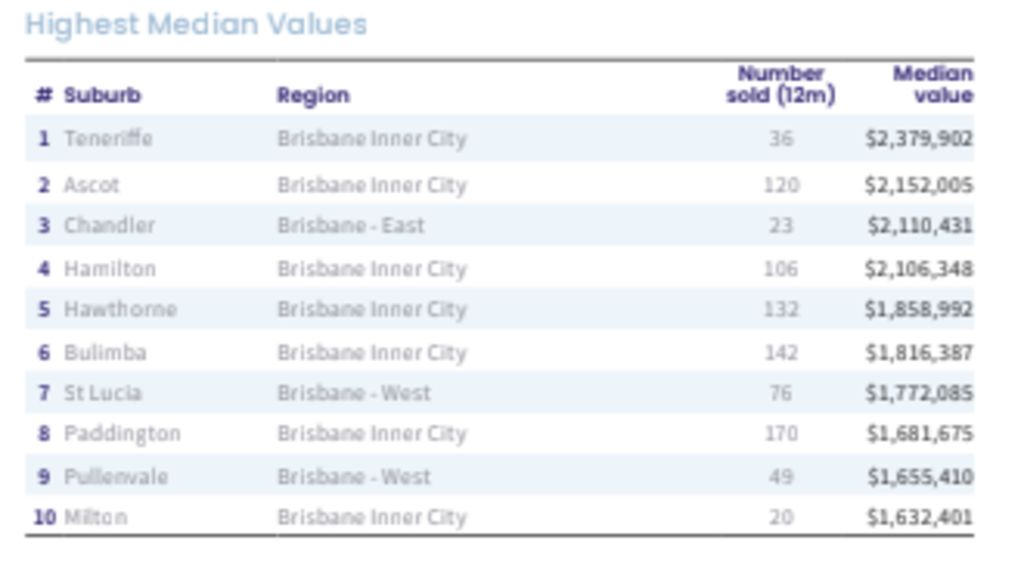

Four suburbs in Brisbane now have median property values of $2 million or more. The most expensive suburb is Teneriffe, with a median value of $2.38 million, followed by blue-chip Ascot at $2.15 million, acreage hotspot Chandler at $2.11 million and old-money suburb Hamilton at $2.1 million.

Patrick McKinnon of Place Estate Agents Ascot said the depth of Brisbane’s market had taken everyone by surprise.

“Without a doubt, it’s phenomenal. Over and over things have kept moving,” he said.

“I just don’t see it slowing down. We haven’t even seen the surge from Sydney yet. I deadset believe we are in for the scariest January. Even though these buyers from Sydney can spend $50,000 on a holiday, they still don’t care about $3 million on a house.”

REIQ CEO Antonia Mercorella said the phenomenal property price growth being experienced in Queensland was a result of a number of factors driving insatiable demand from buyers.

“Queensland hasn’t experienced this sustained level of demand and accelerated growth before, but after years of modest growth, prices here are playing catch up,” Ms Mercorella said.

“Even as our median prices rise, our state is still demonstrating greater bang-for-buck, with investors looking to make their real estate dollar go further, and southerners making the move keen to lap up our State’s incredible liveability factor.

“It’s not surprising that Queensland property is still extremely attractive, given our state’s enviable lifestyle coupled with a sense of safety and relative freedoms during the pandemic, and of course our comparatively great affordability compared to our southern city counterparts.

Shane Hicks of Place Bulimba said Camp Hill had long been one of Brisbane’s favourite suburbs and 2021 was no exception: $363 million worth of property changed hands there in the 12 months to September.

“Camp Hill has been a very hot suburb this year, there’s no doubt,” he said. “It’s a big suburb and it’s broad. We’ve got entry-level properties on busy roads from $750,000-$800,000, to $3 million homes.”

Traditional Queenslanders had been tightly-held this year and with a shortage of character homes on the market, any that had sold in 2021 commanded steep prices.

In October, a renovated Queenslander with a pool at 51 Lewis Street fetched $2.35 million, while 17 Glanosmond Avenue sold for $1.6 million.

But while Queenslanders were always in demand, they were not what was driving Camp Hill’s growth, Mr Hicks said.

Instead, he said it was the knockdown-rebuild market that had gained massive momentum over the past couple years that was pushing prices up.

“People are buying a property for $1.2 million, knocking it down and subdividing the land, then building to homes on the site and selling them off for $2 million each,” he said.

About a quarter of Camp Hill’s buyers were from interstate, mostly from Sydney, he noted – but a lot were also coming from inner city meccas like New Farm and Teneriffe.

“We’ve got young people coming from those areas to Camp Hill because its close enough to the city to be considered cool. In Camp Hill you can be in the city for under $15 in an Uber or walk home from the Gabba after the cricket,” he said.

And while Brisbane has been tipped to slow down as part of a broader slowdown across the property market nationally, it has also been picked as the best capital city performer for 2022.

“If you look at the bank forecasts, they’re all picking Brisbane to be the best capital city performer, even in the lower growth environment,” Ms Owen said. “Those tailwinds of internal migration and lower prices are likely to keep momentum going.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More