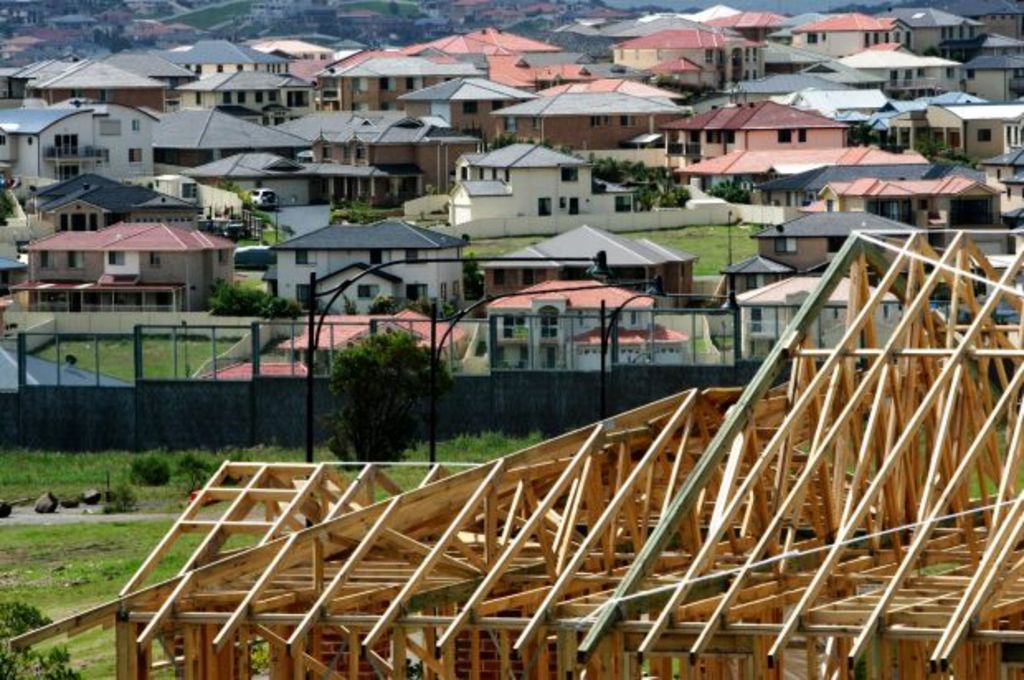

Building approvals 'remarkably weak' as houses lead fall

Australian building approvals have recorded a “remarkably weak” result in May, with detached houses slumping 8.6 per cent in a data release that left economists scratching their heads.

Overall, the number of dwellings approved for construction in Australia fell 3.2 per cent in seasonally adjusted terms in the month, according to the Bureau of Statistics, with units strongly outperforming private sector houses.

The result came in much worse than market expectations of a no-change result, according to senior CBA economist Belinda Allen, who said Tuesday’s result calls the validity of the data into question.

Remarkably weak Aust approvals to build detached houses: -8.6% is largest fall since May 2015 spike. Perhaps @DGPetrie knows why QLD to blame: house approvals -20.7% m/m #ausbiz pic.twitter.com/wr6avAzuD4

— Sean Callow (@seandcallow)

July 3, 2018

“There appears to be some issues with the data in today’s release, stemming from Queensland,” Ms Allen said.

“Approvals in Queensland fell 26.7 per cent in the month, led by a 20.7 per cent fall in private sector house approvals and a 35.8 per cent fall in the volatile other residential approvals.

“This looks out of character for private sector houses to fall as dramatically in a one‑month period and raises questions over the validity of the data.”

On a trend basis, building approvals have fallen for the past seven months and are now down almost 11% from their peak 3 years ago. Approvals for apartments are at lowest level in almost 4 years #ausbiz #property pic.twitter.com/wJIbOrfVEZ

— Callam Pickering (@CallamPickering)

July 3, 2018

Queensland’s surprise result doesn’t fit with the broader economic picture of the state, according to the economist.

“Population growth has turned up in Queensland and while construction lending has fallen, it hasn’t to the same extent as what today’s data indicates.”

Despite a weaker-than-expected result in May, building approvals have gained 3.1 per cent over the year.

Expect the reporting will go hardcore bear porn on this release due the now -ve trend, but (after a few cheeky revisions) the annual number of dwelling approvals actually increased to a stonking 229,433. Whether they all get built, well that’s another matter, obvs (4/6) #ausbiz pic.twitter.com/FLXGsxA24D

— Pete Wargent (@PeteWargent)

July 3, 2018

Westpac senior economist Matthew Hassan also warned Tuesday’s data may be misleading.

“While this is broadly consistent with weaker construction-related finance approvals in recent months, the extent of the monthly move is large for what is usually a more stable component,” Mr Hassan said.

“With some wild swings in some of the state detail, we advise caution in interpreting the latest figures.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More