Capital city markets close to bottoming out, regional areas on the rise: PRDNationwide

Most capital city property markets are just about to bottom out, while regional areas are already on the rise, according to new research from PRDnationwide.

Sydney and Melbourne’s property markets are nearing the end of their downturn, whereas regional areas in their respective states are already on the rise.

Queensland markets are not far behind, with the capital in a downswing while regional areas have not yet bottomed out but are close to doing so.

But, on the other hand, South Australia and Tasmanian markets are on the cusp of reaching their peak – both states avoiding any significant in the recent nationwide downturn.

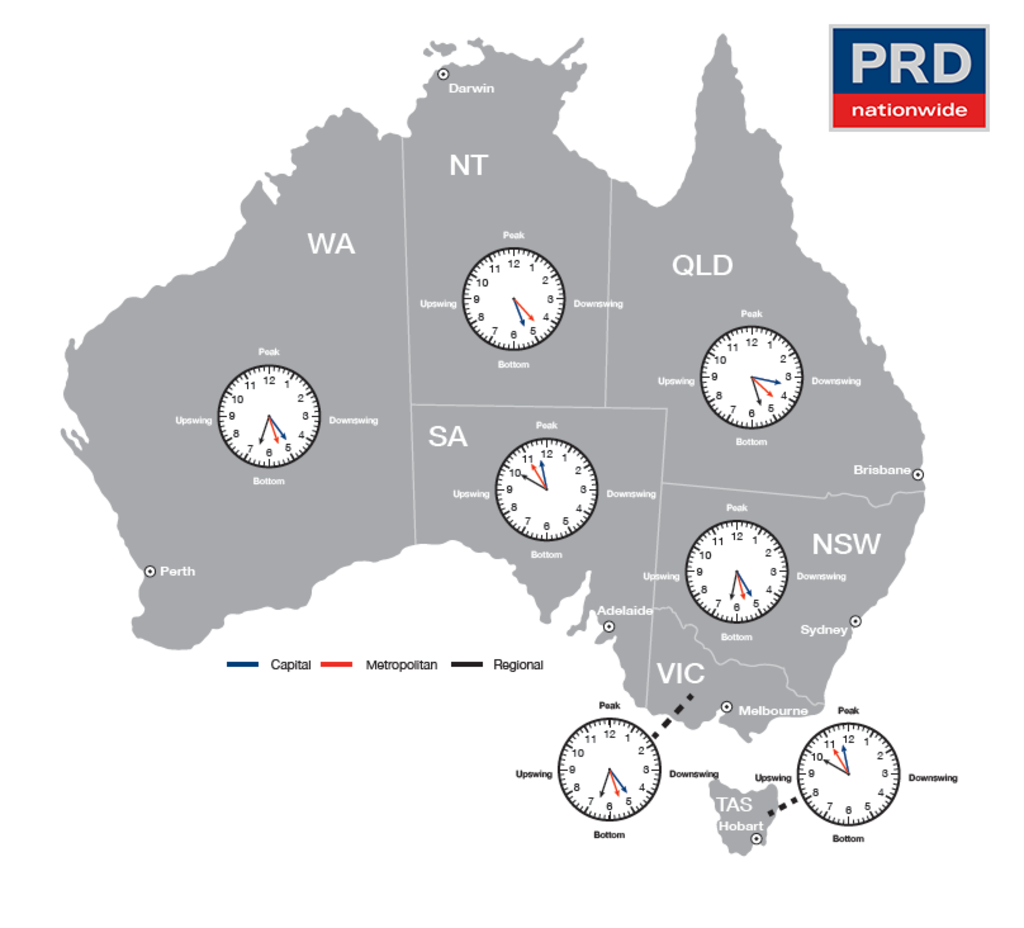

The different markets are illustrated on a property clock for each state and territory, with 12 representing the peak of the market and six representing the bottom, in the Australia Economic Property Report 2019 released on Thursday by the research wing of real estate agency PRDNationwide.

Regional, metropolitan and capital cities were represented on the clock for each state.

The research comes amid a lift in housing market sentiment in the wake of the federal election, two official interest rate cuts and a move from the bank regulator to let buyers borrow more.

The boost to confidence has prompted several commentators to suggest the downturn in the two largest cities is close to bottoming out, following a five-year house price boom that saw some buyers look to more affordable regional markets instead.

It’s a “crucial” time for buyers in capital cities such as Sydney and Melbourne, according to PRDNationwide national research manager Dr Diaswati Mardiasmo.

“We are in that critical juncture of where we’re at a downswing in most markets at the moment,” she said.

“We have seen a lot of conducive things like APRA lessening lending requirements, the RBA cutting the cash rate twice … now is that crucial time to get into the market before it starts to pick up again.”

Although markets were expected to grow, Dr Mardiasmo said she forecast it would be more of a gradual increase opposed to a surge.

“Having the Reserve Bank of Australia cut cash rates twice in June and July will assist people wanting to get into the market, but at the same time the only times that they do expansionary monetary policy is if there is an underlying issue in the economy itself,” she said.

“That’s why it will be a gradual lift as opposed to an immediate shoot up.”

While South Australia and Tasmania are nearing the peak, significant falls are not predicted in the immediate future.

“You can really still get a bargain in Hobart and Adelaide as opposed to Brisbane, Sydney and Melbourne,” Dr Mardiasmo said.

“When it comes to investors, the rental yields for Hobart and Adelaide look good, vacancy rates are good and there’s still a lot of interest in these places for them to get into the market.”

Dr Mardiasmo said regional markets were shaping up as some of the strongest performers.

“If we base it solely on figures, regional markets are still going fairly strong, and with all of the infrastructure development that has been committed to regional markets, and the fact that regional markets are still more affordable than capital cities,” she said. “I would definitely expect to see large growth in regions markets, whether it’s Victoria, NSW or Queensland.”

In April’s federal budget, the government pledged a $100 billion infrastructure spend over the next decade with much of that going towards fast rail projects between regions and city centres and also through city deals.

Some economists expect further interest rate cuts, which could offer another boost to housing. Over the June quarter house prices in the combined capital cities fell just 0.4 per cent, on Domain figures, and are tipped to edge up one per cent in the second half of 2019 in Domain’s Property Price Forecasts.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More