How did Canberra's property market fare amid COVID-19 compared to other capital cities?

2020 has been a year like none other. Canberra has been faced with multiple challenges of an unmatched bushfire season, a wild hailstorm, a global pandemic and the subsequent economic upheaval that has ensued.

Given the unpredictable nature of the pandemic and the fear of the unknown, buyers and sellers initially delayed property decisions.

During lockdown, the pullback in market activity aligned to the pandemic-related containment measures, which helped shield home values from major declines.

From the outset, Canberra was in a better position than other capital cities to withstand the initial impact of COVID-19.

The economy has been buffered by the higher number of public sector jobs and industry’s reliant on public sector spending, with certain government departments expanding during the COVID-19 hiatus.

Economic disruption has not been felt evenly across Canberra with tourism and hospitality workers experiencing the brunt. Younger and lower-income households have been the most vulnerable to job loss or income reduction, and are more likely to rent than be home owners.

The early forecasts of significant falls in property prices will have heightened the uncertainty for home owners, although these severe predictions have not eventuated to-date.

Historically, property prices have held up well against negative economic shocks. There have been varied outcomes on the property market when faced with an economic downturn; even major share market losses or recessions have not led to severe price falls.

During the global financial crisis, the slowdown in global and the Australian financial sectors had a flow-on impact on employment, household income and borrowing capacity.

Despite this, Canberra house prices fell 5.4 per cent from peak to trough and units a more moderate 3 per cent. Falling interest rates, government stimulus packages and mining investment aided the road to recovery for Australia and property prices rebounded quickly.

Fast-forward to the recession faced by Australia in 2020. Canberra home values have been incredibly resilient during the pandemic.

As home values fell in Sydney and Melbourne, the nation’s capital continued to grow. Canberra house prices are at record highs, numerous suburb records have been smashed, and the auction market continues to provide a robust performance.

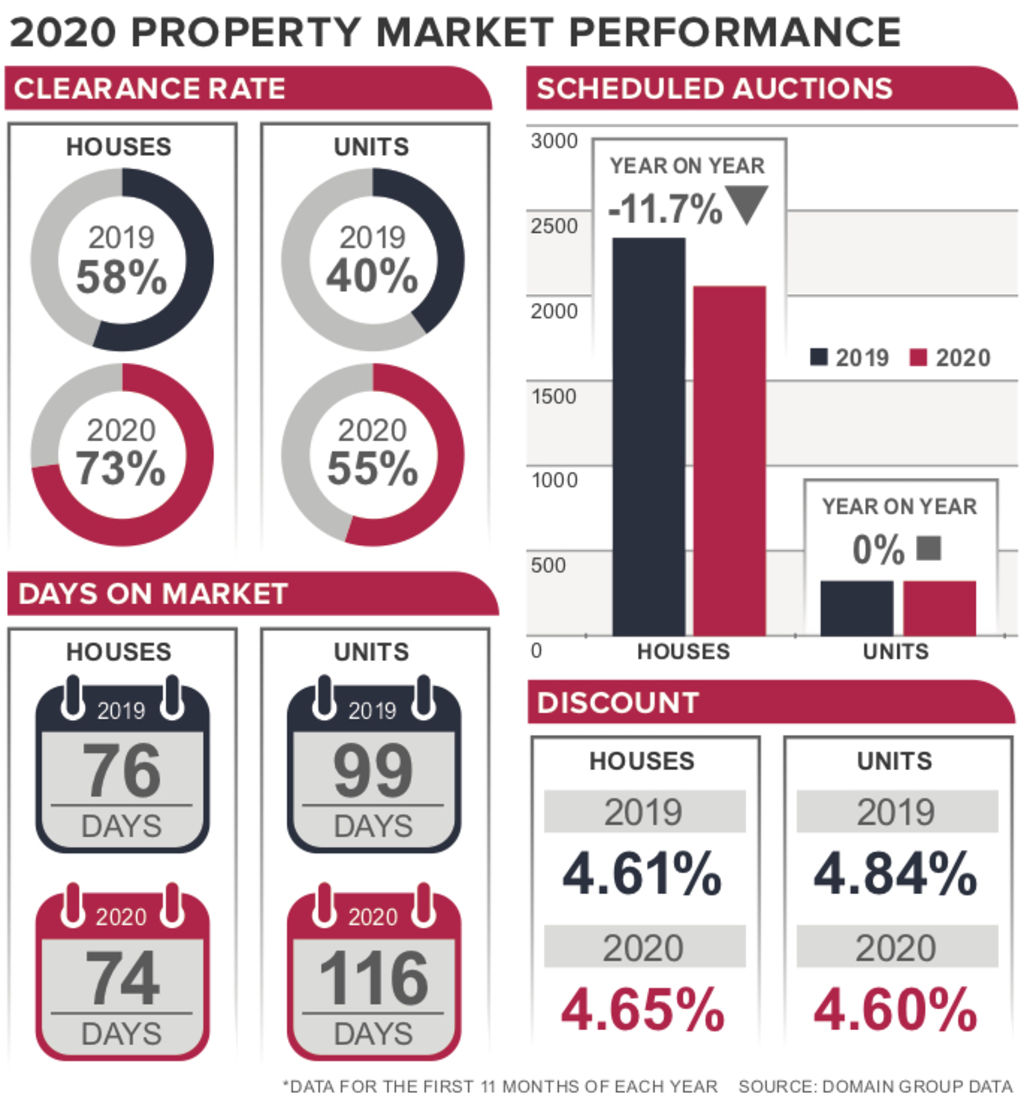

Last month’s clearance rate was the strongest outcome for the month of November, with a record portion of sellers finding a buyer before auction day and median auction house prices reaching a new peak.

It may seem unbelievable that the local housing market has performed so well.

Significant government stimulus, mortgage holidays, three interest rate cuts this year and consistently low levels of supply have supported prices. As well as the low rate of infection in the ACT throughout the pandemic.

Buyers have been lured back into the market by low interest rates, government tax cuts and other incentives. Owner-occupiers are leading the charge with strong demand from first-home buyers and upgraders.

COVID-19 has been the catalyst for change as we enter the working-from-home era and likely to have spurred some to seek out a new home or renovate.

As the year ends, Canberra house prices are likely to continue to defy initial expectations and push to another record high.

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

- © 2025, CoStar Group Inc.