How the HomeBuilder incentive could impact the Canberra property market

The federal government’s HomeBuilder scheme will provide a much-needed boost to the local housing construction sector in the wake of the COVID-19 crisis. It will help to supercharge budgets for Canberrans building new homes or undertaking a substantial renovation.

The stamp duty waiver on land and off-the-plan sales from the ACT government provides additional savings. The key winners of these initiatives will be prospective buyers wanting new homes, not just first-home buyers but anyone looking to upsize or downsize, as long as you fall under the income threshold and property value cap.

For purchases the HomeBuilder value cap is set at $750,000, while the stamp duty waiver is set at $500,000 then a sliding scale up to $750,000. The pricing caps are problematic for markets such as Sydney, where new home costs are high. Canberra, on the other hand, offers greater value for money with median unit prices significantly beneath this cap and median house prices a little above.

The two schemes provide a helping hand to home buyers and a lifeline to the construction industry, increasing jobs, housing starts and injecting millions into the ACT economy. Although the HomeBuilder scheme does have its flaws as it aids short-term demand rather than driving sustained long-term demand.

The timeframe of HomeBuilder is particularly problematic, given that it expires at the end of the year. It is argued that the stimulus will be utilised by those who were already planning to build. Rather than creating additional demand for construction work, it will merely bring this work forward.

A housing stimulus that fast-tracks a decision already made rather than stimulating sustained demand through economic reform tends to create an immediate surge in activity followed by a decline.

A prime example is during the GFC, when the first-home buyer boost was doubled from $7000 to $14,000 for established homes and $21,000 for new homes.

In the ACT the value of first-home buyer loans jumped by 140 per cent in the 12 months to September 2009 compared to the same period the year prior. This subsequently dropped 40 per cent in the following 12 months and down a further 19 per cent thereafter. At the same time, house prices rose, stifling affordability.

Also, think about the substantial planning and organisation that is required to undertake a six-figure renovation. It makes the HomeBuilder scheme an added extra for someone already on the path to renovating. Therefore, it is likely to be skewed towards new builds and off-the-plan purchases rather than renovations.

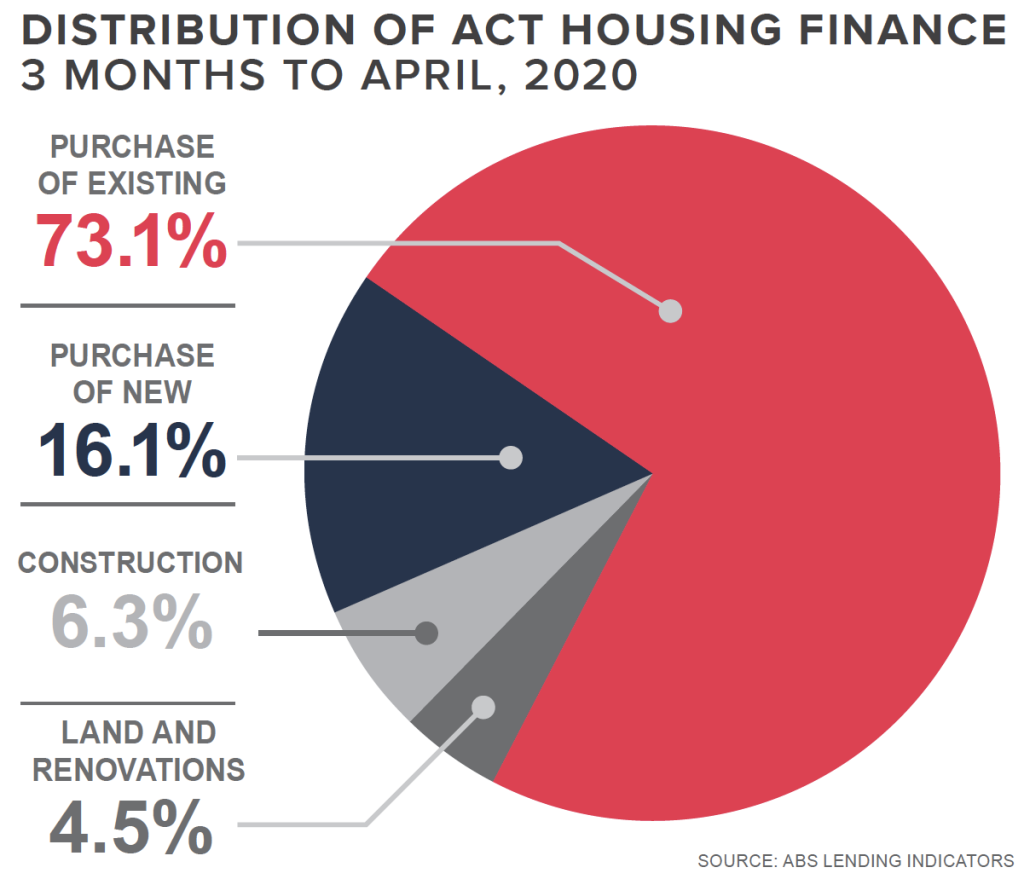

The vast majority of home loans are for established homes at 73.1 per cent of the value financed in the three months to April. While 16.1 per cent are financed for new homes and 6.3 per cent to construction, a smaller 4.5 per cent accounted for the purchasing of land and renovations. We are likely to see this tilt in favour of new homes and construction in the coming months.

Since off-the-plan apartments are included in the scheme, it will help absorb some of the construction-ready projects across Canberra, while the newer suburbs are likely to benefit from increased interest in house-and-land packages.

Home owners need to act quickly to be able to take advantage of the HomeBuilder scheme before the end of the year, although the ACT stamp duty waiver will be in place until June 2021.

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More