Consumer anxiety on the rise as coronavirus impacts economy, NAB survey shows

Consumer anxiety is on the rise and household spending is rapidly changing as the coronavirus crisis takes its toll on the economy and household earnings, a new survey shows.

Around one in four Australians spent more than what they earned over the past three months, with the number significantly higher among lower income groups, according to the latest quarterly NAB Australian Consumer Anxiety Survey, released on Thursday.

Australians also reported a decrease in their income and a particularly strong decline in their level of saving, while significantly more people cut back their spending on non-essential items.

“The survey is showing just how quickly consumer anxiety is climbing and how our behaviours are changing really quite rapidly,” said Dean Pearson, NAB’s head of behavioural and industry economics.

Of the more than 2000 Australians surveyed, Tasmanians were the most anxious, followed by those in Western Australia and Victoria. Renters were more anxious than home owners and lower-income earners were more concerned than their higher earning counterparts.

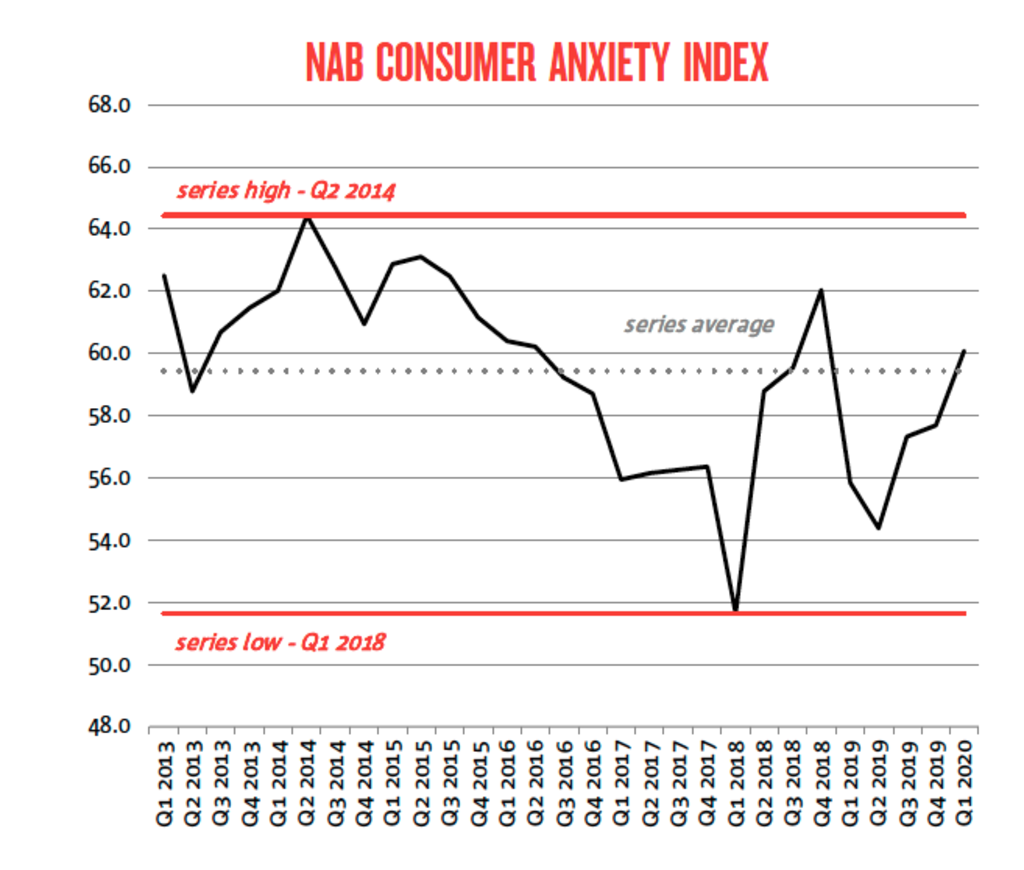

Overall, consumer concern climbed steeply over the quarter, with NAB’s Consumer Anxiety Index up 2.4 points over the quarter to 60.1 points. The index is at above average levels for the first time since late 2018, 4.3 points higher than the same time last year – and only likely to rise further.

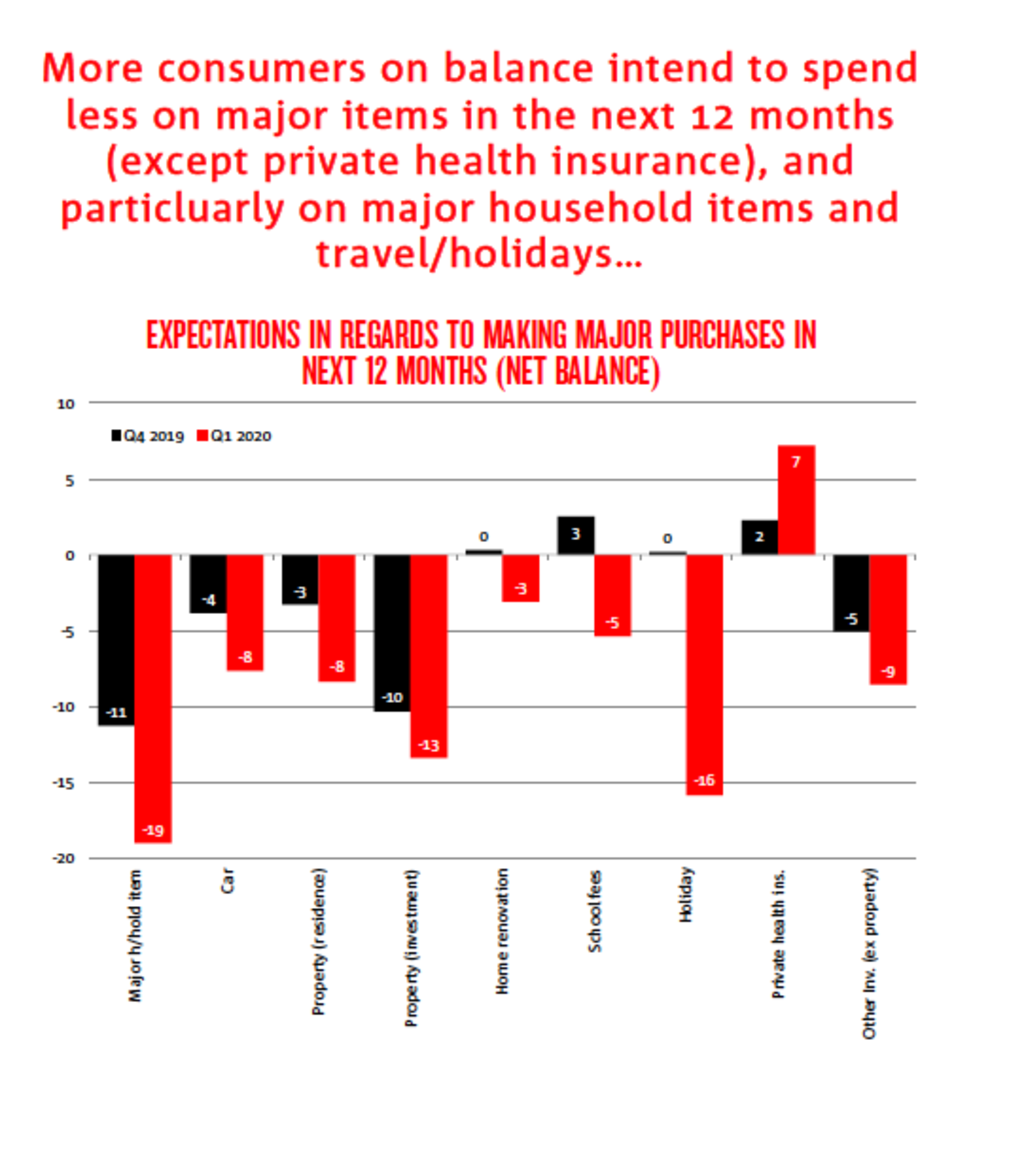

“It’s really quite difficult to see how consumer anxiety will not continue to climb from here,” said Mr Pearson. “When we asked consumers about their eventuality of making a major household purchase, in the next 12 months, that’s really fallen sharply – particularly in things like major household items, holidays and investment properties.”

Anxiety rose across all index components, with the sharpest increase around job security – up 5.8 to a survey high 52.3. While the cost of living remained the biggest concern, consumers felt cost pressures had eased for most items.

NAB Chief Economist Alan Oster said households had become more conservative, cutting back spending on non-essentials such as entertainment, eating out and holidays – prompted by recent restrictions to contain the virus.

However spending on groceries was up, with more consumers also increasing spending on utilities, transport and medical expenses.

“People are spending more on essentials,” Mr Oster said. “We can clearly see this behaviour in our customer spend data as purchases of food and other supermarket items are surging, while spending in other parts of the economy, particularly those associated with tourism or hospitality, are falling sharply.”

Spending on home improvement and maintenance was also down, as were expectations to purchase a property to live in or invest in over the next year.

Mr Oster said property price growth would likely come to a halt, particularly as unemployment was expected to hit the double digits by the end of the year. While banks will give mortgage holidays to limit foreclosures, which would put further downward pressure on prices, he could not imagine prices going up this year.

While expectations for the next 12 months regarding incomes, savings and debt were much less positive, noticeably more young people had expected their incomes to rise – and would be left disappointed.

Mr Oster noted the survey predated many of the more recent restrictions to contain the virus and as such did not capture “the real angst that occurred in the back end of March”.

“I wouldn’t be expecting incomes to be going up,” Mr Oster said. “We expect to have quite a severe recession, we think the big hit is going to be the June quarter.

“We would expect to see quite strong growth [once we’re past the coronavirus] however the level of GDP [is not expected] return to what we had … until December 2021, so that means unemployment stays quite high for some time.”

Interestingly the survey did record an increase in anxiety between the first wave of responses between March 12 to 16, and the second wave between March 17 to 20 – with government policy and health seeing the biggest increase in concern.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More