Distressed listings fall to lowest levels since interest rate hikes

Distressed listings are at their lowest level since the RBA’s consecutive interest rate hikes kicked off in early 2022, according to Domain data.

January marked the first time since then that all capital cities saw a decline in distressed listings – properties that must be sold due to financial or other hardships. This indicates the resilience of mortgage holders and households who have had to endure rising cost-of-living pressures.

Domain chief of research and economics Dr Nicola Powell attributes the January dip in distressed listings to the rise in property prices throughout 2024 after a downturn in 2022 and a slow recovery in 2023.

“For those who do get to the point that they need to sell their home because they’re unable to meet the financial obligation of a mortgage, the sales market has been quite good at supporting a sale,” she says.

“I think, given the fact that we’ve seen prices rise, that will help mitigate any losses associated with selling.”

Strong selling conditions have also spurred momentum in the market and resulted in fewer overall distressed listings.

“We’ve still had strong selling conditions to support quick sales and so they may not have needed to get to the point where they’re an urgent sale – a ‘price reduced, must sell’ type of scenario,” Powell says.

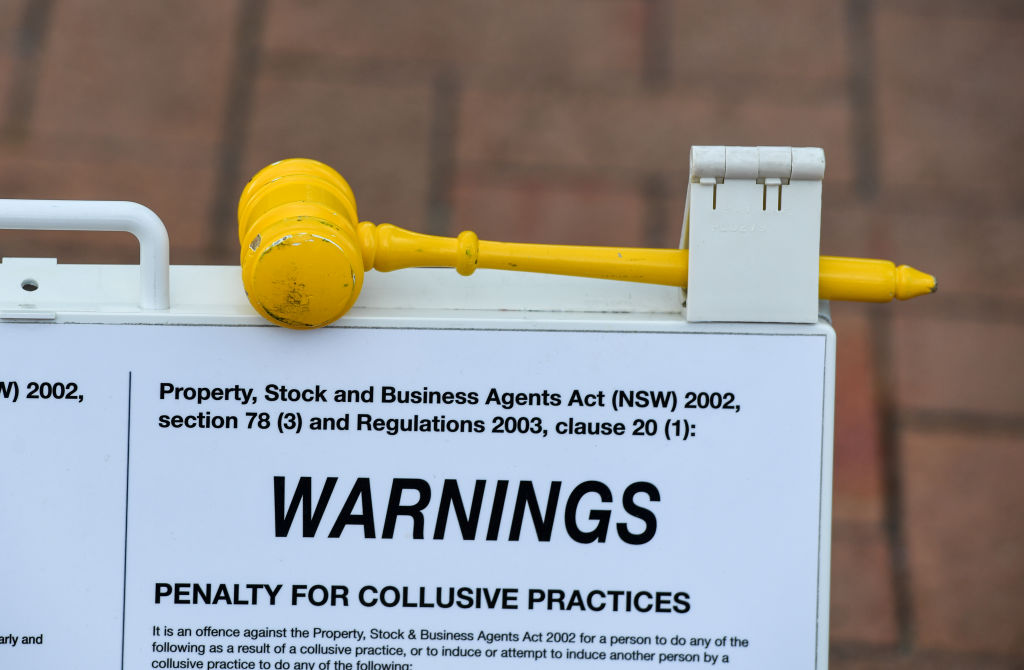

Distressed listings can often be identified by the use of certain key words or phrases, including “urgent sale”, “mortgage in possession”, “repossession”, “distressed property/sale”, and “forced property sale”.

Ray White chief economist Nerida Conisbee maintains households are still experiencing mortgage stress, but the decline in distressed listings suggests “people that have really had to sell have sold and now the market is in a bit more of a state of balance”.

New listings were also at a record high in Sydney, Melbourne and Canberra in January, according to Domain data.

Conisbee believes this surge of new listings may also be attributed to ongoing mortgage stress.

“We did see a lift in properties for sale at the end of last year – not necessarily distress sales but total sales – and I think that was because of continued stress in the market,” she says.

“Even though the worst has come through, I still think there are a lot of people who are still very, very stressed about their mortgages.”

Powell suggests those most affected by the consecutive interest rate hikes that led to a peak in distressed listings were those “early on in their buying journey, when they don’t have equity built up”.

“They might be upsizing from an apartment to a house and making that big leap,” she says. “They’re the ones who, financially, are more at risk and vulnerable.”

However, with a predicted RBA rate cut on the horizon, an overdue reprieve is expected for many households.

“Cutting interest rates will help a lot of people, and the potential for further rate cuts during the year will make it a lot easier for many households to manage their mortgages,” Conisbee says.

Multiple rate cuts this year would likely contribute to distressed listings levelling out and aligning with pre-2022 patterns.

Distressed listings are currently at their lowest since January 2022 in Canberra, April 2022 in Sydney, May 2022 in Melbourne, Brisbane and Adelaide, and September 2022 in Hobart.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More