Fall in New Zealand house prices offers insight into what might happen in Australia

Australian house prices are not expected to plummet below pre-COVID levels with experts saying the local property market can look to the “soft landing” being experienced in New Zealand as a guide.

While Australians are only beginning to feel the pinch when it comes to increased mortgage repayments from rising rates that began in May, New Zealand saw its first rate rise in October 2021 when its Reserve Bank increased the cash rate by 25 basis points.

There have been four more rises since, with the expectation of another 0.50 percentage point increase when the Reserve Bank of New Zealand meets on Wednesday. That will take New Zealand’s cash rate to 2.5 per cent.

But economists say Australian households should take comfort from their neighbours across the ditch who are leading the way in the housing downturn as it may offer some clues as to what could happen back home.

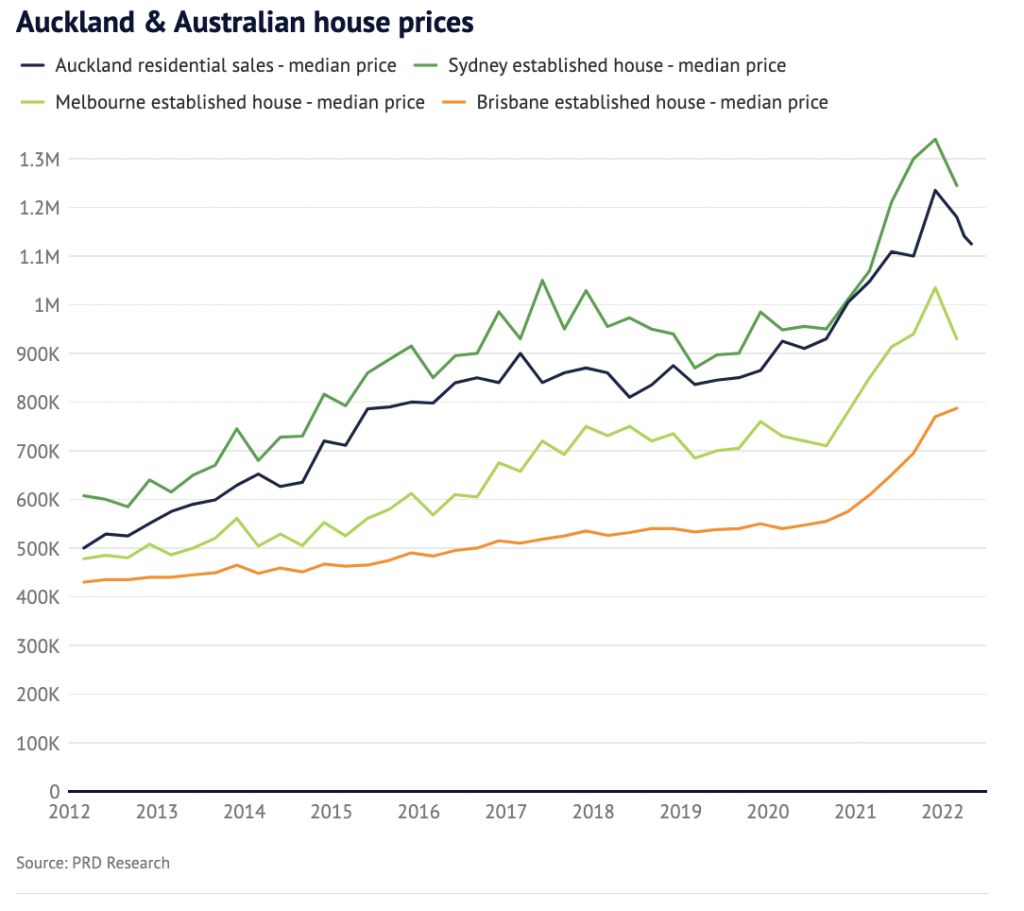

New Zealand house prices have fallen 5.5 per cent from their November 2021 peak with forecasts it will drop 11 per cent by year’s end, according to ANZ New Zealand.

The bank’s chief economist Sharon Zollner said while there were risks of larger price falls, so far, it was on track for a “soft landing”.

“We’ve had a bigger housing boom [than Australia] … so in that regard, we’re cruising for a bigger bruising if the labour market falls,” Zollner said.

“But [so far] it couldn’t have happened in a more orderly fashion … they have to fall 30 per cent to be where they were before COVID in 2020.”

She acknowledged that despite this fall, housing affordability had barely improved after prices rose in the order of 50 per cent during the pandemic.

“Housing affordability is not getting any better, as bank serviceability tests rates go up, the amount you can borrow is shrinking faster than house prices are going down.”

PRD chief economist Dr Diaswati Mardiasmo said Australia was on a similar path as New Zealand started its rate rises sooner.

“We will basically follow the same trend. They just started earlier, but we’re a bit more aggressive,” Mardiasmo said.

“It does give us a clue as to what might happen in our country, particularly in the [major] cities … they’re seeing anywhere between 10 to 12 percentage point drops and 5 percentage point drops in regionals.”

Barrenjoey capital chief economist Jo Masters said while it was worth watching New Zealand closely, there are clear differences in Australia that could potentially see households at home better off.

“While it’s true the RBNZ is further ahead in its tightening … they have indicated they are willing to enter restrictive territory, while the RBA wants to go to neutral territory,” Masters said.

New Zealand also introduced legislation last year that tightened home loan assessments, Masters said, which compounded the effect of rate hikes.

“Given that, you would expect their housing market to fall faster and further,” she said.

Lastly, more New Zealand households took on bigger debts in relation to incomes, Masters said.

“The leverage in Auckland is much greater than either Sydney or Melbourne. Here we talk about the proportion of debt over six times one’s income. At the moment in Australia, it’s a little under a quarter of new mortgages, but it’s running over 50 per cent in New Zealand,” Masters said.

“One way to think about it is what you have seen in Auckland could be our worst-case scenario. If New Zealand can weather that storm, then we can take some comfort that we can too. Their prices rose by much more and households are much more leveraged.”

Masters said she forecast the Australian housing market to fall 13 per cent peak-to-trough, taking prices back to April 2021.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

/http%3A%2F%2Fprod.static9.net.au%2Ffs%2F0f635a43-521f-4f37-81a6-2f15a8d54d15)