First-home buyers dropping out of the property market as investors return, new data shows

First-home buyers are getting crowded out of the hot property market by stiff competition from investors, downsizers and buyers in between.

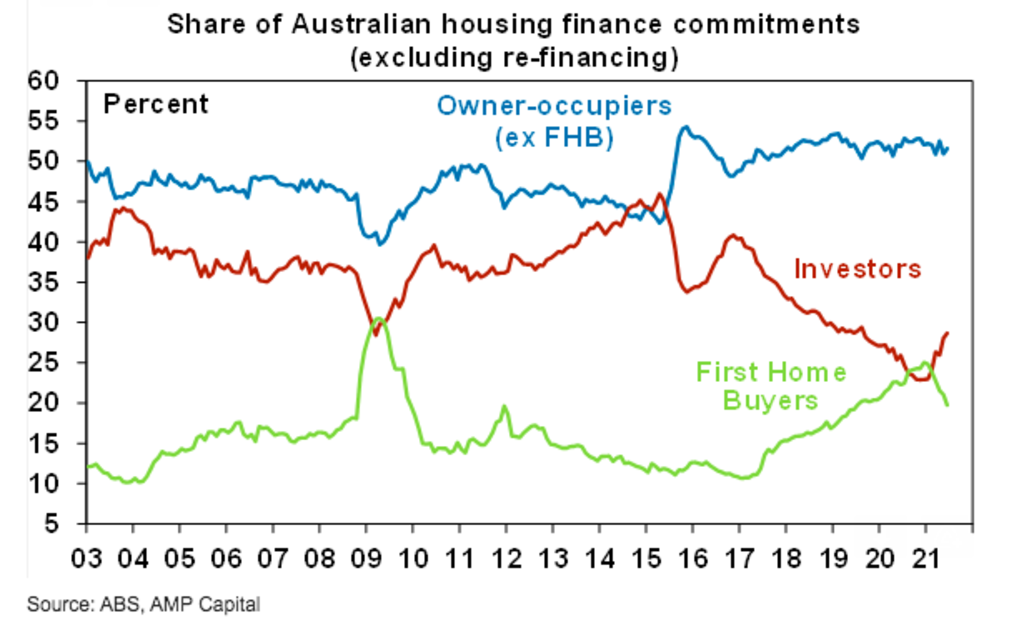

The value of loans to first-time buyers dropped 7.8 per cent in the month of June, ABS figures released on Tuesday show, down 14.7 per cent from the January peak.

Lending to investors is heading in the opposite direction, up 0.7 per cent in the month and 40.5 per cent higher than in January.

First-time buyers had a window of opportunity to purchase during 2020 when those lucky enough to keep their jobs could take advantage of ultra-low interest rates and temporary pandemic-era government stimulus measures such as stamp duty concessions and the HomeBuilder grant.

They faced less competition as investors largely sat on the sidelines due to uncertainty about the economic outlook and a COVID-19 shock to the rental market that saw vacancy rates soar. Levels of first-time buyers reached the highest point since the GFC when the First Home Owner Grant was tripled.

But rising prices have tempted investors back into the market in recent months, attracted by the prospect of future capital growth and the chance to borrow at interest rates that could stay low until 2024.

Those same price rises have pushed homeownership further out of reach for some first-home hopefuls, who struggle to save enough to keep up with the increased deposit requirement.

“Investors are definitely coming back,” The Agency chief executive Matt Lahood said. “A lot of them have got money they want to place somewhere in the next 12 months.”

First-home buyers were facing competition on several fronts, he said, from investors, downsizers who were looking for apartments, expats who had returned and were looking to buy and expats who were still overseas but were looking to invest in Australia.

“Generally, there’s a lot more competition for properties,” he said, adding that young buyers were often helped by their parents.

Ray White NSW chief auctioneer Alex Pattaro said competition for entry-level houses was split half-and-half between first-home buyers and investors, and in some neighbourhoods, the first-home buyers were struggling to keep up with price rises.

“In certain parts of Sydney, we are seeing first-home buyers priced out,” he said. “They’re looking at either larger apartments or venturing to the outskirts of Sydney.”

First-time buyers were often the first to sit on their hands at the sign of a coronavirus outbreak or another shock, he said. But when they did try to buy, the competition was “ridiculous”.

“There’s no doubt there are more investors in the marketplace than 12 months ago, even six months ago, which is the reason why first-home buyers are seeing more competition at auctions with a different pool of buyers,” he said.

On average, his team had seen seven registered bidders per auction between January and June, but July’s figure had jumped to 11, meaning there were four more bidders in lockdown than before it.

“There are a lot of buyers who have missed out on a lot of properties. Those buyers have now seen a shortage of stock,” he said.

“There are a number of buyers who have sold property recently … going above and beyond to secure property, or they could be left renting.”

Melbourne-based mortgage broker Chris Foster-Ramsay has seen first-home hopefuls decide to sit on the sidelines and wait out the property boom in the hopes of trying again in spring.

“There was a point in time where first-home buyers just turned around and said, ‘We’re out, we’ve had enough, we’re going to wait. It’s too crowded; it’s such a hot market,’” the Foster Ramsay Finance principal mortgage broker said.

“Typically, what we’ve found in the past is when there’s competition between a first-home buyer and an investor; usually, an investor will win because an investor has deeper pockets.”

Propertybuyer chief executive Rich Harvey adds that investors might have equity to help them buy in a rising market.

“The poor first-home buyer, unless they’ve got the bank of mum and dad, they’re going to max out pretty quickly,” he said.

“We’re definitely seeing a significant increase in the proportion of investors as the year has gone on. The thing that’s attracting them is capital growth, jumping into a rising market.”

The lending figures showed home lending overall had edged lower in June, down 1.6 per cent, even as property prices kept rising.

Westpac senior economist Matthew Hassan said the overall dip was “neither here nor there”, but there were signs of first-home buyers peaking and “dropping out of the picture”.

“Around investors, I don’t think we’re at the peak yet,” he said.

“[But] there’s still a bit of a question mark around how strong that segment will be … we’re coming into a lot of disruptions through July, August, September.”

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More