First-home buyers set to see neighbours' median property prices, incomes in new map tool

First-home buyers will be able to see how much their neighbours spent on a home using a federal government scheme that helps purchasers get into the property market.

Buyers have this year been flocking to the First Home Loan Deposit Scheme, which allows the purchase of a modest home with only a 5 per cent deposit without paying lenders mortgage insurance.

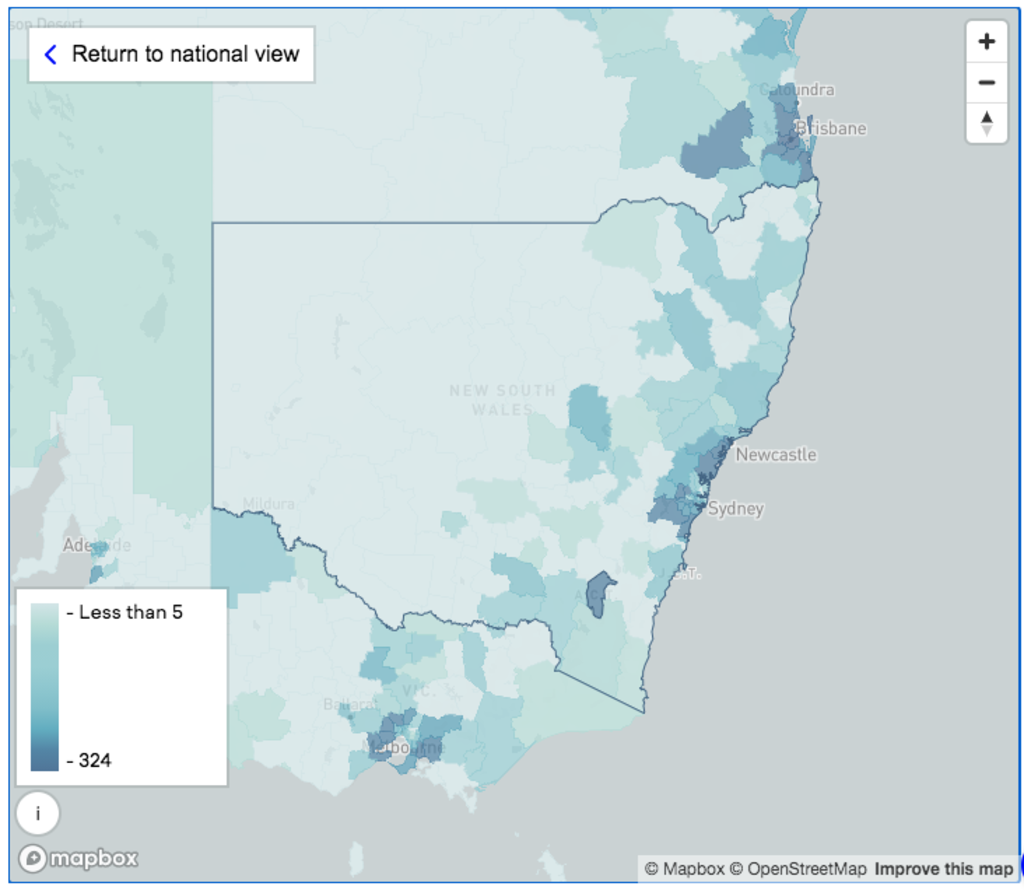

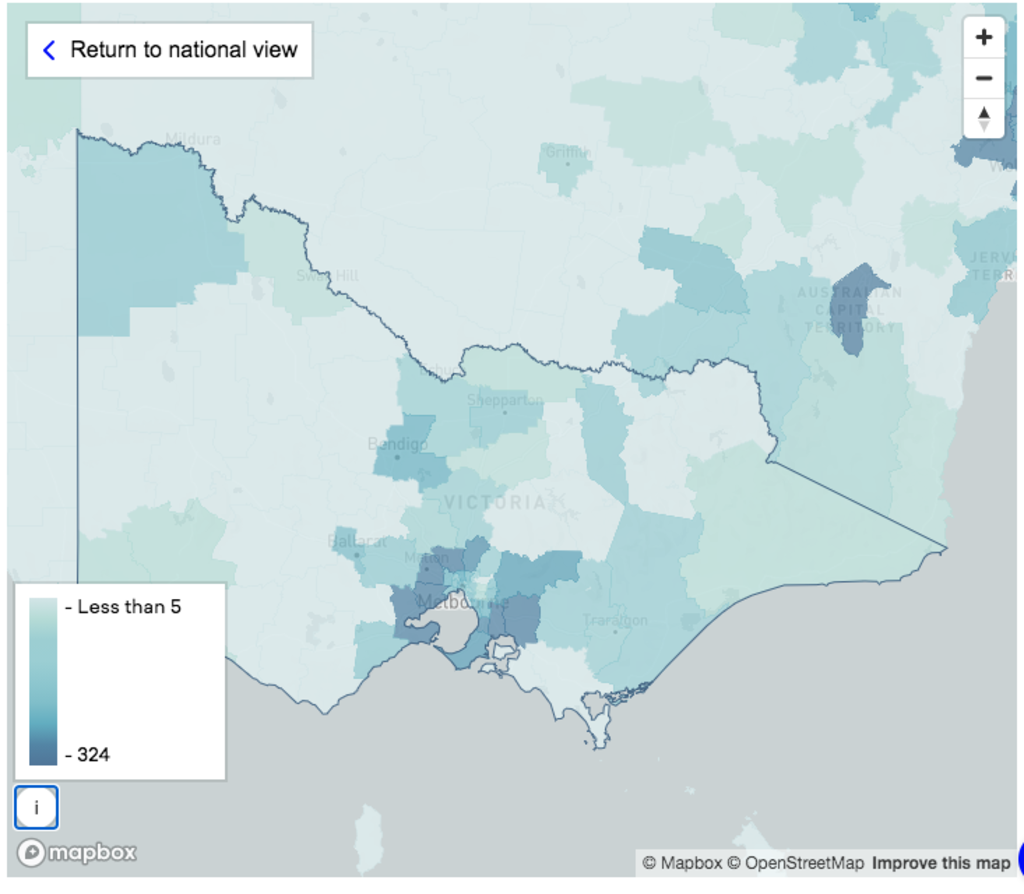

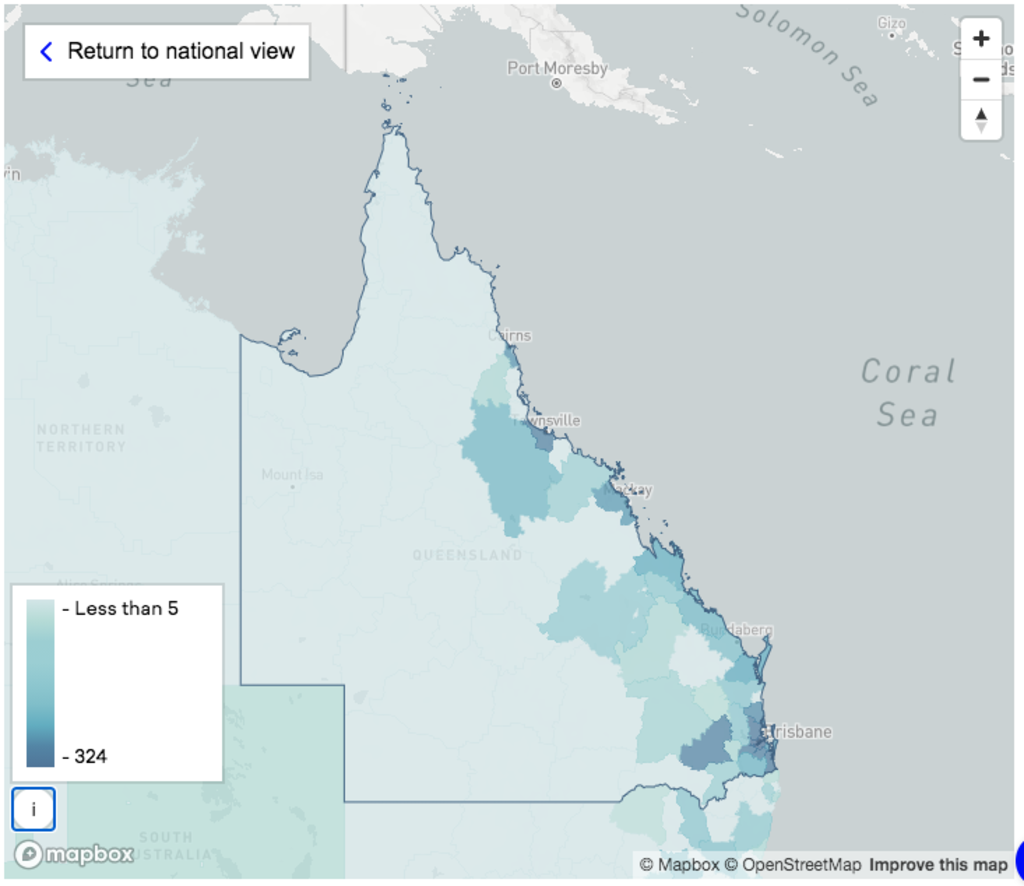

The average amount that buyers using the scheme paid, their household income and the average deposit they saved are displayed by local government area or postcode in a new mapping tool published by the National Housing Finance and Investment Corporation, which oversees the program.

“People generally have a range in mind when they’re looking to buy a property, and when they see a taxable income, they can form an assessment as to, ‘is this person similar to my circumstances’,” NHFIC chief executive Nathan Dal Bon told Domain.

“It’s giving them some further information that will help them narrow down the area they want to live in, based on the experience of others in that area.

“It will give them a good indication of where properties in their price range are located.”

Buyers on the NSW Central Coast, for example, had a median household taxable income of $107,000 and paid a median of $574,000 for a home. Blacktown buyers had a similar income, $108,000, but paid more at $611,500.

Heat maps for the first six months of the scheme, to June 2020, show a heavy concentration of buyers in the relatively affordable outskirts of the major cities.

Buyers must spend below a certain price cap to qualify for the scheme, set at $700,000 in Sydney, $600,000 in Melbourne, $475,000 in Brisbane, $500,000 in the ACT, $400,000 in Perth and less in regional areas.

Mr Dal Bon said more properties were available within the price caps farther from city centres, especially for buyers looking for a house instead of an apartment.

“It’s probably a reflection of the affordability. When you have a look at first-home buyer incomes, that also determines what they can afford, both from the 5 per cent deposit but also the serviceability,” he said.

“Typically, if you want to have a house underneath the property price thresholds that will mean you’ll be looking at a greenfield site, which are typically on the outskirts of the major cities.”

The top three local government areas to take advantage of the scheme are all in south-east Queensland, with Brisbane first, followed by Moreton Bay to the north and the Gold Coast. The NSW Central Coast, the ACT and Blacktown were also popular.

Top 10 LGAs by number of FHLDS guarantees issued

| Rank | State | LGA |

| 1 | QLD | Brisbane (C) |

| 2 | QLD | Moreton Bay (R) |

| 3 | QLD | Gold Coast (C) |

| 4 | NSW | Central Coast (C) (NSW) |

| 5 | ACT | Unincorporated ACT |

| 6 | NSW | Blacktown (C) |

| 7 | QLD | Ipswich (C) |

| 8 | QLD | Logan (C) |

| 9 | NSW | Lake Macquarie (C) |

| 10 | QLD | Townsville (C) |

Source: NHFIC. As at 30 June 2020 for the 2019-20 cohort

The mapping tool is part of a new research portal for housing research and data being launched by NHFIC.

Despite the uncertain economy, Mr Dal Bon said demand remains strong for the scheme now amid low interest rates and stimulus for first-home buyers. Some states offer stamp duty concessions while the federal government offers grants for new builds.

An extra 10,000 places were announced in last month’s federal budget to buy or build new homes through the FHLDS (New Homes) program.

Charter Keck Cramer director of research and strategy Angie Zigomanis said the scheme helped buyers with reasonable job security get into the market sooner than if they had to save a full deposit.

“As interest rates have gotten lower and lower over time, it’s meant prices have gone up. Part of prices going up has meant the deposit hurdle has become more difficult for first-home buyers,” he said.

“It will help them get into the market sooner rather than later.”

But he warned the economic outlook was still uncertain, and the outer suburbs tend to be at higher risk in any market downturn.

“It’s important to make sure that a person doesn’t extend themselves too much, because the risks are higher for a low equity loan,” he said.

Mortgage broker Chris Foster-Ramsay said the scheme had been “massively popular”, with clients interested in using it for homes on Melbourne’s outer fringe.

But he warned anyone buying with a low deposit to consider their preferred location and nearby amenities, as well as current and planned infrastructure.

“Five per cent deposits are okay, but you have got to make sure you are doing it for the right reasons, you are buying in the right areas that have got the infrastructure, that you can see yourself living in for five to 10 years at least,” he said.

Elsewhere, a new study painted a bleak picture for those unable to contemplate buying their first home.

Some 60 per cent of renters were struggling to pay their rent, or worried they would not be able to make rent in the coming months, in a study for the Australian Housing and Urban Research Institute by researchers from RMIT University and the University of Adelaide. The figure is based on a survey of 111 tenants and landlords.

Thirty-eight tenants also kept a diary of pandemic life, and half of these raised their payment troubles with the landlord or agent – but only half of those got a satisfactory outcome.

Some tenants did not ask for a discount because they were worried about jeopardising repairs to the home or getting a good reference, the research found.

Perceived stress levels were significantly higher for renters than landlords, the research found, as many worked from home in shared housing or could not get building defects fixed during lockdown.

The study recommended a protective negotiation framework with an independent assessor, clear government advice for real estate agents, centralised guidance on the evidence tenants need to provide to show financial hardship, and a landlord hardship fund.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More