Fixed mortgage rates likely to rise well ahead of RBA rate hike

House-hunters flocking to the property market off the back of low mortgage rates are being warned borrowing costs could rise in the coming months, even if the Reserve Bank keeps interest rates on hold at record lows for years to come.

While the Reserve Bank has made it clear the cash rate isn’t going anywhere anytime soon, experts warn homeowners could face higher mortgage rates later this year, with a more significant tightening expected in 2023.

Competitive fixed-mortgage rates have likely reached their lowest point, or are close to it, and will rise in the second half of the year, ANZ senior economist Felicity Emmett said.

“In the second half of the year these sub-2-per-cent, three-year fixed rates that we’re seeing advertised at the moment are less likely to be around [as bank funding costs rise],” she said.

“Cheaper funding is not available forever and that will feed through into variable mortgage rates too.”

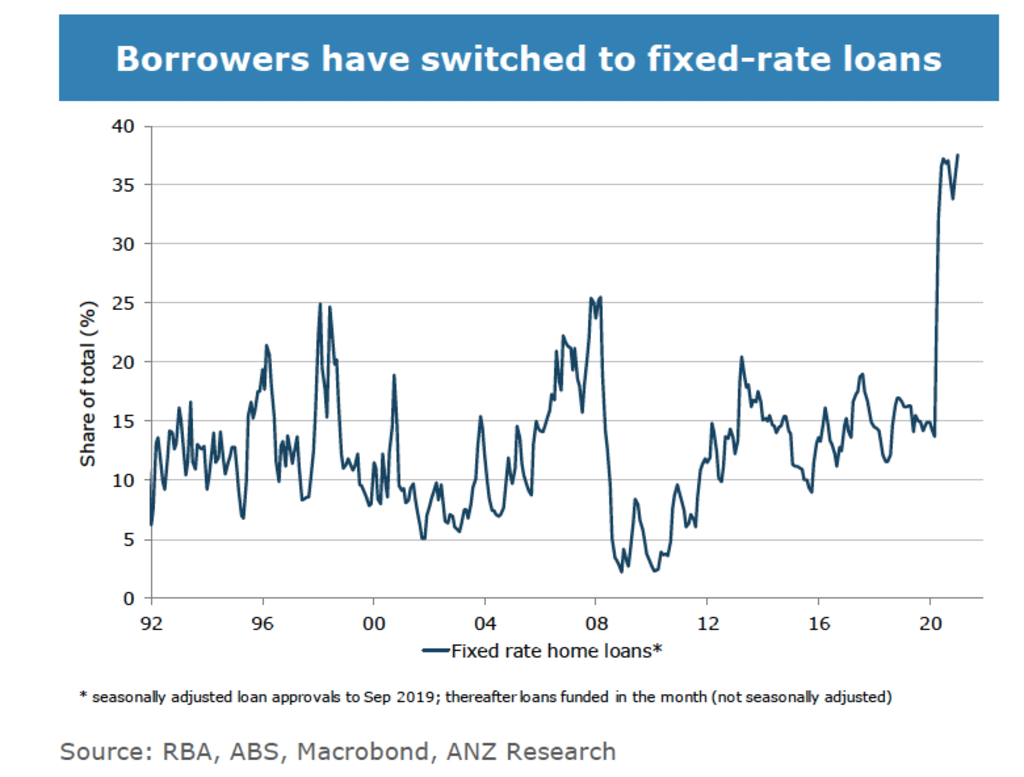

Over the past six months, more than 30 per cent of new loans have been at fixed rates, with three of the four big banks – Westpac, NAB and the Commonwealth Bank – offering two-year fixed-term rates below 2 per cent.

While ANZ does not have data on the tenure of fixed-term loans, it is assumed a large proportion of loans taken out in the past six months will be rolling off from May 2023, meaning borrowers will have to refinance when fixed rates are considerably higher and variable rates are also likely to be higher.

“It will represent a tightening for people’s cash flows, but keep in mind, in terms of people’s ability to afford these loans, that the banks still have lots of criteria around mortgage serviceability and there is the buffer there,” Ms Emmett said.

AMP Capital chief economist Shane Oliver said rates for longer fixed-term periods would rise first, noting Commonwealth Bank had already lifted its four-year rate earlier this month – increasing it by 20 basis points to 2.19 per cent.

“The money market is already factoring in [RBA rate] rises from 2023,” he said. “That’s not having much of an impact on two-year rates yet … but as we go through the course of the year, the possibility of rate hikes in 2023 will start to impact shorter rates as well.”

As rates rise, Dr Oliver said, there was a risk some buyers who took advantage of very low fixed rates would run into trouble when it came time to refinance. However, he added, neither the RBA nor APRA seemed concerned about it yet because neither interest-only loans nor household debt levels had hit higher levels.

“But as the boom continues it’s likely we will see an increase in credit growth and interest-only loans, and authorities might start to worry that this is getting a bit too hot.”

Low rates combined with government incentives had created strong buyer demand and price rises, Dr Oliver said. Consequently, higher rates and the winding back of incentives could start to slow down the market.

“The next few years are going to be interesting, at the moment we’ve got a massive boom … but if the trend in interest rates has bottomed and we see not just a cyclical rise in interest rates but a longer-term uptrend, you’ve got to wonder what is going to continue to spur the property market on, particularly if immigration levels remain down,” he said.

Ms Emmett agreed that increases in fixed-rate loans could take some of the heat out of the property market, but noted it would only tighten lending at the margins.

“I don’t think it will be enough on its own to really make a marked difference because rates will still be very low and I know at the moment there is an element of a fear of missing out [FOMO] for those entering the market … that’s why I think by the end of the year we will get the macro-prudential measure to slow the market.”

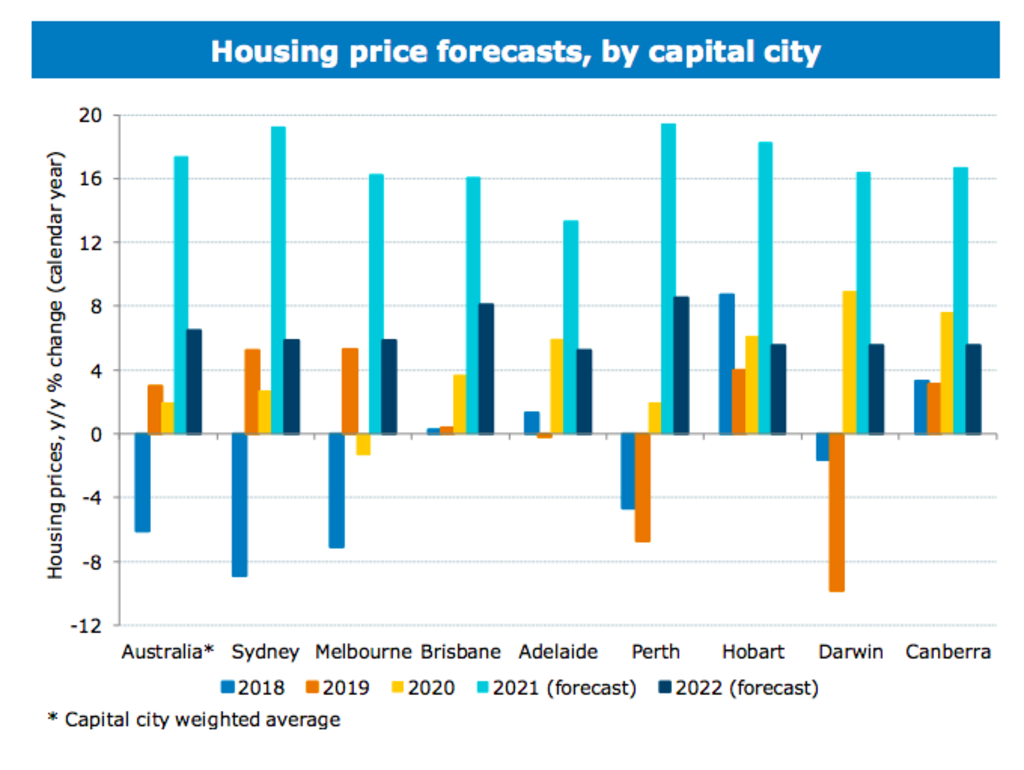

The bank is forecasting house price rises of 17 per cent this year, with the first quarter likely to post the strongest growth, Ms Emmett said.

Buyers jumping into the market with high loan-to-income ratios needed to make sure they factored in future rate rises, said Steve Mickenbecker, Canstar group executive of financial services.

“The banks do build a buffer in … but that doesn’t change the fact that your household budget is up for more repayments [when rates rise],” he said.

“FOMO is back and people are taking risks they wouldn’t have a few years ago,” he added. “The difference between a repayment at 2 per cent and 5 per cent is absolutely huge … [but] a lot of people’s memories are short and people [just] think, ‘I can afford this at 2 per cent.'”

A homeowner who borrowed $500,000 on a 30-year principal and interest loan would pay about $1850 a month at 2 per cent, and about $2680 at 5 per cent, Canstar calculations show.

With mortgage rates “more or less” as low as they would go, Mr Mickenbecker expected to see more people consider fixing loans for a longer-term period, which would cost more but see them avoid rate hikes until 2025. Or, alternatively, they could stay on variable rates while they were low, and then lock in a longer fixed-term as rates began to rise.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More