Has the end of the election and the RBA rate cut given the Canberra market a boost?

The Canberra property market softened in the first half of 2019, but price falls are likely to end later this year.

Uncertainty created by the May election, tighter bank lending conditions, the prospect of changes to negative gearing rules and a slowing economy all weighed on the market.

Canberra house and unit prices fell by 2 per cent over the year to March and recent indicators suggest prices have likely fallen further.

Canberra’s clearance rate in May was 51 per cent, well down from the 67 per cent recorded in May 2018. The average time taken to sell a Canberra house has also risen over the year.

But four key economic and political changes since May means Canberra property prices could stabilise soon, with the potential for a modest turnaround in the second half of 2019.

First, the Coalition’s unexpected victory in the federal election means there will be no changes to negative gearing and the capital gains tax discount.

The election of a Labor government usually contributes to higher Canberra property prices due to the expectation of more public sector jobs. But Labor’s proposed tax changes were aimed at improving housing affordability and were likely to push prices down a bit further, so the Coalition’s surprise win will contribute to prices stabilising.

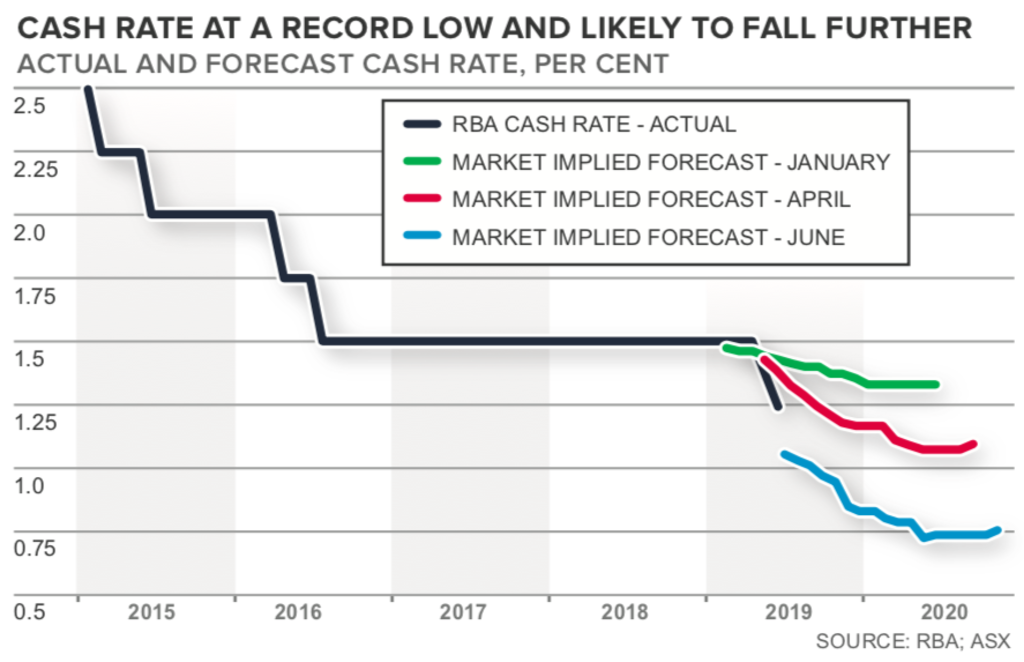

Second, the Reserve Bank cut the official cash rate to a record low of 1.25 per cent at its June meeting. And it’s not stopping there, with the central bank strongly hinting that it will be cutting rates further.

The financial markets are predicting a further two cash rate cuts by early 2020 (see graph). As a result, most owner-occupiers will be paying an interest rate of less than 3.5 per cent on their home loan by early 2020.

While falling interest rates are a sign of a weakening Australian economy, lower interest rates will provide support to property prices. Lower interest rates help people pay off their mortgage and give people more disposable income, make it easier to get a home loan, and will encourage some investors back into the market.

Third, the banking regulator is removing the requirement for banks to assess a borrower’s ability to repay a loan at a mortgage rate of at least 7 per cent. Instead, banks will be required to use an assessment rate of 2.5 percentage points above the offered rate.

In combination with lower interest rates, these changes will effectively mean the maximum amount an applicant will be able to borrow will increase by about 15 per cent compared to early 2019. But these changes won’t send Canberra prices skyrocketing as banks continue to lend cautiously and households are wary about taking on more debt.

The final change is the federal government’s proposed first-home loan deposit scheme. This initiative will enable first-home buyers with a small deposit to buy a home earlier.

A buyer with a deposit as low as 5 per cent will be able to use the government as guarantor, which means they will avoid having to pay lender’s mortgage insurance.

While this policy will do little to improve overall affordability, it may provide a small boost to the lower end of the Canberra market.

These big changes over the past few weeks suggest a bottoming-out of the Canberra market in 2019 is now more likely, but of course, nothing is guaranteed.

- Trent Wiltshire is an economist at Domain Group. Tweet your questions to @trent_wiltshire.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More