Hobart housing affordability is as bad as Sydney's: NHFIC

Low-income earners in Hobart are unable to buy or rent the majority of properties on the market with the housing affordability crisis on par with some of the country’s most-expensive cities, new research reveals.

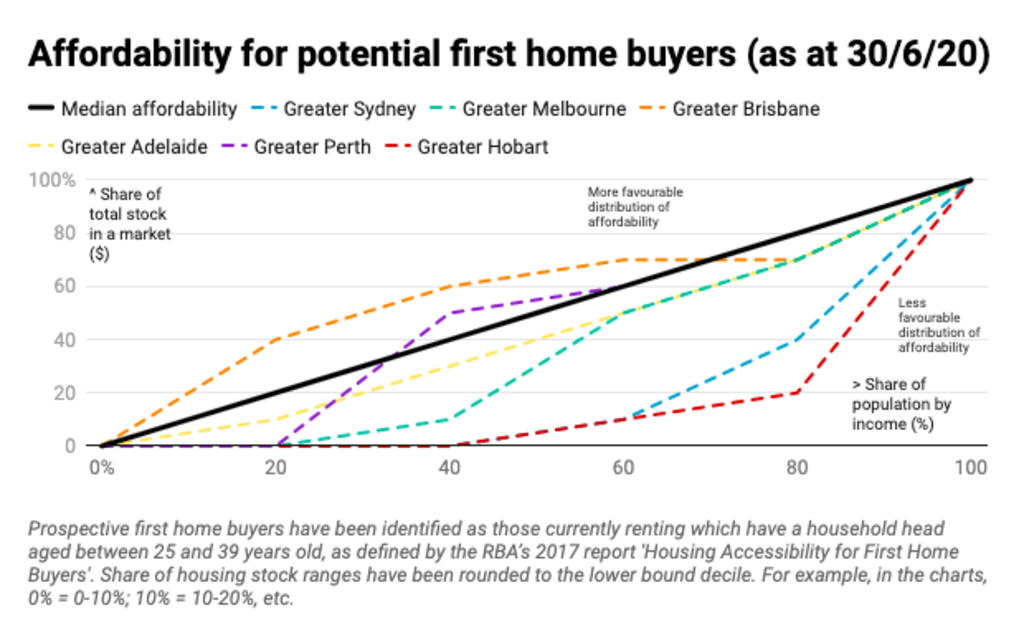

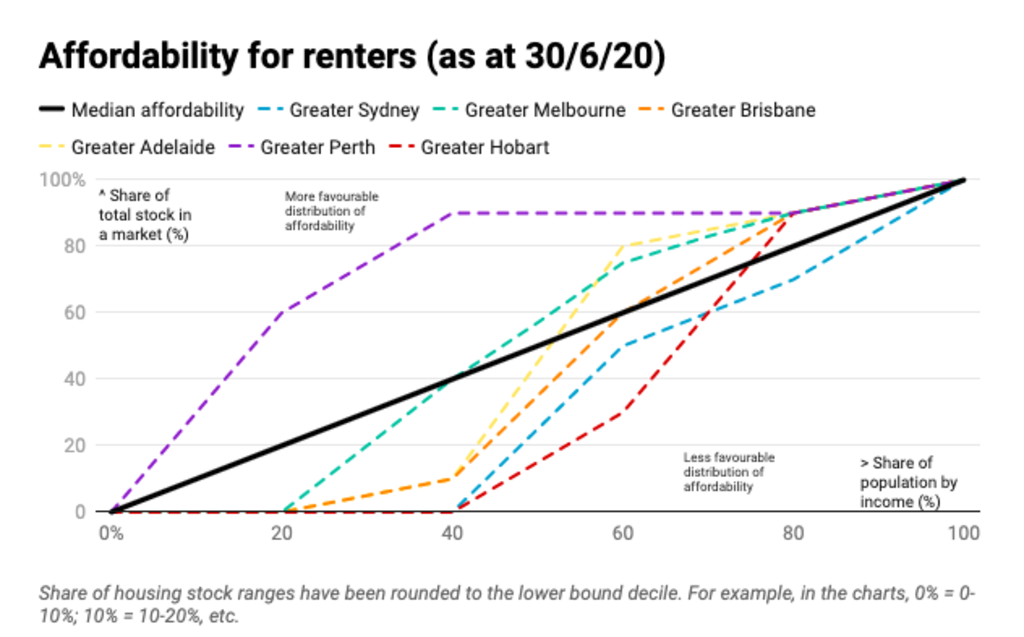

The bottom 40 per cent of income earners in Hobart and Sydney are unable to afford to buy or rent 90 per cent of properties in either markets, according to the National Housing Finance Investment Corporation.

Potential first-home buyers who earn slightly more money are not much better off — even the bottom 60 per cent of income earners are only able to afford to buy just 10-20 per cent of properties.

NIFIC head of research Hugh Hartigan said the cost of housing in Hobart and Sydney was tough for low-income earners.

“Clearly what we’re seeing in places like Sydney and Hobart, the bottom income earners can afford a very small proportion of rentals, if any at all, at the moment,” he said.

“Cities like Hobart that were once considered affordable are becoming increasingly unaffordable for renters and first-home buyers.”

It was hard to fathom that Hobart renters and prospective first-home buyers faced a housing affordability crisis on a similar scale to those in an international city like Sydney, says independent, Tasmanian-based economist Saul Eslake.

“It is a big social problem, which is coming up in our current state election,” Mr Eslake said. “It’s one that, if not addressed, will become an economic problem.

“If people are thinking about moving to Tasmania and think ‘I can’t afford to buy a house here there’, there will be a loss of economic momentum.”

While this data was a snapshot of June 2020, Mr Eslake said there was a risk the situation had since worsened since and homelessness was likely more widespread in the face of rapidly rising house prices this year.

The most affordable city for renters is Perth, where the bottom 40 per cent of income earners can afford to pay for about 90-100 per cent of rental properties in the market.

The most affordable city for potential first-home buyers is Brisbane, where the bottom 40 per cent of income earners can afford to pay off a mortgage for around 60 to 70 per cent of properties in the market.

The cost of housing was much better in other capital cities. In Perth, the bottom 40 per cent of income earners could afford nine out of 10 rental properties.

In Adelaide, the bottom 40 per cent of income earners were only able to afford 10 per cent of rental properties but this jumped to 80 per cent once tenants they were in the third quintile of earners.

The corporation, which is in charge of tracking housing affordability for the federal government, analysed whether renters and potential first-home buyers could afford to buy or rent properties in each capital based on their income for the first time to measure whether the situation improves or deteriorates, according to Mr Hartigan.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

- © 2025, CoStar Group Inc.