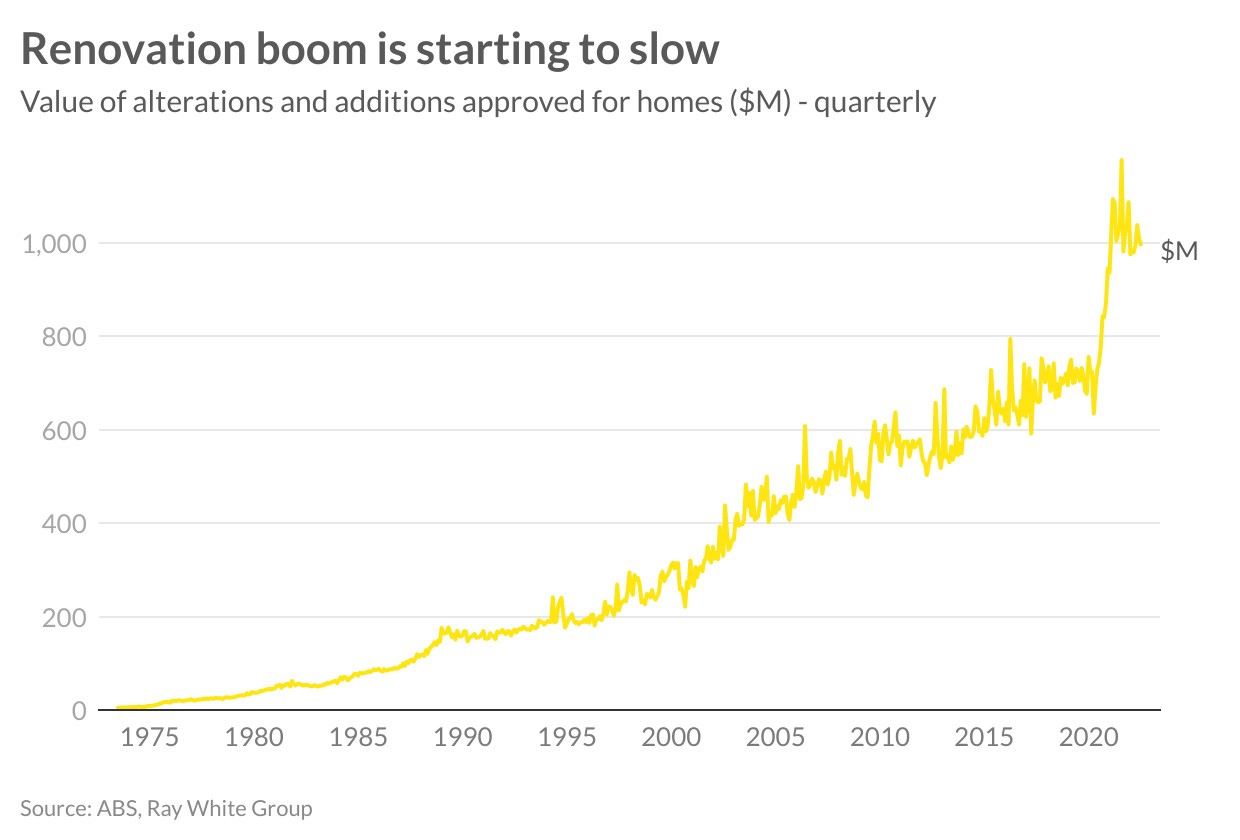

Home renovations slide as interest rates continue to rise

The rate of home renovations is slipping as interest rates rise.

The Reserve Bank of Australia on Tuesday again hiked the nation’s cash rate, this time by 0.25 points to a nine-year high of 2.6 per cent.

The increase is the sixth consecutive since the RBA started lifting rates in May this year.

As property prices slip backwards, due in part to higher interest rates, renovating is a method for improving value.

But the ambition of adding more space or modernisation is tempering, as the cost of a renovation blows out, hand-in-hand with cash rate increases, and builders and tradies trickle to a scarce supply.

However, some homeowners will have found that even by doing nothing to their properties, prices have rocketed, Ray White economist Nerida Conisbee wrote in her weekly economic report.

“The level of renovation activity has slowed a little bit since the start of the year, driven by rising interest rates and difficulties in finding builders,” she said.

The rule of thumb that a reno will boost a property’s value by 10 per cent was challenged by Ms Conisbee.

In her report, she poured cold water on the time-honoured expectation, because no two renovations are identical.

“While spending money on your home will ideally almost always lead to a better home, the question as to how much a renovation adds to the value of your home is a far more difficult question to answer,” M Conisbee said.

“The first challenge is that it depends on how much you are spending. Renovating a bathroom will add less value than adding a second floor extension.

“Swimming pool prices vary considerably and the range in pricing for landscaping can be significant. It is too simplistic to say that a renovation will add 10 per cent to the value of the property because no two renovations are the same.

“The second challenge is that it is difficult to untangle the value add from the renovation from market conditions. If you bought a house anywhere in Australia over the past two years, you would have seen its value increase without doing anything to it at all.

“A renovation would likely have added value but it is hard to work out how much of the increase would be the renovation. The third reason is that there is potential for over capitalisation.

“Spending $500,000 on a renovation in a street where the median house price is $500,000 is unlikely to lead to a doubling of the house price as there is a cap as to how much people are prepared to pay for that street.”

Daniel Senia, managing director of First Place Building company, which specialises in first-home owner builds, said the rate rises have incited fear and quelled buyer enquiries.

“This is completely contrary to the position the RBA and government policy put us in during COVID – including the HomeBuilder grant stimulus and cash to stay home during COVID – to create spending and construction activity during 2021, which has created a yo-yoing housing market and destabilised the industry,” he said.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

- © 2025, CoStar Group Inc.

/http%3A%2F%2Fprod.static9.net.au%2Ffs%2Fe7a4f901-3fb2-476a-a7de-5e3352f9c901)