Home values fall slightly in May amid COVID-19 crisis, new figures show

Property values across Australia have fallen for the first time since June last year, as the economic impacts of the coronavirus pandemic take a toll on sales.

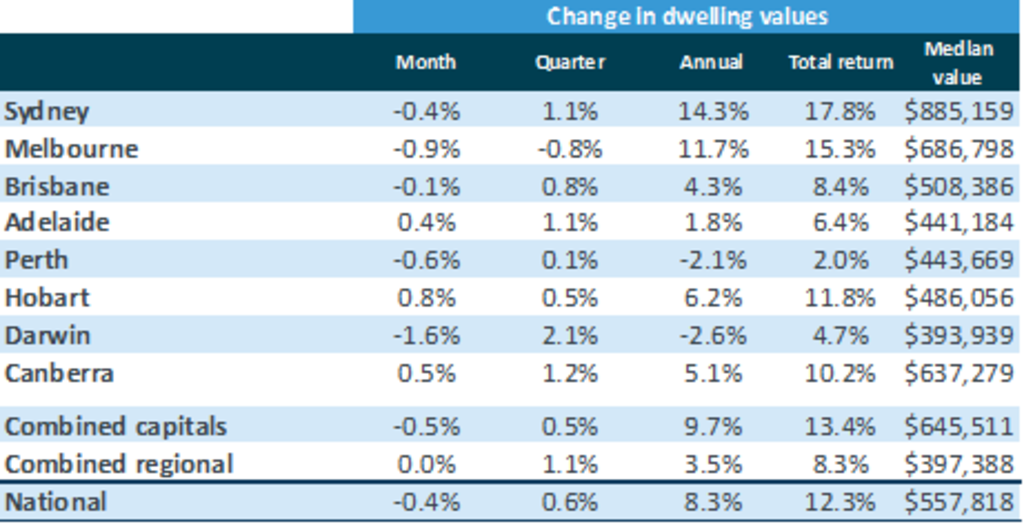

But Australia’s property market may be in for a softer landing than projected, with the latest CoreLogic Home Value Index, released on Monday, showing the combined value of houses and apartments dropped only 0.4 per cent last month to a national median price of $557,818.

CoreLogic head of research Tim Lawless said: “Considering the weak economic conditions associated with the pandemic, a fall of less than half a per cent in housing values over the month shows the market has remained resilient to a material correction.

“With restrictive policies being progressively lifted or relaxed, the downwards trajectory of housing values could be milder than first expected.”

Values fell across five of the eight capital cities in May, dropping 0.9 per cent in Melbourne to a median of $686,798, 0.4 per cent in Sydney to $885,159 and 0.1 per cent in Brisbane to $508,386.

Values also dropped 0.6 per cent in Perth to $443,669 and 1.6 per cent in Darwin to 393,939, however they were up in Adelaide, Canberra and Hobart, which had the largest gain at 0.8 per cent.

CoreLogic head of Australian research Eliza Owen said the fact the falls were only minimal was encouraging. May had been a more positive month for the real estate industry than expected, given almost 600,000 Australians had lost their jobs in April and many more had seen their work hours reduced, she said.

“Even with some cities increasing over the month, it’s clear the momentum has slowed across the capitals,” she said.

“Even though values did fall, they fell by less than half a per cent. Overall this suggests some stability in the housing market.”

Home values across regional Australia remained flat over the month, at a median of $397,388, however Ms Owen said these markets typically saw a lag in price movements.

She expected they would see more downward price pressure in the coming months.

“What we’re seeing in the listings data is that not many people are selling because not many people have to sell as a result of the banks offering mortgage pauses,” she said.

“This has left property prices more resilient to the property downturn.”

September would be a real test for the market, Ms Owen said, as that was when many mortgage holidays and Job Keeper support payments were due to run out, although she said offers by the banks for buyers to switch to or extend interest-only mortgage payments could provide a buffer.

There were still pressure points in the market, though.

Ms Owen noted the drop-off in overseas migration had left Melbourne’s housing market, which recovered from the previous downturn faster than Sydney, particularly exposed.

It was the first capital to see values falls, recording a drop of 0.3 per cent in April, and the only capital to record a decline over the three months to May, with the median dropping 0.8 per cent.

“Melbourne property values have a higher base to fall from, and it’s a relatively expensive market so it’s more exposed,” Ms Owen said. “It may be that Sydney starts to reflect steeper declines [going forward].

“The downturn in Melbourne had been led by the high end of market, with the top-quartile value of properties down by 1.3 per cent over the month. That segments of the market had a larger growth in the ramp-up before COVID-19 hit.”

By comparison, there was a 0.6 per cent drop across the middle of the Melbourne market and 0.3 per cent fall across the most affordable quartile. It was a similar case in Sydney, where the top end of the market saw a 0.6 per cent drop, while the most affordable end saw values increase 0.1 per cent.

The Core Logic figures also showed house values had fallen further than unit values, with the national medians dropping 0.4 per cent for houses and 0.2 per cent for units.

“Houses fell a little further, but there are going to be some unit markets that are worse off … I would expect to see a deeper decline in inner-city apartment markets,” Ms Owen said.

While dwelling values had fallen, sales activity bounced back 18.5 per cent in May after falling more than 30 per cent in April – but were still down 14 per cent year on year.

Overall stock levels remained low, Mr Lawless said, but agent activity was on the rise, with the number of reports generated by agents rising by around 45 per cent since the end of April, suggesting an increase in listings to come.

“Prior to Easter, real estate agent activity was tracking 60 per cent lower than at the same time a year ago. By the end of May, agent activity was only 8 per cent below a year ago.”

Domain senior research analyst Nicola Powell said the marginal movement in prices had coincided with the slowdown in transactions and she expected to see continued price weakness in the months ahead.

“It will be sometime before we see transactions at a level that we would expect for this time of year,” Dr Powell said. “We’ve seen a pullback in both sellers and buyer activity which will provide somewhat of a floor to prices.”

Dr Powell added drastic forecasts for price falls of up to 30 per cent were unlikely, but noted some micro markets within capital cities – particularly Sydney and Melbourne – would be more exposed to greater price declines.

“Sydney and Melbourne are more exposed compared to some of our other capital cities, because they typically have the most population growth … and that’s gone to zero. We’ve also got international travel which has gone as well, so lots of demand factors [for both the sales and rental market] have been taken away … and I think those markets will continue to see the most weakness,” Dr Powell said.

“Once we see mortgage pauses end, that’s the period of time when we will have the greatest exposure to price losses particularly in the upper end.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More