House prices are falling, but buyer beware of holding out for a better deal

Some property buyers are holding off in the hope of a better deal, but experts warn that trying to pick the bottom of the market has risks.

Once-booming property prices have started to fall as rising interest rates reduce the amount home buyers can borrow, and major economists are forecasting double-digit drops.

But buyers are likely to enjoy less choice as prices drop because home owners who don’t need to sell urgently might hold on to their properties until the market recovers.

Jack Henderson, director of buyers advocacy Henderson, is seeing a lot of buyers in this market hoping to wait and buy for a cheaper price.

“The biggest thing is overpaying for a property,” he said.

“They think, ‘If I buy a property today, if this exact property popped up in 12 months time, would I be able to buy it cheaper?’”

Humans fear loss more than they appreciate gains and hesitate to buy an asset that will be worth less money in the coming months, while owners hoping to sell and buy back in may worry about selling at a loss, he said.

He advises clients to focus less on what the market will be doing in a few months time and more on choosing an asset that will sell well in any market based on its location, scarcity and appeal to owner-occupiers.

As prices fall, many owners choose not to sell unless they have a compelling reason, meaning there is likely to be poorer choice available for buyers in coming months, he said.

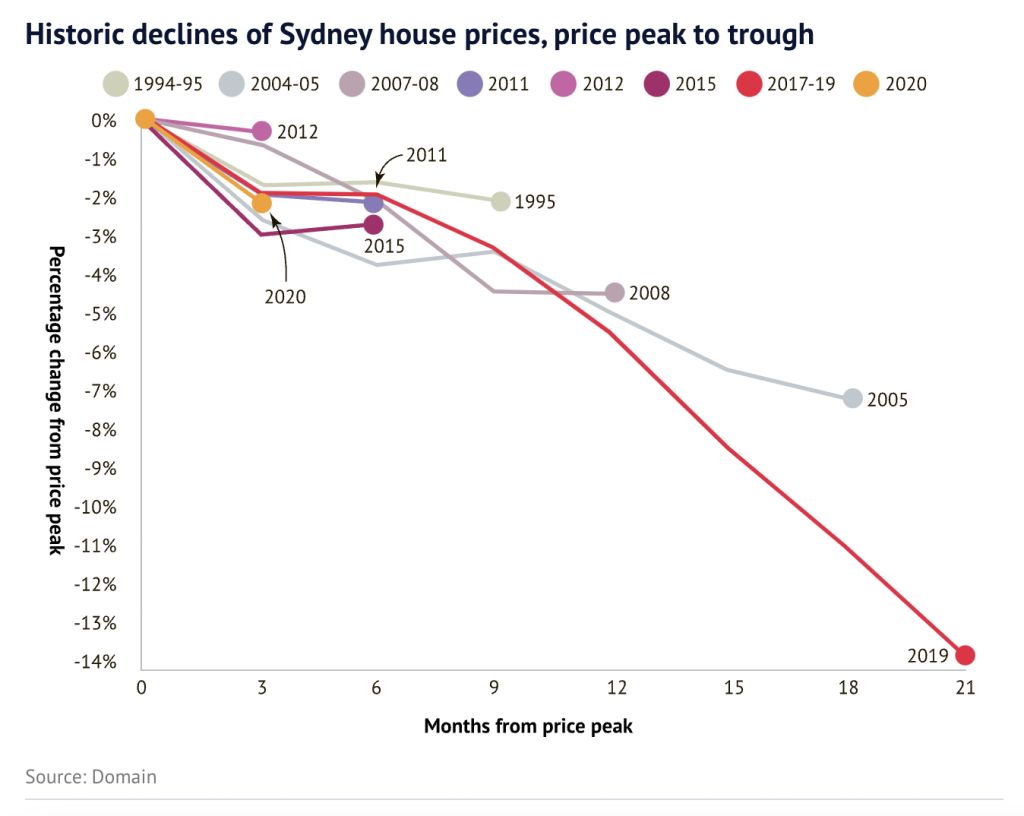

New research shows previous price downturns in Sydney have often been short, lasting 12 months or less, except for the drops in 2004-05 and 2017-19.

In past cycles, these drops have often been less than half the duration of the preceding upswing. There has also traditionally been a greater percentage increase in price than the subsequent decline, Domain’s NSW Spotlight Report, released on Thursday, found.

For example, Sydney house prices rose 62.2 per cent from 2012 to 2015, dipped 2.7 per cent that year, then added another 18 per cent to the 2017 peak, and fell 13.8 per cent in the next two years, according to Domain data.

The report also said a return to pre-pandemic prices was unlikely.

Separate research this week warned housing could become less affordable despite price falls because monthly mortgage repayments are rising.

Moody’s said if interest rates jumped to almost 3 per cent by year’s end, house prices would need to fall more than 20 per cent to improve affordability.

Rose & Jones buyers agent Stuart Jones said a lot of buyers now are in a “watch and wait” pattern and investors especially are looking for opportunities, as they think value is returning. But Jones also emphasised focusing on the asset, not the market.

“My clients are watching and waiting,” he said. “We’re very asset-driven, we’re looking for value rather than paying premiums.”

“What buyers need to do is be very clear around their strategy,” he added, suggesting they make a list of features that are “must-haves” and those that are “nice to have”.

“If a property has got as many of the must-haves as you would like, and is priced in a price band you would be happy to pay, you execute regardless of what’s going on in the market, whether it’s a rising market, a correcting market.”

In Melbourne, Wakelin Property Advisory director Jarrod McCabe said some buyers are hoping to wait for price falls, especially investors, although not as many are holding off as might be expected.

He has also seen some owner occupiers push ahead with plans, but reduce their budget with an eye on rising interest rates.

“The fear of missing out that was in existence late last year is nowhere near to the same extent that it was,” he said.

“Buyers want to buy at the bottom of the market, but no vendor wants to sell in those conditions.

“If you’re able to purchase and [the home you are after] comes up now, make sure you’re ready to do that but don’t be silly about it,” he said.

“If you’ve got a bargain-hunt mentality, chances are you’re going to miss out on a lot of properties.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More