House prices could rise 17 per cent this year, locking some first-home hopefuls out: ANZ

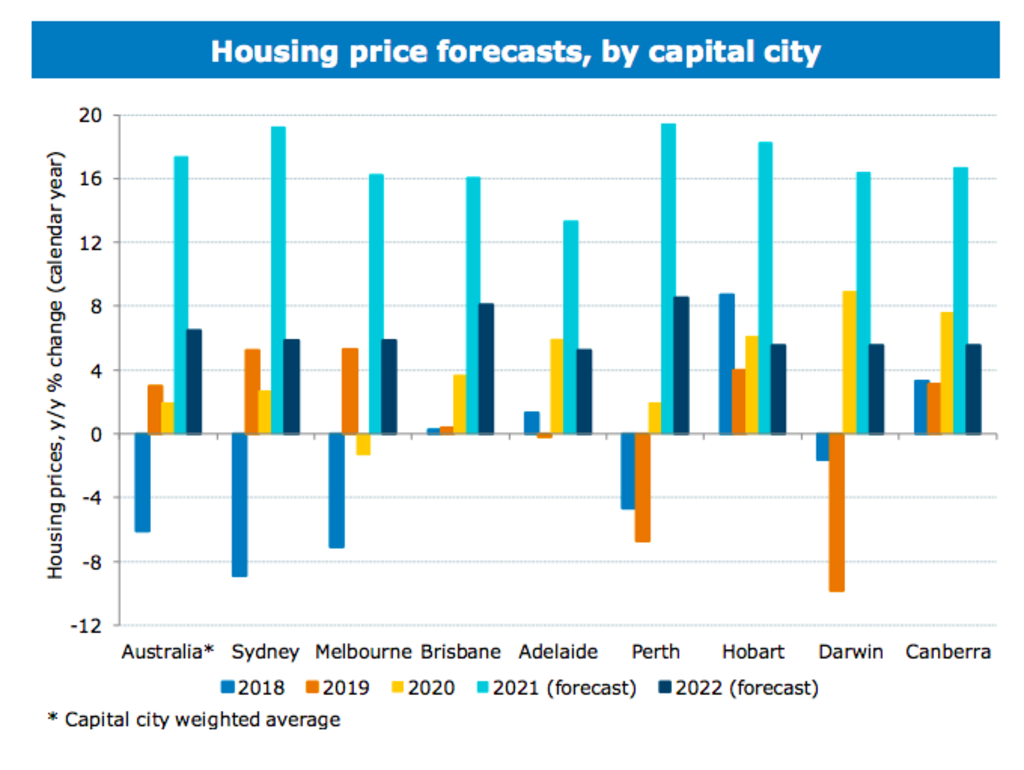

Australian housing prices are set to soar 17 per cent this year across the capital cities, a sharp rise that could lock some aspiring first-home buyers out of the market, ANZ economists have warned.

Sydney and Perth housing prices are forecast to jump 19 per cent in 2021, followed by Hobart (18 per cent), Melbourne and Brisbane (16 per cent) and Adelaide (13 per cent), the research found. ANZ previously forecast a 9 per cent national rise this year.

With banks likely to make it easier to get a home loan, the bank regulator could step in later this year and restrict borrowers from taking on too much debt compared to their incomes, which would slow price growth to 6 per cent in 2022.

The upgraded forecast comes amid a red-hot property market, with buyers offering huge sums at auction or making offers within days of homes being listed.

Ultra-low interest rates – and the expectation that rates will stay low for years – have enabled buyers to borrow more money and bid up prices.

Pent-up demand after last year’s lockdowns has fuelled the boom, with many residents looking for larger accommodation to work from home.

The latest forecast is in stark contrast to predictions made by economists this time last year that prices would fall between 10 and 20 per cent.

“What we’ve seen is a combination of quite strong demand and relatively low supply,” ANZ senior economist Felicity Emmett said.

“Clearly very low interest rates have more than offset the headwinds from higher unemployment and low population growth.

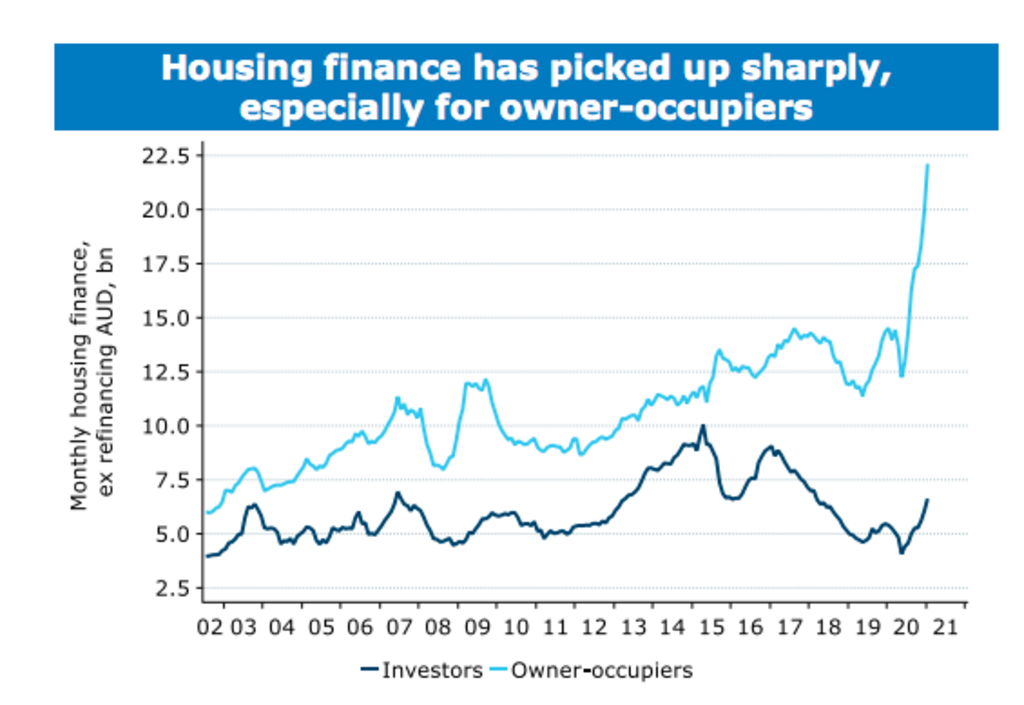

“We’ve seen housing finance really growing very strongly, very high auction clearance rates [and] very strong sentiment about house prices picking up over the next year or so and that has really pushed demand a lot higher.”

But the gains are uneven, with the unit rental market in Sydney and Melbourne remaining weak in the absence of overseas migration or a better jobs market for young workers.

Separate research from CoreLogic found the proportion of properties in the December quarter that changed hands at a profit rose to 89.9 per cent, above pre-COVID levels, but unit owners were more likely to sell at a loss than house vendors.

Only 4.4 per cent of Sydney houses sold at a loss, compared to 12.6 per cent of Sydney units.

In Melbourne, 2.5 per cent of houses sold at a loss, but 13.5 per cent of units lost money.

Pockets of the major cities recorded high levels of loss-making sales, at 31.3 per cent of all sales in Melbourne’s CBD and 21.9 per cent in Stonnington. In pockets of Sydney, such as Botany Bay, Strathfield and Parramatta, the share of sales at a loss was above 17 per cent.

Buyers have been flocking to larger houses instead of units after spending chunks of time at home last year. Owner-occupiers have driven the boom, with new loans up 80 per cent since May, although investor activity is starting to grow.

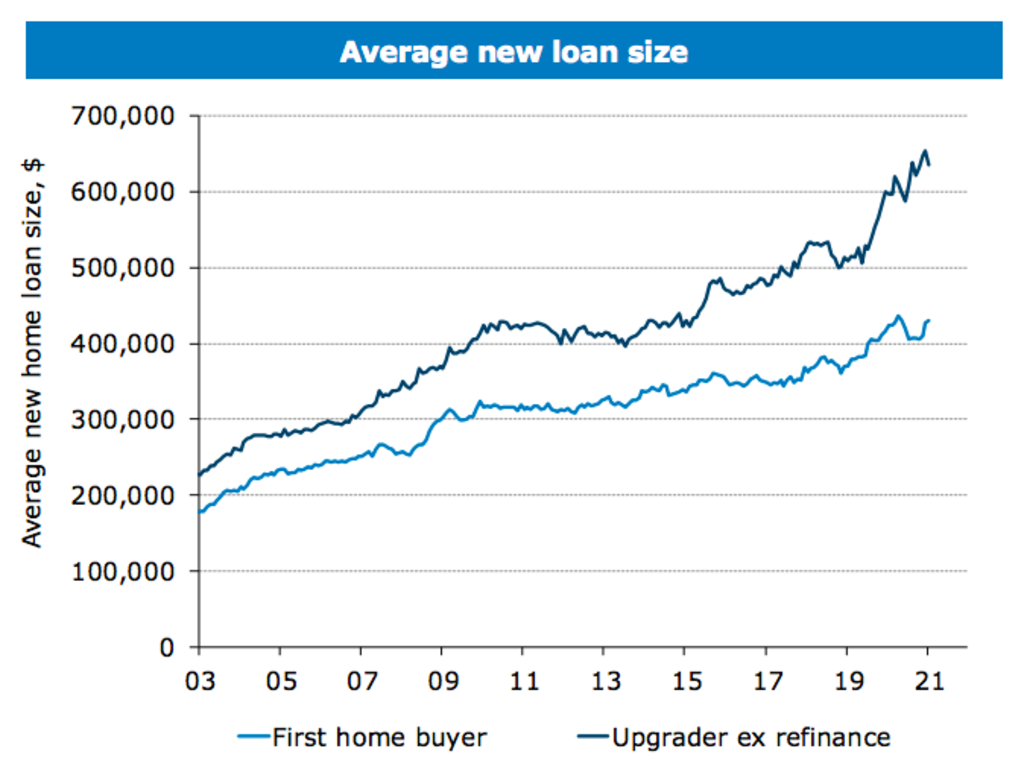

First-home buyers armed with stamp-duty discounts and cheap debt have surged into the market, reaching the highest levels since the GFC, but ANZ said policy supports were unlikely to keep pace with price gains over the medium term.

This raises the affordability problem, with first-time buyers now taking on near-peak levels of debt, and deposit affordability remaining an issue. The average first-home loan was $429,950 in January, about $1000 less than the 2019 peak but double the levels seen in 2004.

ANZ said the housing market had been helped by mortgage holidays and government stimulus payments, although a small number of borrowers had not returned to making repayments and a modest rise in arrears was likely.

With a low volume of homes for sale, buyers are feeling a fear of missing out, but ANZ said the first half of this year would be stronger than the second as fixed mortgage rates lift and government programs such as JobKeeper and HomeBuilder end.

Grattan Institute program director for household finances Brendan Coates said low interest rates were driving gains as buyers expected debt to stay cheap for some time.

The Reserve Bank has said it will keep the cash rate at an ultra-low 0.1 per cent until 2024 – despite the bank’s own research finding a permanent cut to rates of one percentage point could push house prices up 30 per cent over three years.

“Mortgage rates have fallen from 3.5 per cent to, often, 2.5 per cent for a lot of borrowers [which] means that people’s capacity to borrow has risen substantially,” Mr Coates said.

“People are more comfortable taking on more debt in the expectation they’ll be able to repay it.”

Domain senior research analyst Nicola Powell said a lack of homes for sale was sparking strong competition after last year’s lockdowns interrupted people’s plans to buy or sell.

“We have seen a rapid decline in total listings on the market – we just haven’t seen people list their homes as quickly as people are willing to purchase them,” Dr Powell said.

“This lack of stock, which is a trend across all of our cities, has created competition between buyers. They’re supported by low interest rates, leveraging more, and it’s ultimately driving up prices.”

More new listings have started to hit the market, but Dr Powell said she expected to see strong price growth until the number of homes for sale rose enough to meet the level of demand from buyers.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More