Housing market tipped to power on despite end of JobKeeper: economists

The property market is set to roll on full steam ahead despite economic support measures coming to an end from this week, defying long-held worries about a looming fiscal cliff, according to top economists.

The strength of bricks and mortar barely crumbled during the pandemic-induced recession, with property prices edging lower briefly then soaring in major cities and regional towns – flying in the face of forecasts.

At the height of the crisis last year, housing price drops of 10 to 20 per cent were predicted amid fears of a fiscal cliff in September when income support measures were due to end.

But that never happened. Instead of turning off overnight, income support measures were extended for another six months with tapered payments from October.

JobKeeper will come to an end by 28 March, while within days, JobSeeker payments are set to be reduced, bank mortgage holidays will end, and rental eviction moratoriums will stop.

Although economists acknowledge the pain to come for those who will lose work, they believe it will have little to no implications for a housing market that continues to gather pace.

EY Oceania chief economist Jo Masters said the housing market absorbed those changes well last year when house prices accelerated and the economy continued to improve.

“I actually don’t think it’s going to have a dramatic impact on house prices and the housing market. We’ve already had two step-downs in support,” Ms Masters said. “The step-down in October was bigger than the one we’re going to see at the end of this month.”

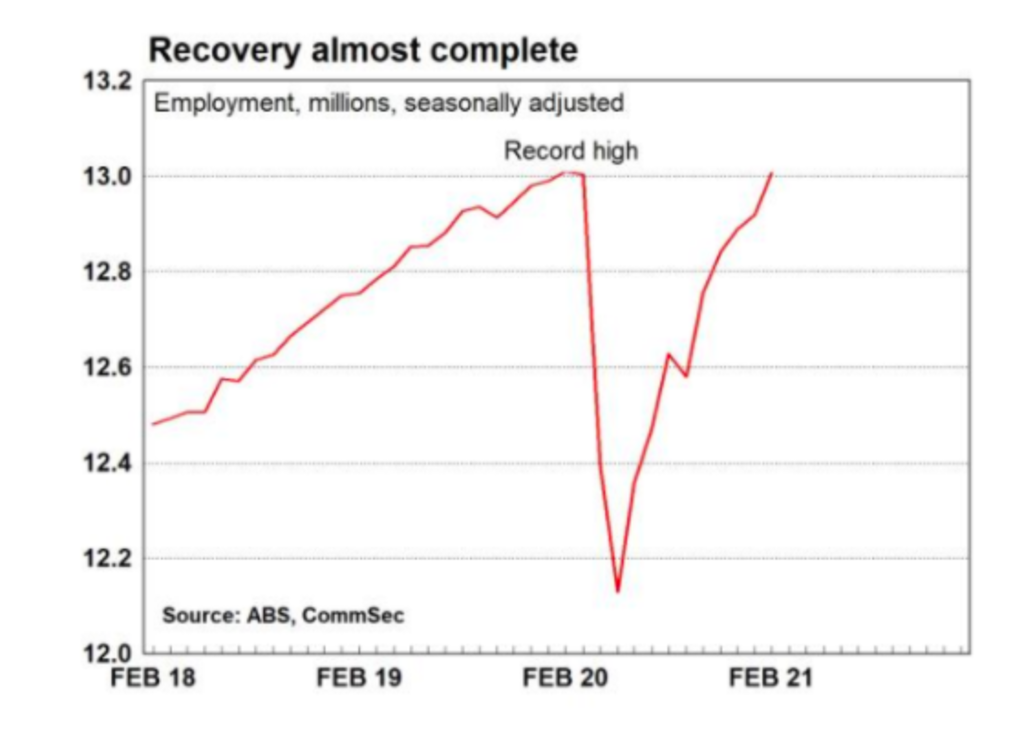

The unemployment rate has fallen to an 11-month low of 5.8 per cent, down from 6.3 per cent in February, Australian Bureau of Statistics figures show, with demand already building to allow skilled migrants into the country after the better-than-expected result.

Distressed selling from investors was also unlikely to happen, Ms Masters said, as they had survived the worst last year.

“We tightened lending standards back in 2014 and 2015,” Ms Masters said. “That’s one of the reasons we haven’t seen distressed sales. We improved lending standards and the mortgage books.”

The expiry of the wage subsidy is expected to put about 110,000 jobs at risk, but that pales in comparison to the overall strength of the economy, according to Commonwealth Bank’s head of Australian economics Gareth Aird.

“What does that mean for the housing market? We don’t think there will be any impact from the expiry of JobKeeper,” Mr Aird said.

“The concerns around the expiry [of wage support] in September were far more valid because the economy was far different.

“Back in September, there were a lot more people on JobKeeper and a lot fewer people employed. GDP and production are back at pre-COVID levels.”

Even ANZ chief executive Shayne Elliot recently said the so-called “cliff” that many feared in September last year was now a “very, very shallow cliff, if it at all”.

The only measures that would slow down the housing market’s remarkable recovery were hiking interest rates and regulators cracking down on bank lending as they did back in 2015 and 2017.

But neither is going to happen anytime soon, according to Mr Aird, who said policy-makers would welcome the lift in activity rather than choking it off as the market is driven by owner-occupiers and first-home buyers.

Some pockets around Australia face headwinds, NAB chief economist Alan Oster said, including city centres and popular travel destinations and the industries surrounding them, such as food and accommodation.

While Melbourne’s CBD and tourist locations in Queensland could be some of the hardest-hit areas, it would just slow down the recovery, Mr Oster said.

“It won’t change the outlook for the property market,” he said.

“We don’t think house prices will keep going at the current rate, but we don’t think it’s going to crash either. It might make things a bit more moderate.

“What we’ve seen so far, in terms of our credit numbers, [is] no increase in investor credit. It’s all owner-occupiers and at the bottom of the market who are moving in.”

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

- © 2025, CoStar Group Inc.