How did Canberra's property market stack up in 2018?

A different pace has emerged for the Australian housing market in 2018. Sydney and Melbourne have felt the brunt of the property market slowdown, however most of our capital cities markets haven’t remained unscathed.

As history proves, housing markets are cyclical in nature. They tend to exist for roughly seven years, although Australian housing cycles have been occurring at a greater frequency than this and the imminent downturn shouldn’t come as a surprise given the bullish Sydney and Melbourne run in price growth.

Australia’s six-year low unemployment rate, strong population growth and continued economic expansion suggests the price declines, particularly in Sydney and Melbourne, have been driven by deliberate efforts to tighten credit availability. This is uncharted territory for an Australian housing downturn, with prior slowdowns tending to coincide with increasing rates from the Reserve Bank.

House prices in the nation’s capital have bucked this trend. Prices may still be rising, though the pace of growth has eased to less than half of what was recorded last year – a marked difference from the peak of the current price cycle when double-digit growth was achieved in early 2017.

Forecasts suggest that Canberra will close the year recording annual growth, although the pace will continue to slide.

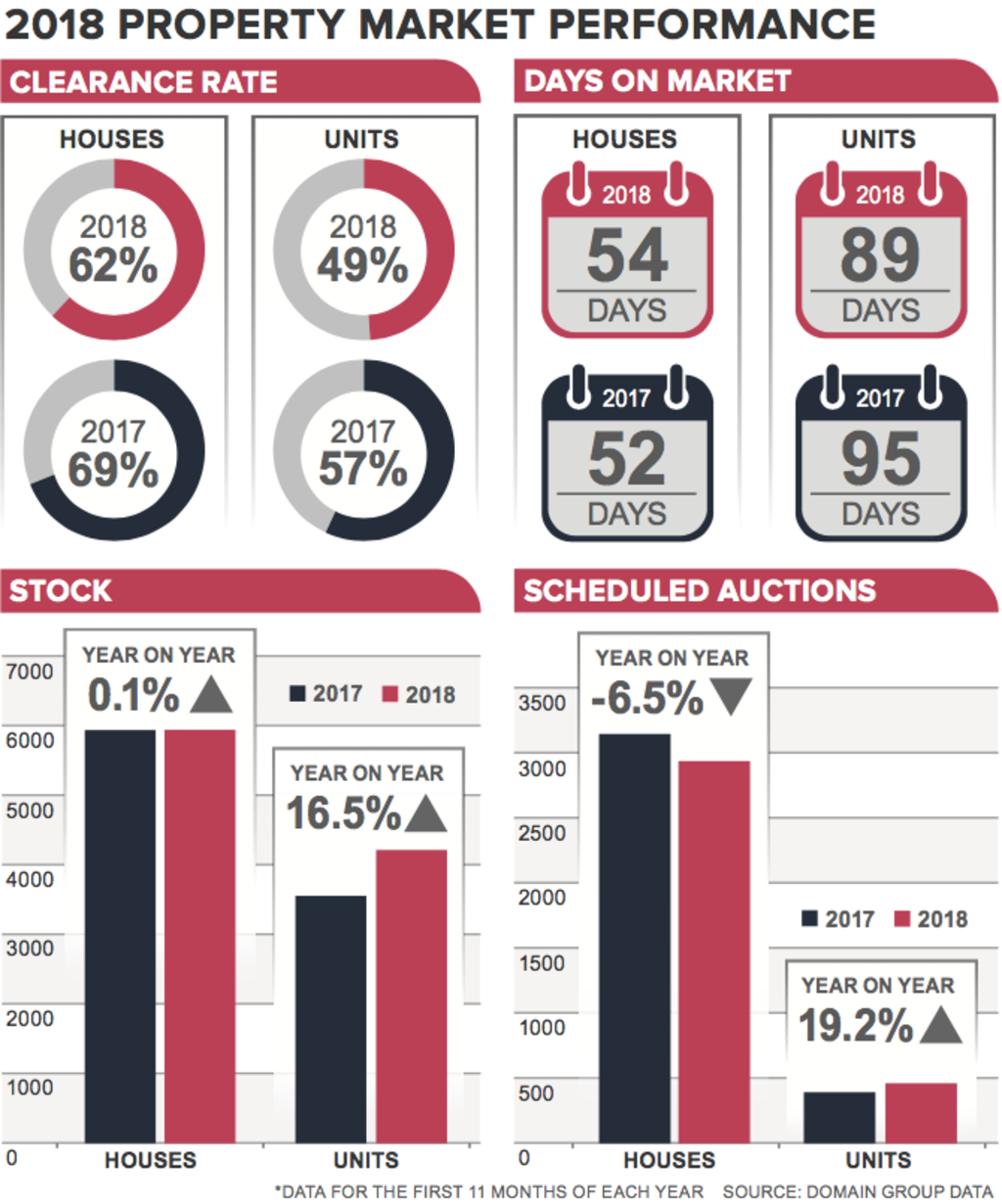

Other market indicators also illustrate the reduced buyer demand in the Canberra market – houses are taking marginally longer to sell, spending 54 days on the market, two days longer compared to 2017.

The buoyant auction market has also been impacted with clearance rates for houses declining from 69 per cent in 2017 to 62 per cent in 2018, together with fewer vendors opting to sell by auction. That stock levels have nudged marginally higher indicates fewer buyers are active.

It is important to note that Canberra home owners have reaped the benefit of six consecutive years of house price growth – an upswing supported by flowing housing finance and rising purchasing activity, sparked by low and falling interest rates.

There is an intrinsic connection between the performance of the housing market and the availability of credit, but political cycles can add another dimension of complexity in Canberra.

Credit availability has been the catalyst of the current slowdown in price and buyer activity. The change in the lending environment has progressed steadily over the past few years, with tightening of credit and improved credit quality that initially targeted investors.

- Related article: Canberra property forecast shows modest growth over 2019-20

- Related article: Low-income households in Canberra face second-least affordable rents

- Related article: ‘A high cost for liveability in ACT’: The most affordable suburbs in the capital

The year-long public inquiry into banking misconduct has prompted lenders to reduce their credit growth and place a heightened level of scrutiny towards borrowers, which have impacted the broader market. Both owner-occupiers and investors are now faced with rising mortgage rates, tighter credit conditions, and reduced borrowing power.

But the future prospects for Canberra remain positive.

New residents have and will continue to be lured to the capital, with interstate buyers attracted by greater affordability, growing job prospects, a higher average wage than neighbouring state capitals and a family-friendly lifestyle.

As the population continues to swell, it will support the future demand for housing. Although, given the lending environment, the price cycle will be one of more moderate growth as borrowers face more restrictive lending as a result of regulatory intervention and what has been a bruising royal commission into banking.

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More