How does the result of the federal election affect Canberra's housing market?

Prospective first-home buyers have been thrown a number of lifelines from the election result. They may have to wait for the scheme to come to fruition, but ultimately the initiatives should make the journey to home ownership an easier one.

That said, it is subject to opinion whether financially driven schemes are the best approach to help aspiring home owners. Affordability can be addressed through other avenues, such as altering planning rules to help boost housing supply.

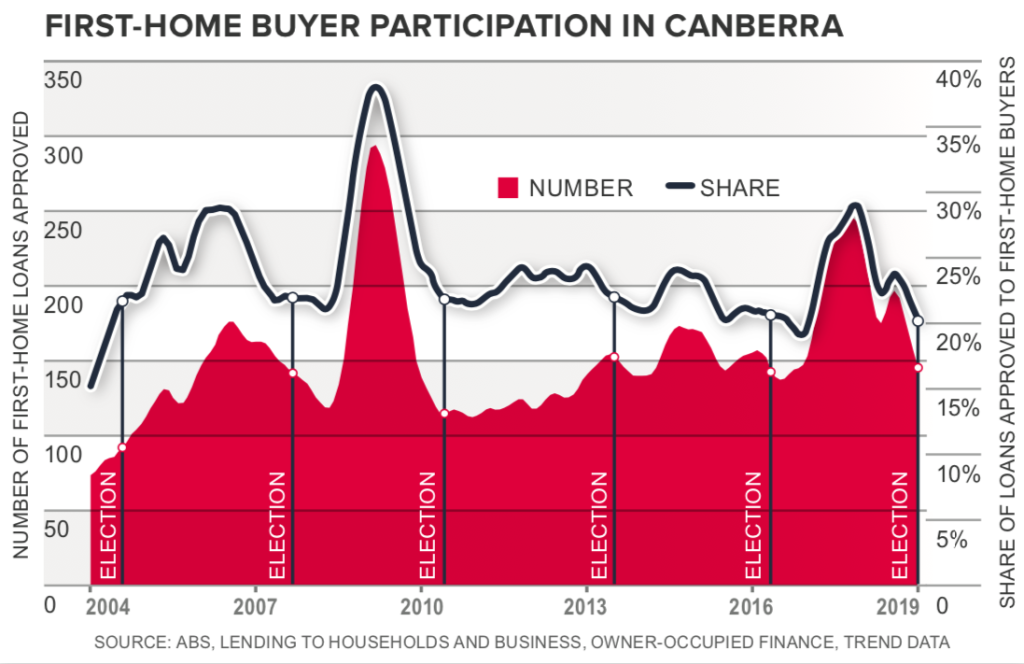

The government has a long history of using policy to address home ownership. In 2000, John Howard reintroduced a first-home owners’ grant, and in 2008 this was temporarily boosted by the Rudd government to help first-home buyers through the global financial crisis. This created Canberra’s biggest surge in first-home buyer numbers and that trend was echoed across Australia.

Arguably the biggest hurdle to home ownership is saving the lump sum deposit. It takes on average four years and 10 months to acquire a 20 per cent deposit on an entry-level Canberra house and three years and two months for a unit – double this time if you aim to make the purchase on your own.

Will the federal government’s first-home buyer policy actually work? Qualifying first home buyers will need as little as a 5 per cent deposit, with the additional amount to reach 20 per cent guaranteed under the scheme. Not only does this save thousands of dollars on costly lenders’ mortgage insurance, purchases can be made sooner.

The scheme is capped at 10,000 which accounted for roughly one in 10 first home buyers last year. Since it accounts for a small segment of first-home buyers, the impact on market activity is likely to be marginal compared to an uncapped policy.

If the numbers were bottomless, it would create heightened demand and if unsupported by an increase in affordable housing, it is likely to support price growth at the lower end of the market.

The policy does come with risk.

Any first-home borrower utilising this scheme with less than a 20 per cent deposit could commit to paying too much interest over the lifespan of the loan, and place themselves at risk of over-extending. It may encourage also first-home buyers with little-to-no established credit history to take on debt with a high loan-to-value ratio.

- Related: How new developments influence the Canberra property market

- Related: How many politicians own property in Canberra and where?

- Related: Canberra suburbs with the strongest house price growth over five years

This is of particular concern in areas that have seen price falls – sparking the added risk of negative equity.

Many first-home buyers will already have the 5 per cent deposit but may not be able to access the scheme.

Some may struggle to afford a loan based on banking regulations, considering the assessment benchmark for a borrower’s capacity to service a home loan sits higher than current mortgage rates – a change introduced in late-2014 forming a suite of measures aimed at reinforcing residential lending standards.

However, another silver lining has been added to the property market with APRA, the banking regulator, announcing its plans to scale back the assessment rate for home loans, allowing banks to review and set their own serviceability assessment rate.

Coupled with the Reserve Bank providing strong indication they are poised to cut interest rates next month, these changes are likely to support market activity, with some buyers taking advantage of their increased borrowing capacity.

- Dr Nicola Powell is a senior research analyst at Domain Group. Tweet your questions to @DocNicolaPowell.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More