How first home buyers can get help to spend $100,000 more at auction

Forty thousand more first home buyers and single parents can now purchase a home with a minimal deposit under an expanded scheme that experts say will prop up prices.

Aspiring home owners can get into the market sooner, and purchase more expensive homes with a smaller deposit, under the federal government’s expanded Home Guarantee Scheme and increased property price caps that start on Friday.

The large increase in loan guarantees, which waive the need for costly lenders mortgage insurance, is expected to boost first home buyer demand and could limit price declines for more affordable homes amid the market downturn, experts say.

“It may put a bit of a floor under prices,” said AMP Capital chief economist Dr Shane Oliver.

“The problem with [such a scheme is] it adds to demand; those who get in at the start probably get some benefit but for the average first home buyer it only pushes up prices.

“It would be far better for first home buyers if … we weren’t artificially propping [the market] up.”

However, Oliver said interest rate rises would have a larger impact on first home buyer demand, with the scheme unlikely to offset the impact of higher interest rates, affordability constraints and depressed buyer confidence.

“We might see a spike in first home buyers in the next three months because of the expanded scheme, but I don’t think they’ll come back in a big way until prices are lower,” he said.

He added the cooling market could also reduce appetite for the scheme, as taking on a larger mortgage increased the risk of falling into negative equity as property prices fall.

Under the expanded scheme, 35,000 first home buyers per year can now purchase a new or existing home with as little as 5 per cent deposit, up from 20,000 first home buyers last financial year.

Another 5000 single parents looking to enter or re-enter the property market will be able to buy with a 2 per cent deposit, via the Family Home Guarantee, which was expanded from 10,000 places over four years.

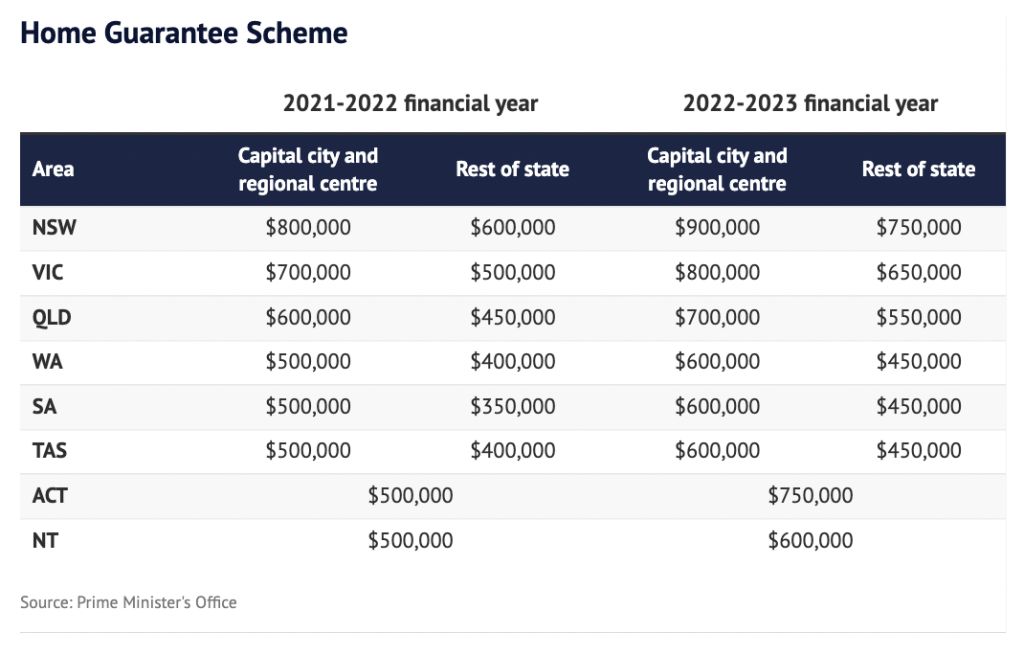

Price caps for eligible properties have also increased, from $50,000 to as much as $250,000 depending on the region, resulting in a maximum purchase price of $900,000 in Sydney. Price caps in both the NSW and Victorian capitals increased $100,000.

A further 10,000 loan guarantees for those in regional areas and a shared equity scheme, proposed by Labor in the lead up to the election, will not be available until early next year.

It comes as NAB on Thursday cut its property price forecasts, and now expects Sydney prices to fall 8.8 per cent this year and 13.4 per cent next year, and Melbourne to fall 7.7 per cent this year and 14.1 per cent next year.

Barrenjoey chief economist Jo Masters also expected the scheme to support prices at the lower end of the market.

“As a policy, like many of the fixes we’ve tried over the last few years, it does put additional money into the hands of first home buyers and when you give them more money that typically drives up demand and prices,” she said.

However rather than adding to prices, as was seen in a rising market, the scheme would likely moderate the price falls seen for first home buyer properties, Master said. She noted it would have less impact on prices than stamp duty exemptions and concessions and cash grants.

With consumer confidence at levels typically associated with a recession, higher interest rates, and declining property prices, she expected to see reduced demand for the loan scheme. Some of this would be offset by very low unemployment, increasing wage growth and the fact that rates were still at historically low levels.

Grattan Institute economic policy program director Brendan Coates expected the scheme would have some upward impact on buyer demand and prices. However, he too said this would be small compared to the toll rising interest rates were taking on buyer demand.

“It will have some impact because you are bringing forward home purchases … and somewhere between one in two and one in three first home buyers in Australia each year [could get a place in the expanded scheme],” he said.

However, with forecasts for sizeable price falls, Coates suspected more first home buyers would hold back and expected the take-up of the scheme may be stronger next year, when prices had pulled back.

Increased price caps for eligible properties also meant demand would be less focused on particular price points, he added.

Housing minister Julie Collins said the expanded guarantee scheme would help thousands more Australians into homeownership, but noted it was part of a larger suite of policies focused on addressing housing affordability, including a council on housing supply and a national homelessness plan.

“These policies include the Housing Australia Future Fund, which will build 30,000 social and affordable housing properties nationally in its first five years,” she said.

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More