How much will interest rate cuts impact you? Not as much as you might be hoping for

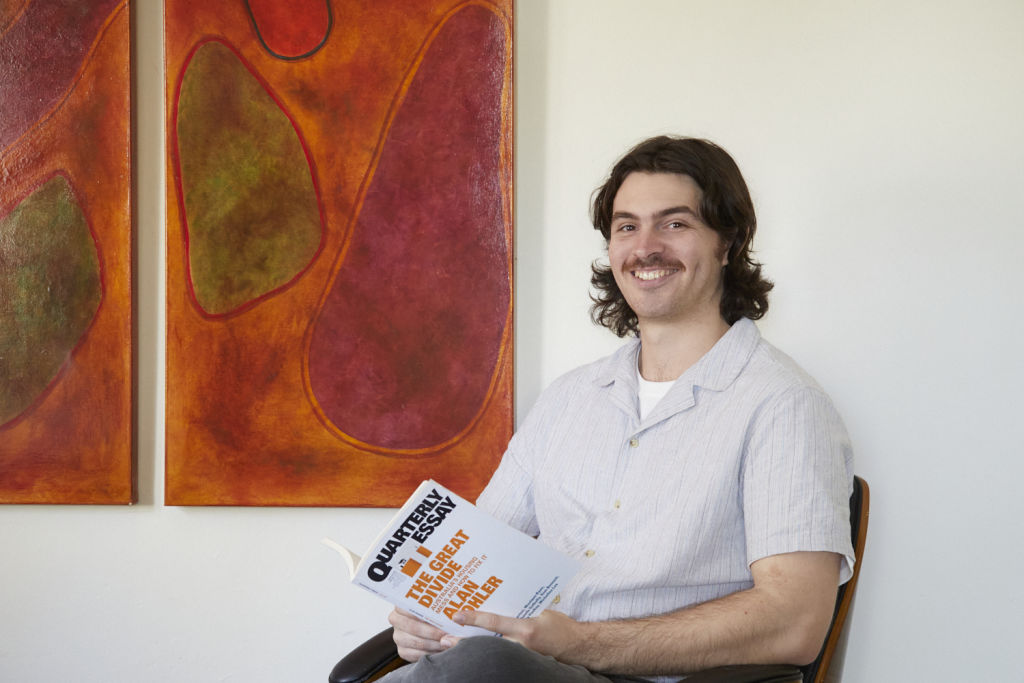

Sydney resident Jack Dona hears and reads about interest rates a lot. On TV, on the radio, online, at work … it is an ongoing national conversation that is difficult to avoid.

But he finds it difficult to identify with because, as someone who rents, he does not believe any cash rate cuts – whenever they end up coming – will bring him any financial relief.

When interest rates went up, his rent got put up. His expectations of the same happening in reverse are low to nil.

“I don’t really expect [interest rate cuts] to help too much,” he says. “Landlords are not going to pass the cuts.

“Each time I get a rent increase, the real estate agency will say something along the lines of, ‘sorry, due to increased costs, your rent is going up’, but I don’t expect them to send me the same email telling me costs have gone back down. No doubt, we aren’t getting a rent reduction.”

When the cash rate began to increase from 0.1 per cent in April 2022, the banks immediately passed the rate rises to their customers on variable-rate home loans.

With each rate rise, the pressure to maintain household costs built and for many investors, a trickle-down effect down came to pass. Quickly, thousands of tenants across Australia found themselves with notice of significant rent increases.

The cash rate has been on hold at 4.35 per cent since November 2023.

Many experts, including banks, speculate that the RBA will begin to cut rates in 2025, which has given mortgage holders hope for some financial relief going forward.

But a few cuts to the cash rate won’t be the magic bullet solution households are hoping for, says PRD real estate chief economist Dr Diaswati Mardiasmo

“People put a lot of emphasis on it, and a lot of expectations, like, it [would] solve everyone’s problems. And that’s not the case,” she says.

“There’s no guarantee that every bank will also cut their interest rates.”

A significant problem many Australians – both renters and homeowners – have faced is high inflation over the past two years, which has translated into soaring costs including food, insurance, petrol, public transport, clothes and utilities.

“Inflation touches everyone in a way that interest rates don’t necessarily, and that’s renters and mortgage holders alike,” says Sean Langcake, head of macroeconomic forecasting at BIS Oxford Economics.

The Reserve Bank monitors and keeps inflation down, and it does that by increasing the cash rate to lower people’s spending capabilities.

“An important thing to bear in mind is that when the cash rate is lowered, that will only happen at a time when inflation is lower as well,” Langcake says. “It’s going to be quite a while before you start to see interest rate cuts helping people out.”

While Langcake says the impact of any cash rate cuts will be negligible, Peter Tulip, chief economist for the Centre For Independent Studies, says it very much depends on how long someone has owned their home.

People who have recently bought and have higher levels of mortgage debt are more likely to feel relief from cash rate cuts than those who bought 10 to 30 years ago or paid off almost all their mortgage, he says.

“The effect of mortgage rates on the cost of living depends a lot on when you bought your house.

“For people that have been in their house a long time, the cash rate may not be the most important thing in their budget, but for new home buyers, it will probably overwhelm everything else now,” he says.

While a lower cash rate may not immediately put more cash in renters pockets, Domain chief of research and economics Dr Nicola Powell says it could increase their borrowing power when they can buy, or for those with a mortgage, when they need to refinance.

“If you see the serviceability buffer being moved back to 2.5 [percentage points] or we see a cash rate cut, that could be a bit of a game changer because it might mean that some people can get the finance they need,” she says.

“I don’t think that will come with one rate cut. We will need a couple … to have an increased borrowing capacity.”

Fortunately, many economists and banks believe multiple cuts could be on the cards for next year.

| Sep 24 | Dec 24 | Mar 25 | Jun 25 | Sep 25 | Dec 25 | Mar 26 | Jun 26 | Sep 26 | Dec 26 | |

| Westpac | 4.35% | 4.35% | 4.10% | 3.85% | 3.60% | 3.35% | 3.35% | 3.35% | 3.35% | 3.35% |

| NAB | 4.35% | 4.35% | 4.35% | 4.10% | 3.85% | 3.60% | 3.35% | 3.10% | 3.10% | 3.10% |

| CommBank | 4.35% | 4.10% | 3.85% | 3.60% | 3.35% | 3.10% | N/A | N/A | N/A | N/A |

For Dona, some of the most significant expenses he has experienced have been utility and food costs.

“Utilities was a big one for me. Our utility prices went up a lot. Food, that’s a huge cost. Prices for either food or utilities will not go back down, [even] if they cut the cash rate and if they do, I’m guessing they’re still going to be higher than the pre-pandemic or pre-RBA rate rise prices,” he says.

Even if the cash rate cut helps with borrowing capacity, Dona believes the bigger issue is that property prices are growing much faster than wages.

“Growing property prices, for me, is the big issue because if you cut the cash rate down by a little bit, you’ll have this tiny, cream-of-the-crop group of people who’ll be able to afford to get in and buy a house. Once they buy, the price is going to go up because the supply has shrunk, and it’ll be gate-kept for the next cohort of people who could potentially afford it,” says Dona.

“We’re all f***ed,” he says. “I think I’ll only be able to own property as a result of my parents passing away.”

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More

- © 2025, CoStar Group Inc.