How will stage three tax cuts confirmed in the federal budget affect home buyers?

Stage three tax cuts were confirmed in Labor’s federal budget yesterday, with Aussies set to gain more from their pay packets from July 2024.

So what does this mean for the property market? Specifically home buyers and their borrowing capacity?

The new cuts will see the 37 per cent marginal tax bracket scrapped, and the 32.5 per cent marginal tax bracket lowered to 30 per cent.

The government will also increase the threshold for the 45 per cent marginal tax rate. This means that Aussies earning between $45,000 to $200,000 will pay the same 30 per cent tax rate.

Currently, those that make up to $18,000-per-year pay no tax, those that earn between $18,001 and $45,000 have a 19 per cent tax rate, and those that make between $45,001 and $120,000 pay 32.5 per cent in tax.

Aussies that earn between $120,000 and $180,000 pay 37 per cent in tax, and those that make $180,000 or above pay 45 per cent in tax.

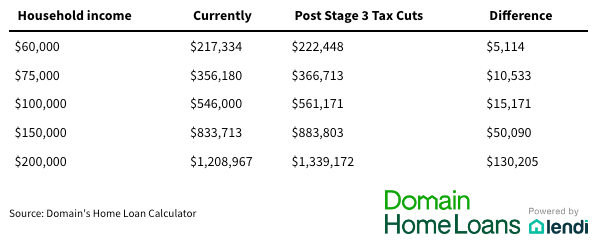

Domain’s latest analysis shows that while everyone will benefit from stage three tax cuts, higher income earners will come out on top and will have more choice in suburbs where they can afford to buy a home.

Domain’s Chief of Research and Economics, Dr Nicola Powell, tells Nine that “largely the take home is that everyone will be better off in terms of improving their borrowing power.

“However, that change in borrowing capacity does vary depending upon what income bracket you’re in. Largely speaking, the higher your income, the greater your borrowing capacity will improve.”

Put quite simply, higher income earners will be able to borrow more dollars, rebuild some of the borrowing capacity that has been lost, and look at other suburbs in which to buy a home.

“An increase in borrowing capacity opens up slightly more suburbs in which you can afford to purchase as it opens up different price points,” says Dr Powell.

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More