Interest rate hikes: How an RBA increase would affect your mortgage repayment

The Reserve Bank kept rates on hold this month, but experts are increasingly pointing to rate hikes in the near future. For Australia’s indebted property owners this could mean paying hundreds of dollars more in repayments every month.

But now the market is at a tipping point. Experts are predicting significant interest rate hikes, and they have the potential to hit hard – particularly for speculative property owners who over-extended themselves during the boom.

Those who haven’t factored in rate rises to their household budget could see themselves in hot water, suddenly needing to find hundreds of dollars extra a month.

Ex-RBA board memberJohn Edwards recently predicted eight rises in the official cash rate in the next two years to bring the official cash rate to 3.5 per cent from the current 1.5 per cent.

Thankfully, most lenders currently assess borrowers against a minimum rate of 7.3 per cent – about 3 per cent higher than most applicants’ rates – to ensure they can afford a loan if rates moved, Mortgage Choice chief executive John Flavell said.

“While some borrowers may find themselves in ‘mortgage stress’ after a few rate increases, for others, rates would have to increase significantly before they start to feel uncomfortable,” he said.

Their research found a third of Australians said they’d need to see rates jump by “at least 2 per cent” for a considerable impact to be felt.

- Related: Half NSW mortgagees concerned about repayments

- Related: Repayments to get more expensive: forecast

- Related: Houses not more unaffordable, but are riskier

For someone with a modest $300,000 loan, repayments could jump by $366 a month if rates moved from 4 per cent to 6 per cent.

On a much larger loan of $1 million repayments would be $1220 more expensive in the same scenario.

Property Investment Professionals Australia chairman Ben Kingsley warned that some borrowers may have only factored in interest rates peaking at 6 per cent, which would leave them at risk of mortgage stress.

“Given the current levels of household debt, I have no doubt in my mind that if the vast majority of borrowers were paying interest around the 7.25 per cent, we would have a significant uplift in mortgage stress, unless the economy was booming, unemployment was low and real wage growth was flowing through to households.”

The more likely scenario is a 1 per cent rise in interest rates, which would see an economic slowdown due to households spending less, he said.

“This would limit the RBA’s ability to lift rates higher from this point, again unless the broader economy is firing.”

He recommended borrowers put extra savings into an offset account or into their mortgage while rates were low. This would provide a “buffer” for unexpected events – preferably enough to cover six months of repayments.

Borrowers could also consider fixing all, or part, of their loan, but this would restrict the amount extra that can be repaid and break costs could be expensive, he said.

Dream Financial senior advisor Paul Bevan warned that anything higher than a 7.25 per cent rate for mortgage repayments would cause “concerns” for borrowers.

A borrower with a $400,000 mortgage facing a rise from 4.25 per cent to 7.5 per cent would face an additional $10,000 a year in repayments.

“That’s almost $20,000 extra income they would need to earn to maintain there current standard of living and I’m not seeing many employers handing out $10,000 a year wage rises to their staff at the moment,” Mr Bevan said.

His clients are predominantly opting to fix half their loans.

Despite this, NAB chief economist Alan Oster was also not convinced the RBA would hike rates quickly enough to cause significant mortgage stress.

“The balance sheet is robust, 60 per cent of loans are variable, and [most are] 2.5 to 3 years in advance of where they need to be [in terms of repayments],” he said.

“If you’re worried about a bubble the last thing you’re going to do is put up rates,” he said.

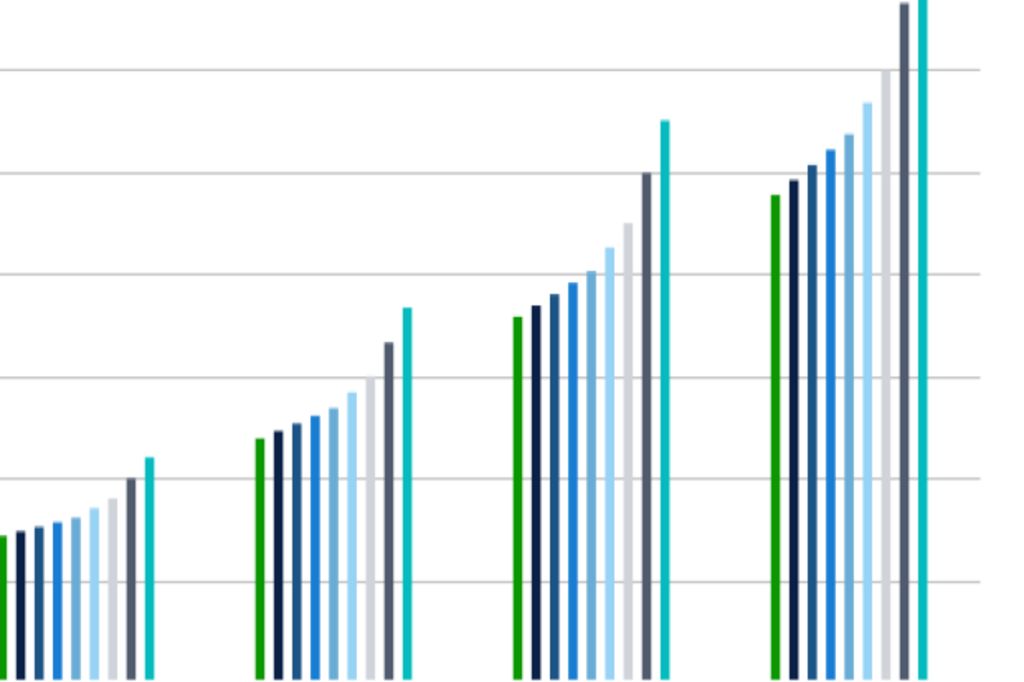

Mortgage repayments are now actually lower than they were five years ago in most states. And fewer households are facing mortgage stress, Census data shows.

This is largely thanks to low interest rates.

If these rates increased they’d quickly appear much more expensive for households, a recent report from LF Economics shows.

“The standard mortgage payment formula shows nationwide debt repayments relative to household incomes are lower today than in 1990 and the smaller peak in 2008,” the report said.

In 1990, interest rates were around 17 per cent and borrowers used half their income to repay their mortgage in 1989, compared to 35.9 per cent in 2015.

But given the “current economic climate it’s more likely that mortgage stress would be caused by factors other than rising interest rates,” Joanna Pretty, general manager for non-bank lender State Custodians said.

“Rather, the most common causes are ‘life events’ such as unemployment, marriage separation or health issues.”

How to prepare for a rate hike

- Calculate how much extra each rate increase could cost you

- Consider fixing your loan, or part of it

- Make additional repayments ahead of time as a ‘buffer’

- Reduce your expenses where possible

- Speak to your bank, broker or financial planner

We recommend

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More