Interest rate hikes sting homeowners an extra $12,000 since last year

Homeowners with an average-sized mortgage are coughing up $1000 a month extra in repayments after interest rates jumped by another quarter of a percentage point.

This thumping ninth increase in a row means Aussies with a typical home loan of about $600,000 are being stung $12,000 a year more in overall interest since the Reserve Bank of Australia started lifting rates last year – and more is expected to come.

With the nation’s official cash rate now at 3.35 per cent, the most financial tension is being felt by one particular type of homeowner, experts say.

Buyers who paid top dollar at the peak of the market, which is now on a downward slide, are likely feeling greatest pain, according to Domain’s market analysts.

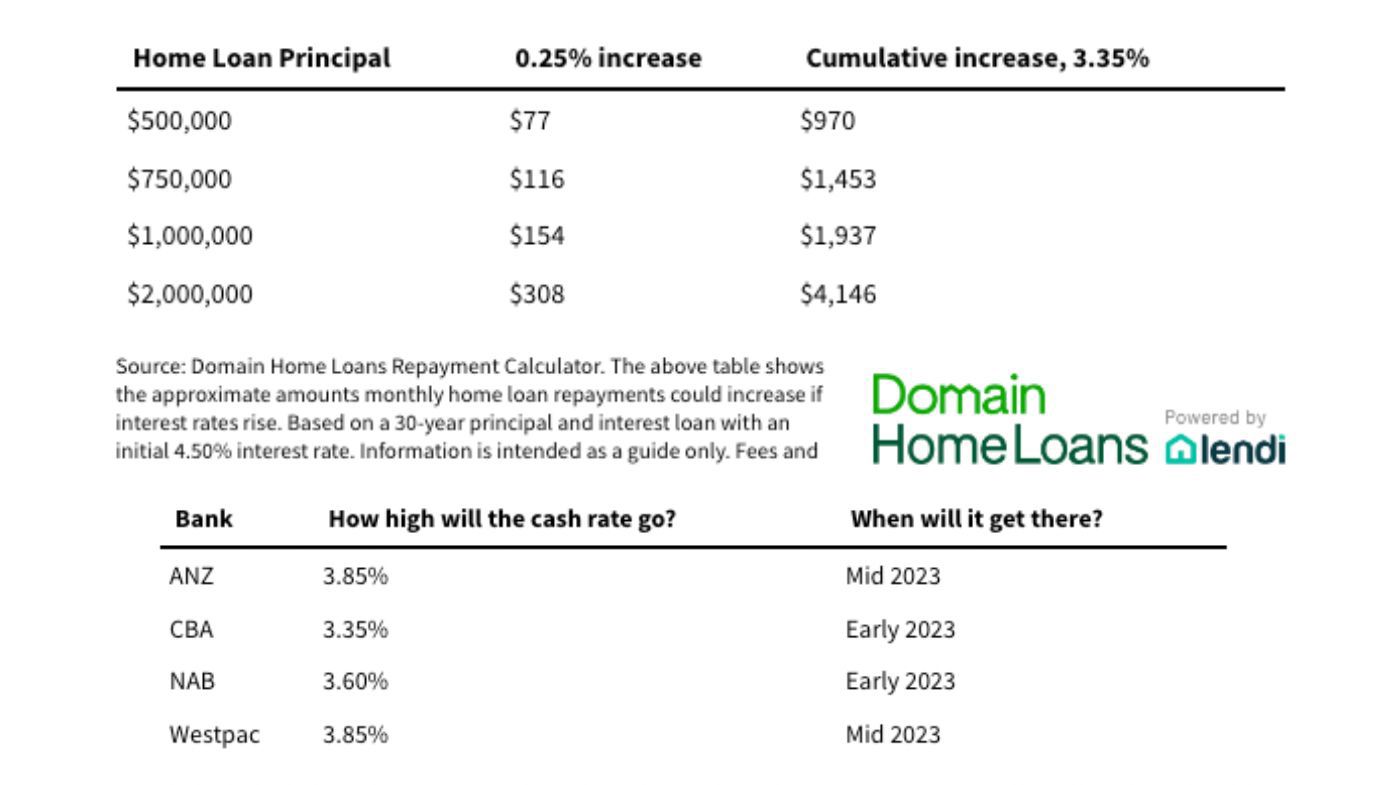

The big four banks have anticipated the cash rate will peak between 3.35 per cent and 3.85 per cent in the first half of this year, according to Domain research.

277 Ekibin Road East, Tarragindi, Queensland

See photos of the listing here

Finder’s latest RBA Cash Rate Survey shows homeowners are forking out an additional $12,000 annually in interest to cover that ballooning portion of their loans, compared to April 2022.

Graham Cooke, head of consumer research at Finder, described the increase as a “significant amount of extra money to allocate towards your mortgage every month – especially when household budgets are already stretched thin”.

Domain’s mortgage calculations reveal a homeowner who borrowed $1 million is now handing over an additional $2000 month in repayments.

Dr Nicola Powell, Domain’s chief of research and economics, said buyers who transacted at the crescendo of the market – which has come and gone in Sydney, Canberra and Melbourne, but is still unfolding Adelaide – will have “overpaid” and are “feeling the pinch”.

“Inflation surged in the December quarter of 2022 and headline CPI figures were stronger than market expectations,” she said.

However, despite the rolling pressure, Domain’s research shows a low rate of distress listings, indicating most homeowners have so far managed to meet their obligations to lenders.

“Domain’s unique data of distressed listings remain well below the five and 10 year average, indicating that there isn’t a huge number of people defaulting,” Nicola said in the report.

“While they did lift in September, they have fallen in recent months. This data set allows us to understand how homeowners are managing as they roll off their ultra-low fixed rates ahead of the imminent refinance boom.”

4 Taree Close, Pakenham, Victoria

See photos of the listing here

Domain Home Loans general manager Kareene Koh said buyers are adjusting to the higher-rate market but recommends refinancing or saving to bake in a financial buffer, as it can take three months to get comfortable with new circumstances.

“Borrowers have digested and normalised to the interest rate environment and we’re seeing signs that there’s more confidence to work with the current market conditions instead of continuing to stand on the sidelines,” she said.

“The banks are predicting two more rate rises but think about preparing for another three or four rises so you’re ready if this changes.”

16/14-16 Lamont Street, Parramatta, New South Wales

See photos of the listing here

We recommend

We thought you might like

States

Capital Cities

Capital Cities - Rentals

Popular Areas

Allhomes

More